What’s the best CSM commission percentage?

10%? 20%? How about 30%?

What if I told you it’s not that common for CSMs to even get a percentage commission? In fact, many simply avoid opening up that can of worms because the ensuing discussions are guaranteed to be:

- Overlong. A team could talk for hours about the actual commissions CSMs deserve in any given organization, and how that variable part is split between Retention/Expansion revenue.

- Complex. KPIs like ARR / MRR / NRR, growth rate, upsells, renewal rate, churn rate, and more can all further influence the compensation model.

- Contentious. Other teams that might deserve a commission structure and could (rightfully) ask for one too, which further lengthens and complicates the discussion.

The bottom line is that while many CSMs get bonuses, it takes a very specific type of CS team to actually receive a percentage.

With the hope of shedding some light on the topic, I’ll look over some classic CSM compensation models, some common commission percentages, and then talk about the best way to measure their effectiveness.

Lastly, we asked the CS community about their opinions and experiences with CSM commissions. We’ll feature some of their answers and concrete examples further down in the article.

What’s the Best CSM Commission Percentage? An Overview

The CSM commission represents a bonus added to the base salary on specific CSM compensation models. While traditionally, commissions are a percentage of sales, in CS, they are usually calculated as a split between retention revenue and expansion revenue. This split is what we call the CSM commission percentage. Lastly, using commissions in customer success is not always the norm and may vary depending on the business model, market, and type of customers.

For example, a business that lands one or two new, high-ARR customers per year might find it cumbersome and ineffective to provide a commission percentage to its CSMs. On the other hand, a business that relies heavily on customer retention and expansion may incentivize those respective targets through a fixed bonus or variable commissions.

As is to be expected, the SaaS space can vary significantly, and so too do the CSM compensation models. Let’s look at these models first to better understand commission percentages and their ideal use case.

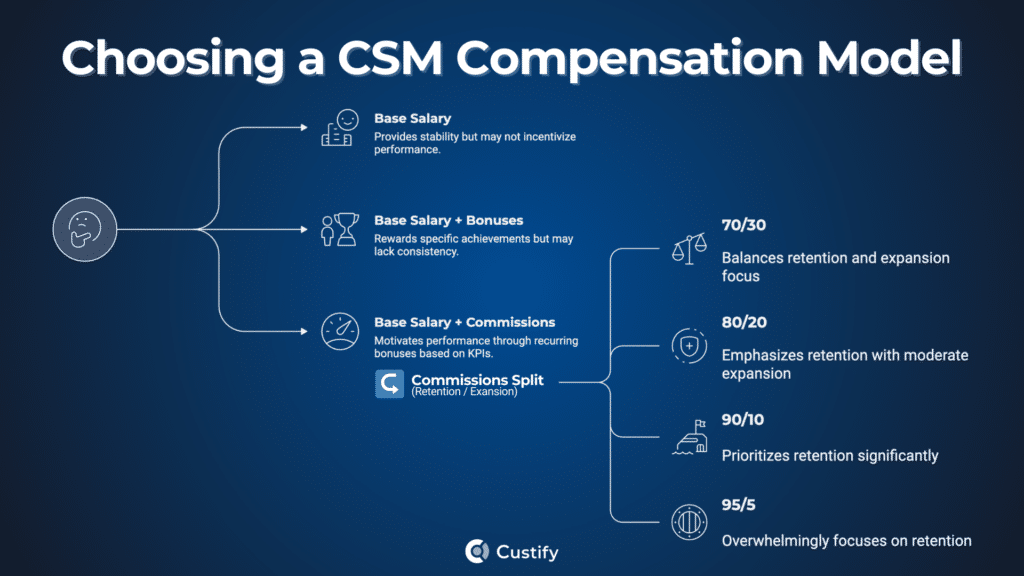

CSM Compensation Models

1. Base Salary

Starting with a classic, CSMs could be simply compensated through a base salary. Most organizations that go for this model usually make the salary attractive to prevent CSMs from leaving for other companies that do offer bonuses or commissions.

How to Change to a Base Salary Plan

Switching from a commission plan or bonuses to a base salary plan could be seen as a downgrade. However, you can reframe it as a positive – a clear, stable salary can help CSMs have more predictable income, reduce their pressure to deliver upsells, and help them stay more productive and focused on your existing customers.

2. Base Salary and Bonuses

Bonuses sit somewhere between a simple base salary model and a variable commission model. A bonus could be granted based on specific achievements: hitting an ARR target, keeping churn rate minimal for a given period, or general good performance from a CSM.

These bonuses don’t typically work as a percentage commission, but rather as fixed sums. However, there’s been some confusion around the topic since many use the terms “bonus” and “commission” interchangeably. If this is the case for your org, you should be made aware of it early on.

How to Change to a Bonusing Plan

If you’re just adding bonuses to a regular base salary, most CSMs will be happy to receive the extra payout. If you’re downgrading from commissions to bonuses, that’s where things get trickier. You have to make sure the bonuses are worthwhile to compensate for the loss in commissions. Alternatively, you can offset that loss through an increase in the base salary.

3. Base Salary and Variable Commissions

Variable commissions can be calculated either as a percentage of the overall revenue (ARR), split of retention and expansion revenue (the most common method), of sales, or of CSMs’ monthly renewal quota (for example, if the retention quota is $30,000 ARR, and a CSM gets 15% of that, it amounts to a bonus of $4,500).

This isn’t always the case, however, as some companies come up with their own, complex formulas for calculating commission percentages.

Lastly, unlike bonuses, which may be very sparse, commissions typically get paid out periodically (monthly, quarterly, yearly, etc) based on quota attainment.

How to Switch to a Commissions Plan

If you’re adopting a commission percentage plan, most CSMs should be happy with the new comp model. However, it may put extra pressure on them to deliver. You should be clear in your messaging so as not to discourage CSMs, and you should emphasize that commissions are essentially a perk. Ideally, when switching to a commissions model, you should keep the base salary the same.

How Commissions Can Vary

Before any commissioning model can take shape, you need to agree on the percentage and methodology all the decision-makers on your board, particularly the CFO. There are a few ways you can go about this.

- Base salary. First, figure out the ideal base salary for your CSMs and note that it should be at the very minimum 70% of the OTE a CSM receives. Any less and it starts looking a bit ridiculous – CS isn’t sales after all.

- OTE Split. The on-target earnings (or OTE) represent the total amount a CSM can earn if they meet all their targets. This includes the base salary and the variable commission package. Then you can further split the variable part of that based on their targets:

- Retention + Expansion. Calculating commissions as a percentage of retention revenue and expansion revenue. The safe bet is 75% retention commissions and 25% expansion commissions. Note that this is a default for the typical role a CSM has – that of retaining customers with some expansion goals. You can vary the weighting of retention or expansion based on your KPIs.

- Other KPIs. Other KPIs, targets, and factors that can influence commissions include:

- CSAT Score

- NPS

- Customer health scores

- Growth rate

- Adoption rate

- Churn rate

How to Measure the Effectiveness of Your CSM Commission Percentage

As with any effort in CS, one must measure its effectiveness in order to move forward with purpose and intention. When picking a CSM commission percentage, we can look at a few metrics that tell us how effective that commission model is:

- Customer retention rate. As most variable commission comp plans factor in at least 70% from retained revenue, your customer retention rate is the obvious first KPI to use.

- CSM productivity and performance targets. These typically vary from one organization to the next. However, you should still find a way to measure this.

- Upsell and cross-sell rates (account growth/expansion). The second part of a variable commission plan usually includes between 10% and 30% of expansion revenue. To gauge the effectiveness of your expansion efforts, look at upsells, cross-sells, and customer growth rate.

- Customer satisfaction score. Lastly, you can also look at CSAT and NPS scores to see the other side of your new comp plan: how are customers feeling the change? Is their level of satisfaction the same, higher, or lower? Monitoring CSAT during the change could help prevent issues with CSM focus and burnout.

Note that you’ll also need some benchmarks to start with, so write down your current levels for each of these KPIs before you make any changes to your comp plan. Lastly, remember to set objectives with clear leading and lagging indicators to know what your goals are.

CS Leaders Debate: What’s the Best CSM Commission Percentage?

1. Start at 20% then Adjust Based on Objectives

I’ve found the right comp model depends a lot on the stage of the company and what behaviors you’re trying to incentivize over the next 6–12 months. A simple starting point I’ve used is an 80 percent base / 20 percent variable structure. From there, the 20 percent can be weighted based on the problem you need the team to solve.

- If churn is the biggest issue, you might put 70–80 percent of the variable toward renewal targets with accelerators.

- If expansion is the focus, you can go closer to a 50/50 split between renewal and expansion.

- If adoption is the gap, and you have the telemetry to support it, you can tie part of comp to seat usage or milestone completion.

TLDR: decide which behaviors matter most in the next phase, and build the comp model to reinforce those. Happy to chat more if helpful.

– Stephen Wise, CEO & Co-founder at Snowise

2. The Commission Percentage Should Help CSMs Act with Intent

A good commission plan should make CSMs act with intent. If the plan only rewards the final renewal signature, it pushes people to think in quarters instead of building stronger customers.

I prefer a model that rewards verified milestones across the year. It gives you a clear view of effort and removes the cliff effect where everything hinges on one date. The best plans also discourage hero moves. If only big renewals matter, CSMs shift their attention to the loudest accounts. A fair model keeps the entire portfolio in play.

– Irina Vatafu, Head of Customer Success at Custify

3. 10-30% Comp Eligibility or Uncapped with Limits

In my experience with CS and Acct Mgmt teams, a 10-30% comp eligibility is pretty standard. But I also had one that was not capped for my team. Now it does need to be managed from how much is paid out if the person/team hits 300% of the plan. And you can do that by doing monthly payments not to exceed $X or X% of what is listed in the comp plan, so the CSM doesn’t cash in and then take another job. Hope that helped a little.

– Chris Otenbaker, Director of Client Success at PlanITROI

4. Simple Retention Commissions Keep the Comp Plan Predictable

In SMB, overthinking commission structures slows you down. The faster option is a simple bonus tied to measurable retention. It keeps compensation predictable for the company and transparent for the CSM. The goal is clarity. If your comp plan needs a spreadsheet to explain it, you already lost trust.

– Vicky Kalbande, Managing Director at Sleek Bill

5. 20%, Variable Based on Experience

I’ve gone mostly with an 80/20 split, but also had ranges up to 75/25 and 85/15.

The higher variable split was usually for more experienced Enterprise CSMs with more outcomes agency, the lower ones for more mid-market / auto-renewal customers.

– Manuel Harnisch, Fractional CCO, Customer Success Leader at topSERV Fractional

6. Make Sure CSMs Can Reach their Retention and Expansion Targets

Commissions help when they highlight the right priorities. They become noise when they reward outputs the CSM cannot fully influence. Many renewals depend on product fixes, billing clarity, or integrations. A fair plan should reflect that reality and protect CSMs from taking the blame for gaps they cannot control.

– Anca Radosu, Customer Success Manager at Medicai

7. Commission Percentages that Increase Year over Year

[CSMs] should get paid commissions based on the ARR of every account in their portfolio.

For every year customers stay, they should increase like:

- 1st year – 5%

- 2nd year – 10%

- 3rd year – 15%

- 4th year and beyond – 20% (assumed break-even point) including all the expansions, up-, and cross-sells that are sold.

It’s up to 25 times as expensive to acquire a new customer than keeping existing ones. Selling to existing customers has up to 14 times higher conversion rates than selling to new ones.

It’s time compensation structures get adjusted accordingly.

– Markus Rentsch, CEO at Remark-able

8. Don’t Reward Luck, Reward Measurable Outcomes

Most teams jump straight to the percentage question, but that skips the hard part. The real mistake is assuming commissions fix weak processes. If renewals are unpredictable or product adoption is shaky, no percentage in the world feels fair. You should only introduce variable pay once you can measure the inputs that drive outcomes, otherwise you reward luck, not behavior. Revenue incentives also look cleaner on paper than in reality. Enterprise cycles are long. If a commission pays out once a year, the feedback loop is broken. A monthly or milestone based bonus often drives better consistency.

– Philipp Wolf, CEO at Custify

9. Check If Commissions Actually Make Sense for Your Organization

CS commissions are often a shortcut that avoids the harder discussion about your product and customer journey. If you need commissions to keep people motivated, you have a deeper issue. A CSM should grow accounts because the value is clear, not because the comp plan forces them to behave like a sales rep. Some teams should skip commissions entirely and invest in better segmentation and clearer ownership instead.

– Andrei Blaj, Managing Partner at Atta Systems

Conclusion: CSM Commissions Will Always Vary

Whichever compensation model you pick, one thing is clear: using a variable commissions percentage will incentivize CSMs to reach their retention/expansion goals, with the biggest downside being a smaller base salary (usually) and variable OTE, leading to a less-predictable income stream for your CSMs.

So what’s the commissions percentage you settled on? Are you still deciding? If you need a better view of your retention and expansion KPIs, Custify can help centralize all the data and generate insights in a single, easy-to-use dashboard for your accounts. Set up a call, and let’s see how we can assign some real numbers to your CSMs’ performance objectives.