Recurly is an enterprise-level billing management software designed for subscription-based SaaS businesses.

Its main selling points are its simplicity, vast feature list, and many integrations. Merchants looking for complex recurring billing management that can scale easily will love this platform.

Recurly is a great source of information about your customers’ current and past subscriptions and payment history. This data is no longer siloed within the accounting department, but is made available to any department or third-party integrated app.

What can I do with Custify and Recurly?

- Segment your customers based on data such as failed payments or value of account in MRR.

- Define lifecycle stages based on revenue and make sure recurring revenue stays on track with tasks and alerts. You might, for example, set alerts for unpaid invoices or tasks to check the last payment date.

- Build customer success playbooks based on transaction status (e.g., “failed payment”) or next billing date. For example, if the last transaction status is “Failed”, a series of messages can be sent via email or other channels until the status changes.

- Create health scores and KPIs in Custify based on MRR or total income values.

- Create alerts for failed payments or based on the time since the last failed payment.

Note: this is a one-way integration. Data cannot be pushed to Recurly.

How does Recurly work with Custify?

From matching companies, we import multiple data points related to client revenue to be displayed in the 360 view:

- Due invoices: The number of unpaid invoices issued to the company.

- Total amount due: Total amount to be paid.

- Monthly recurring revenue (MRR): This is a calculated metric based on the last payment amount.

- Total income: The total amount received from the company since the beginning of its subscription.

- Transaction status: The transaction status of the last invoice (paid or unpaid). This can be sorted in specific segments or targeted with playbooks.

- Last transaction date: The date of the last successful payment.

- Next billing date: When a company’s next invoice will be issued according to their subscription.

How do I activate this integration?

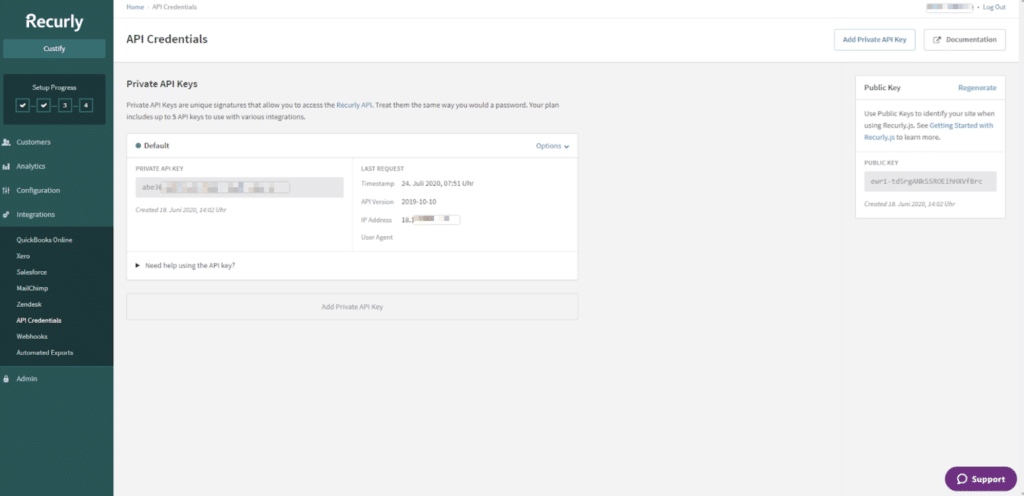

1. In Recurly, navigate to the API Credentials page and create a new “Private key”.

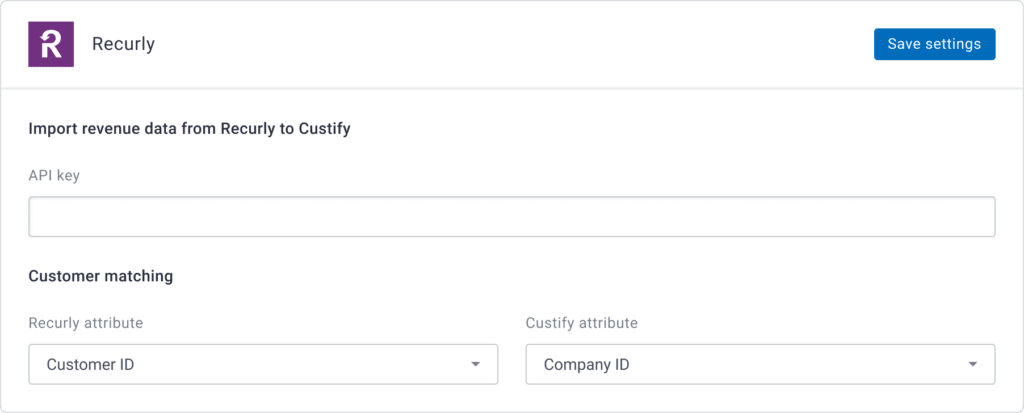

2. Copy and paste the API Key to the Custify Integration page:

3. Press “Save settings.”

Note: If you are using different IDs for your customers in Recurly and Custify, you can select which field should be used for the ID matching.