Sometimes the key to long-term, profitable customer relationships in SaaS is the ability to look beyond the best-possible case for your business and compromise.

That’s essentially what downselling is – a compromise between what you would like to sell and what the customer can afford or justify for their current needs.

In this piece, I’ll walk you through:

- what downselling is and what causes it

- how and, more importantly, when to downsell

- why it can help you mitigate MRR loss and shore up your revenue streams

What Is Downselling?

Downselling means presenting customers with a lower-priced offer when they can’t afford or justify the spend on your regular one. Also called Downgrading, it is both a sales strategy and customer success tactic, as it can work for new prospects as well as customers in danger of churn. Lastly, it needs to be supported by actual value delivery – remember you shouldn’t downsell a product that won’t work or meet customers’ needs.

Benefits of Downsells

It’s instinctual to think of them as suboptimal, but a downsell shouldn’t be seen as a loss.

Gartner’s recent Future of Sales report shows uncertain B2B buyers are 30% less likely to complete a deal, and 42% less likely to complete a high-quality one. With a downsell strategy in place, you can immediately shift gears and present a deal they feel certain about taking. But without downgrading, never forget you might be missing out on 42% of your potential customers.

So, instead of taking the L, think of it this way:

- Downsells generate revenue where otherwise there would’ve been none.

- Downsells dissuade customers from doing business with competitors.

- Downsells help new customers realize the true value you are providing.

- Downsells can provide an essential revenue stream to support your business.

- Downsells may present a product that aligns better with customers’ needs.

- Downsells can mitigate customer churn, acting as a lifeline for loyal accounts.

- Downsells can still lead to expansion as customers begin to see the value.

For new prospects, I like to think of downsells as an opportunity for customers to “dip their toes in” and essentially take your product for a test drive.

For churned customers, downsells might help you prevent fully losing that account while helping them keep a product that may be essential to their success. After all, a slight revenue churn can be a calculated loss when the goal is increased customer retention.

What Causes a Downsell?

The typical causes that lead to a downsell are:

- Customer can’t afford the product.

- Customer can’t justify the price point of the product.

- Customer doesn’t need the full product.

- Customer is going through financial hardships.

- Customer has a low product fit.

- Customer expresses interest in upgrading at a later time.

- Customer is simply uncertain.

All these situations can prompt a salesperson to avoid the loss of a sale through a downgrade. Conversely, a CSM can also avoid customer churn by effectively downselling at-risk customers that face these issues.

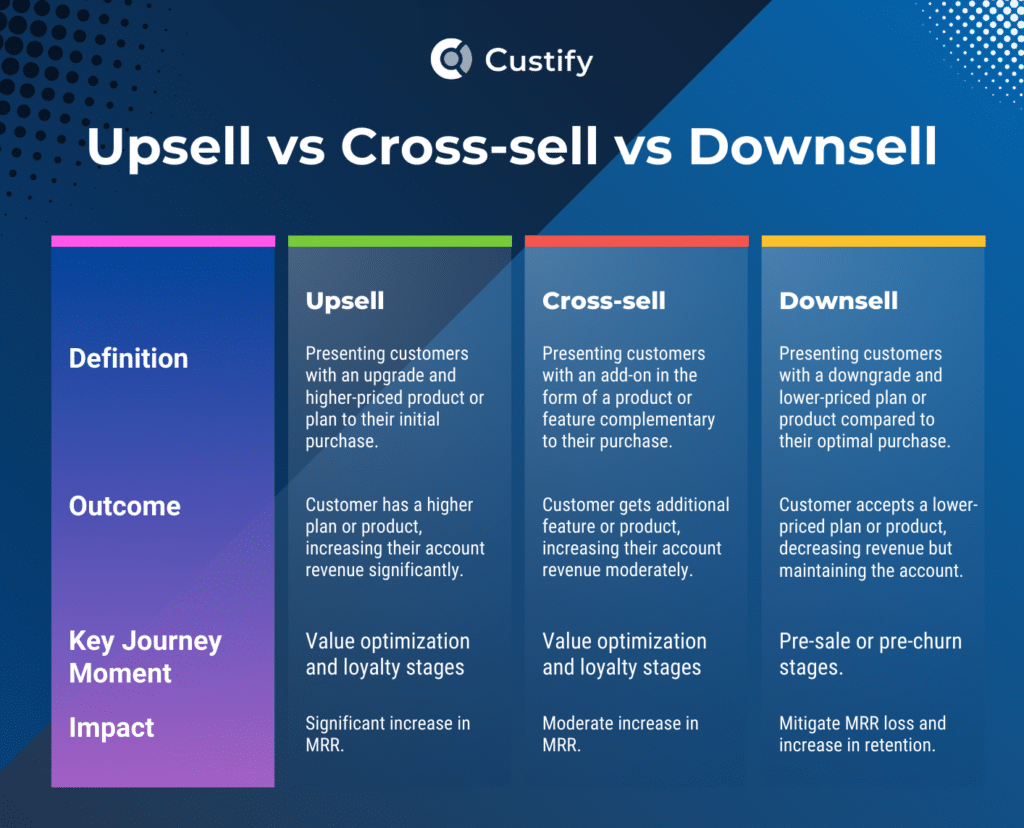

Downsell vs Upsell vs Cross-sell

Here at Custify, we covered the potential of upsells and cross-sells, and we’ve talked about them extensively throughout our blog. But how do the two compare when put next to downsells? Let’s find out:

How to Calculate the Right Type of Downsell

Offering a downsell can itself be tricky. Most businesses, whether SaaS, eCommerce, or otherwise, will have multiple customer segments, each with its own wants and needs. And then you can also account for each customer individually, depending on your budget and bandwidth. So how do you figure out the best route to take?

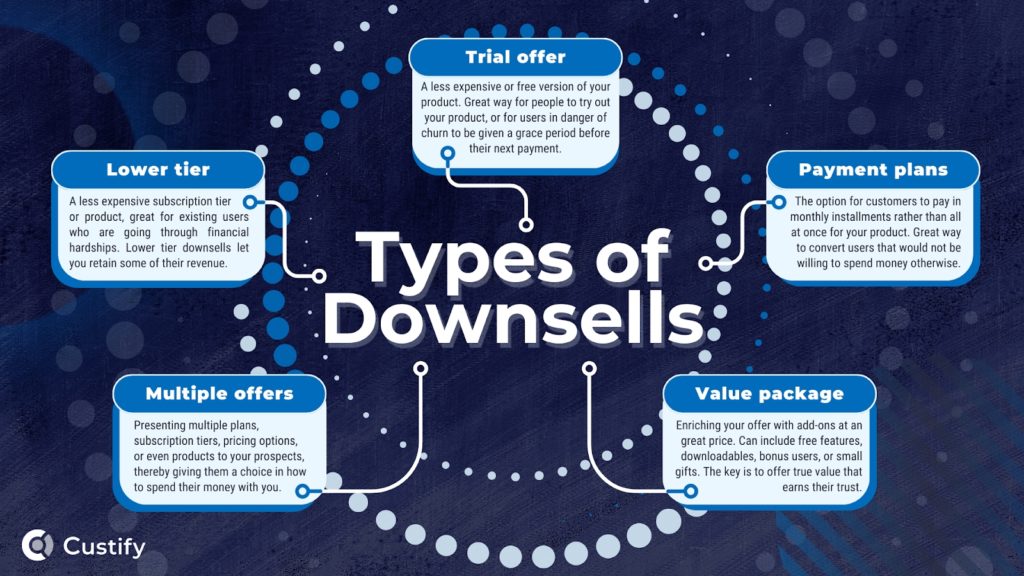

Types of Downsells and How to Calculate the Right One

First, you’ll need all the data you can gather for each account, along with the options you have for downsells. Here are the 5 most common types:

- Trial Offer. One of the most common downsells, trials are a great way for people to try your product, or for users in danger of churn to be given a grace period. Too many companies lose customers entirely even when downselling to a trial package can get you that revenue back once the trial ends. Use customer data to create a snapshot of a customer that’s likely to purchase after the trial – then use that to prepare offers for lookalike customers.

- Lower Tier. If you don’t want to entirely lose the MRR of an account just for the promise of gains later, you can downsell to a lower subscription tier instead. Using your CS data, see if your churned customers regard your product as essential to their operations but don’t have the money for a high-end subscription anymore. If that’s the case, offering them a lower tier can be a lifesaver for both parties.

- Payment Plans. Customers might be open to paying in monthly installments rather than all at once. It might be that they need the product but they’re not willing to give out all that money at once. Use customer data to determine which customers are more likely to agree to monthly payments and employ some targeted downgrading. This can be a great way to convert users that would not pay otherwise.

- Multiple Offers. We all love to have a choice when deciding what to buy and how to pay for it. Having multiple pricing options and subscription tiers, and even different products, can be a sure way to diversify your revenue streams. Using the data in your CSP, analyze your entire customer base and see if they would be open to multiple plans, and then what those plans should be.

- Value Package. Try to spruce up your offer with add-ons, freebies, downloadables, and even small gifts. It’s all about value realization – the sooner customers think they’re getting value, the more likely they’re willing to spend. So consider adding free items onto your product or subscription to make the offer more enticing. Use customer data to determine what customers would value most.

Within eCommerce, the typical downselling strategy involves presenting customers with alternative products, more affordable payment options, or complementary products that can keep their average order stable while increasing the value they receive for the same price.

Key Components of an Effective Downsell Strategy

1. Have the Right Customer Data

Throughout the article so far, I’ve highlighted just how essential data is to your downsell strategy. But not just any data – you need to follow data hygiene principles and work with correct numbers:

- Ensure your tech stack is set up to capture essential datapoints. The first step is setting up your array of tools to monitor customer activity. The next step is to integrate all your tools and set up a product dashboard to monitor account metrics at a glance.

- Validate the data. Start with an audit of existing datapoints and systems. Determine their quality in terms of accuracy, completeness, security, and then do the same for new metrics you’re capturing.

- Standardize data conventions across your organization. Everyone in your company needs to:

- Use the same terminology for your data

- Agree on your leading metrics

- Monitor incoming data continuously

- Act on their insights in a prioritized manner

- Update your data collection methods. Systems either change or become irrelevant. Studies show 60% of the data we collect daily becomes obsolete by the end of the day. Part of customer success’ job is to ensure that doesn’t happen.

2. Choose the Correct Moment

Downselling can show diminishing returns based on the number of tries. Success lies in showing the right downsell offer to the right person at the right time. And most times, you can only attempt to downsell once before a customer becomes disinterested. So here’s how to identify the best moment for each customer:

- Before existing customers churn. When it comes to existing customers, make sure you have a churn prediction model in place that can tell you “hey, this account is about to churn.”

- After they’ve said no. Remember to avoid assuming a customer or prospect will say no to an expensive product or service. Let them spell it out, and only after that are you supposed to go for a downsell.

- Before they go to a competitor. After they’ve said no, there’s usually a period in which they have yet to go to a competitor. This is typically tied to their budget and your competitors’ offer. If they see a free or cheaper version of what you’re offering, they might rush towards it. You need to present the downsell offer before that happens.

- Before you set a high bar for your competitors. This line is usually difficult to find, but you need to show them your downsell offer before you explain what the perfect solution should look like for them. Try to set a high bar for the competition while making sure your downsell offer still meets that standard.

If, after all of this they’re still not convinced, don’t offend them by insisting. It’s much better to maintain a friendly relation, offer to help in the future, then add them back to your marketing pipeline so they remain in touch with your brand. Present it as a way you can add value without them paying a nickel.

3. Offer Exactly What the Customer Wants

Yet another point where data is crucial is in deciding what downgrade offers to present to which customers. I mentioned this higher up in the article, but it bears restating that each client is different and will respond differently to your offers. That’s why you need to have a clear understanding of the types of downsells you can attempt and the data that tells you which customers will be receptive to your offers.

Irina Vatafu, Head of Customer Success at Custify, explains how this strategic, customer-centric approach pays off:

“Downselling isn’t just about reducing prices—it’s about strategically realigning value with customer expectations. By deeply understanding each customer’s usage patterns, goals, and constraints, our team proactively tailors downsell offers that genuinely resonate. This proactive, personalized approach has helped us retain countless customers who would otherwise churn, giving us not just a short-term revenue boost but also laying the groundwork for future expansion.”

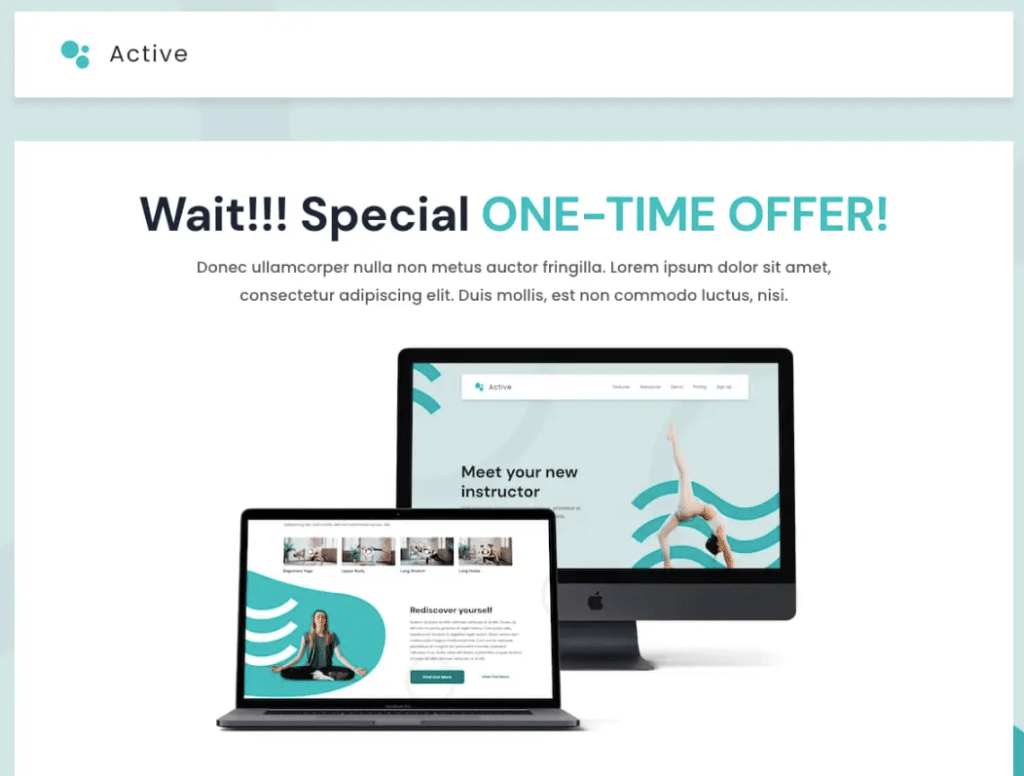

Predominantly online businesses, particularly SaaS and eCommerce, often have dedicated landing pages for downgrades. Also called downsell pages, they are tailored to specific customer segments, presenting them with a great, more cost-effective offer.

4. Don’t Stop Hinting at the Advantages of an Upgrade

After a downsell, the assigned CSM can constantly hint at the advantages of an upsell, or a return to the previous subscription tier. Regardless of the type of downsell, CS can work with marketing on the best way to reach back out and target the respective customers. This could mean:

- Adding them to an email flow specifically tailored for downsold customers

- Showing them in-product messages highlighting their missing features

- Checking in periodically through their preferred communication channels

While helping customers optimize their spending is nice, always remember the end goal of a downsell is an eventual upsell. Mitigating lost MRR should be the most basic value you obtain from a downsell, recovering it entirely is great, while actually growing MRR is the ideal outcome.

Downselling FAQs

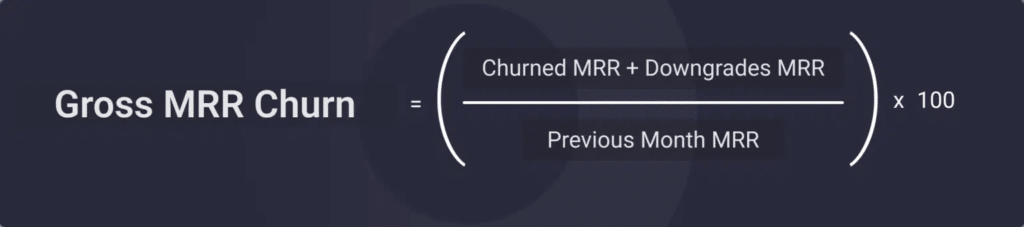

1. Should downsells be included in Gross Churn?

The simple answer is yes. Gross churn includes any type of revenue churn – whether that’s through downsells or through customers churning entirely.

2. Does Gross Retention include downsells?

Similar to the previous question, the answer is yes. Gross revenue retention accounts for revenue lost through downsells, or downgrades as they’re sometimes referred to.

3. Where does a downsell come in the sales funnel?

Downsells can be proposed in three places in the sales funnel and customer success playbooks:

- After a prospect refuses the main product or service. If your sales nurtured leads refuse the main product, particularly when they do so because of financial reasons, then it’s time to present the downsell according to the previous points in this article.

- After a customer refuses an upsell on the main product or service. If an existing customer refuses an upsell, you can present a lower priced alternative of the product that’s still at a higher price than what they currently pay.

- When a customer is in danger of churn. Using your customer data to identify signs of churn, you can then present downsell offers to those customers, essentially attempting to save the account at the expense of some revenue.

4. What is the ARR of downsells and how do you calculate it?

Downsell ARR includes the annual revenue lost to downgrades. To calculate it, simply subtract the ARR for all downsold customers from their projected total ARR before the downsell. The resulting difference is the Downsell ARR.

5. What is a downsell page?

A downsell page is a website landing page created by a business with the goal of presenting downsell offers to one or more groups of customers. Downsell pages are typically a concerted effort of customer success, sales, and marketing, designed to attract customers otherwise unwilling to buy the full-price product or service.

Furthermore, downsell pages are often hidden deep within the sales funnel, unable to be accessed by just anyone. The goal is only for those that have refused initial offers to be able to see the pages.

How a Customer Success Platform Can Get Your Downsell Timing Right

To sum up, the quintessential thing about downsells is timing. Your downsell strategy, in the end, will not only help mitigate MRR loss, but help you recover and even grow MRR in the long run. However, to do that, you need to reach out at the right time, with the right offer, to the right customers.

A customer success platform presents a solution for all three factors:

- Through a purpose-built workflow including customer dashboards, health scores, and automation, you can effectively get notified at the precise moment when customers are susceptible to a downsell offer.

- You can analyze customers and group them into segments.

- Lastly, you can use those segments to prepare personalized downsell pages and offers, allowing you to be highly specific in your targeting.

Like how that sounds? Reach out today – our customer success team is ready to take on your use case as a personal challenge and help you fine tune the perfect downsell strategy.