When you’re looking to prioritize customer requests in customer success, it can be challenging to find the correct, cost-effective way to do it. So how should you go about it?

We’ve recently opened up that question to the online communities we’re a part of – and the results frequently mention one thing: gauging costs vs benefits and calculating a cost-benefit ratio.

Sounds great. But how do you do that exactly?

That’s what we’re setting out to find out today. In this article, we’ll look at:

- What a cost-benefits analysis entails, who typically uses one, its benefits, when CS should use one, and an example of a CBA, so we can see what it’s supposed to look like

- What a benefit-cost ratio is precisely and how you can calculate it (including a formula)

- How to conduct a cost-benefits analysis yourself – this might be tricky, and you’ll need some help from someone with a financial background, but you can still do it!

- A fully-functioning spreadsheet template you can copy and use in-house for your CBAs.

- Then ending with some FAQs to clear up any issue or question you might have regarding cost-benefit analyses and benefit-cost ratios.

What Is the Cost-Benefit Analysis (CBA)?

A cost-benefit analysis represents a financial comparison between costs associated with a specific organizational action and the projected benefits as a result of that action. CBAs are particularly useful and necessary for decision-making in public orgs, but can be equally so in business if implemented correctly. A CBA can be revelatory as to the hidden costs and expected returns of organizational actions, tasks, processes, and projects with no previously-assigned monetary value.

CBAs are particularly valuable for decision-making regarding one or more of the following:

- Selecting product improvements and prioritization regarding customer requests.

- Project planning (setting milestones, budgets, assigning project roles and resources).

- Personnel changes, such as adding, removing, or changing employees / teams.

- Product feature planning, from clear roadmaps to product updates and new features.

- Expanding business operations, such as developing new products or adding new services.

- Purchasing decisions, such as buying software or hardware to improve performance.

To sum up, CBAs are objective and data-driven methods of deciding on a course of action within an organization.

Who Uses CBAs?

Almost everyone in business employs some form of cost-benefit analysis, whether it’s a fully-detailed and comprehensive spreadsheet or a guesstimation based on experience. CBAs are nonetheless very common for:

- governmental organizations

- NGOs

- Non-profit businesses

Regarding for-profit businesses, CBAs can prove particularly useful for customer-focused, CS-enabled companies. In such cases, CSMs can rely on a well-established CBA process to make informed business decisions that prioritize the needs of their most important customers in a budget-conscious way and based on an array of factors the business values most.

When Should You Conduct a CBA?

Cost-benefit analyses are useful for most business decisions. However, the cost of conducting a CBA might be too much for some small, medium, or otherwise basic decisions. That’s why decision-makers must learn when such in-depth financial reports are appropriate or risk losing time and money on otherwise inconsequential CBAs.

Furthermore, to adequately assess the need for a CBA, businesses should look at the timeframe of expected impacts. If the analysis includes long-term impacts, it might not be very relevant as time will invariably change the factors of a decision.

Beyond these caveats, several major decision-making areas stand out as ideal for CBAs:

- Investments. For business development leaders, it can be complicated to decide what areas make the most practical sense for investments. Feelings might get tangled up in the mix – in which case a properly-executed CBA might be the best decision to keep decision-making data-led and financially-sound.

- Pricing changes. For most businesses, but particularly for SaaS, the breadth and complexity pricing strategies and models can be overwhelming and have unforeseen consequences. A CBA can ensure you’re not missing anything while helping you make the most practical choice money-wise.

- Mergers and acquisitions. It should stand as self-evident, but a cost-benefit analysis is an ideal, often-necessary step before completing a merger or acquisition.

- Operational changes. Any business processes can be optimized through a proper CBA, but some may benefit from one more than others. If a process is lagging, slowing down the rest of the company, or can simply be made better through automation or other means, the smart thing to do is a CBA.

- Organizational changes. Any personnel changes or decisions can be vetted through a cost-benefit analysis.

- Product and service changes. As mentioned previously, CBAs can be the key deciding factor when selecting which product changes to implement, or how to adjust your services to make them more cost-effective.

Note: customer success has an opportunity here to influence the product through CBAs – by carefully gauging user sentiment and reading their feedback, the CS team can conduct a cost-benefit analysis and present the Product team with solid groundwork for future product changes and improvements.

Example: How Does a CBA Look?

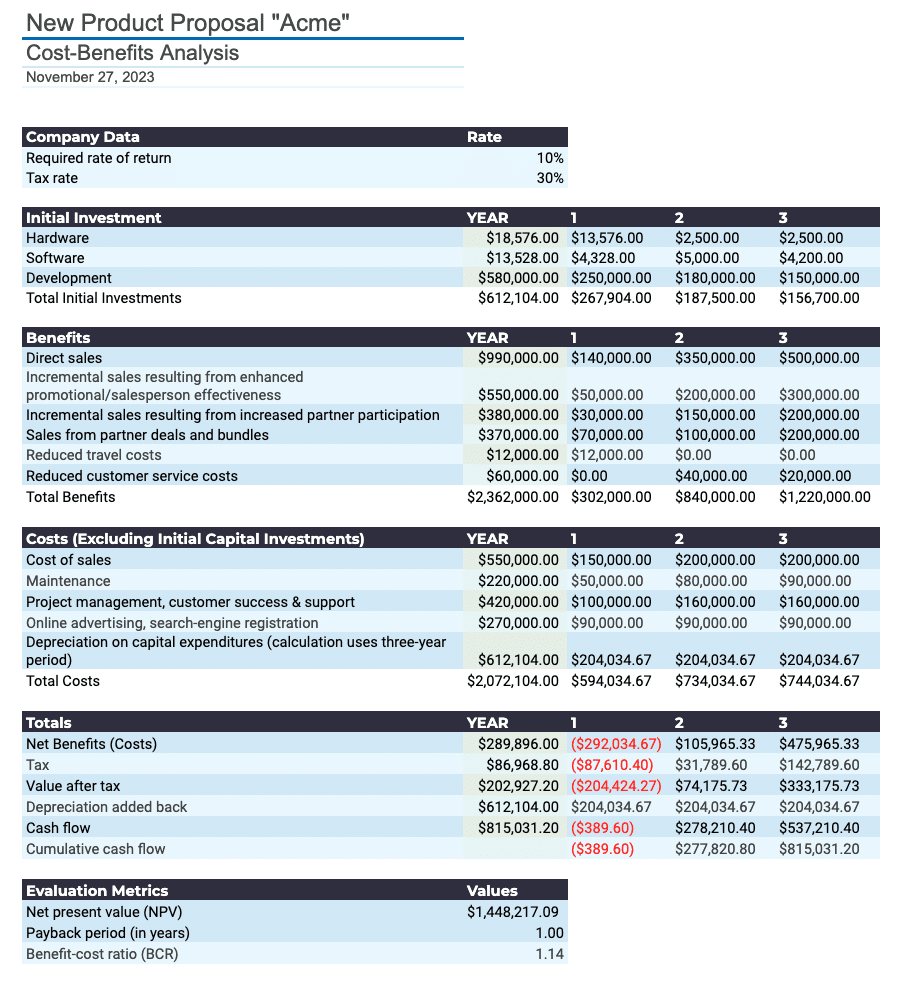

Now let’s see what a CBA actually looks like:

Comprehensive CBA example template, adapted from a Netsuite template. Note that despite its complexity, it does not have any space for the reasoning behind the numbers – a good CBA must always include reasoning, as you’ll see in the “How to” below. We’ve added such a section to our edited template.

What Are the Benefits and Disadvantages of a CBA?

PROs of Conducting a CBA

- Gain insights based on hard data. Making data-led decisions is a clear way to a sustainable business future.

- Obtain an objective view of profitability. Because it’s a data-led process, it allows you to view proposed actions and changes with an objective perspective.

- Allows for qualitative elements. While fundamentally based on budgeting calculations and real numbers, CBAs still allow you to assign monetary value to qualitative factors, which helps gauge intangible value.

- Helps you see the true cost of a business action. CBAs let you see the true cost of a business decision before it happens, or at least get as close as possible to it.

CONs of Conducting a CBA

- Can be a drain on resources and time. For a CBA to be done properly, it needs diligent data hygiene and governance, both of which can take up more time and resources than they’re worth.

- Works with ambiguous data prone to change. The more your CBA includes qualitative elements with financial estimates, the more the final result will grow in ambiguity.

- Forecasting is a challenge in itself. If you’re conducting a CBA looking for an accurate assessment of your break even point, think again. A cost-benefits analysis will never be 100% accurate, especially for a decision with long term implications (longer than a year).

- Does not consider experience. A CBA might be an objective look at numbers, but that doesn’t account for your experience. Leaders who’ve been around the block a few times will have original and innovative ideas that make it difficult to estimate costs / benefits, while still being overall good decisions.

- Can be too quantitative if improperly executed. If you omit less-tangible benefits such as customer satisfaction, loyalty, customer value realization, or customer outcome delivery, CBAs can indeed be very cold, utilitarian, and quantitative.

What Is the Benefit-Cost Ratio (BCR)?

The benefit-cost ratio, often an integral part of a cost-benefit analysis along with net benefits, is the basic ratio between the costs and benefits of a proposed action. How to calculate it? Simple, here’s the base formula:

Benefit-Cost Ratio vs Net Benefits

Despite the usefulness of the ratio above, some prefer to look at net benefits as the key metric of a CBA. The formula for this one is just as simple:

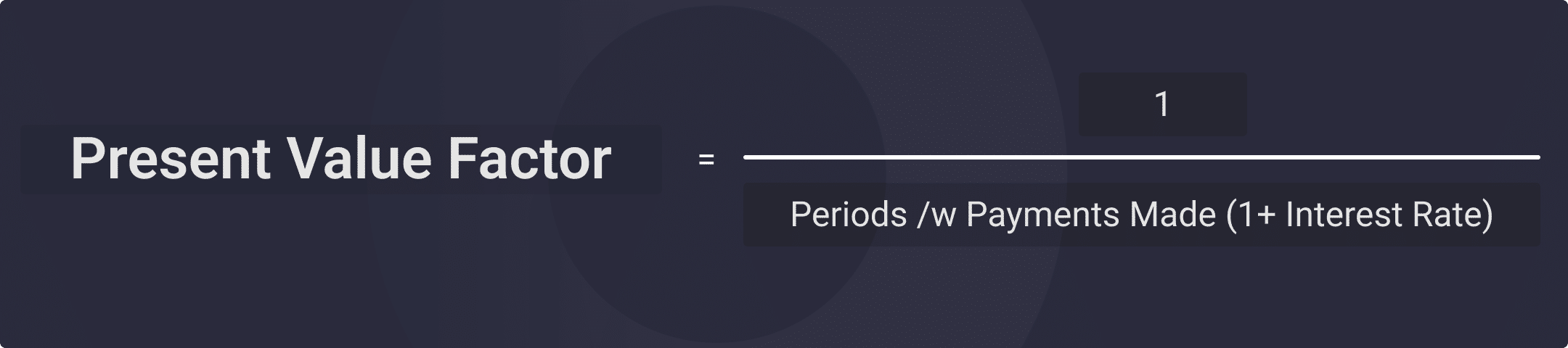

You can also look at this formula as a way to calculate the estimated potential ROI of a specific course of action. Some like to go more in-depth and exact with their calculations and include interest rates into the formula by using present value factors.

where:

How to Conduct a Cost-Benefit Analysis

The following is a review of the steps you should take before and during a CBA. It’s encouraged that many of the steps below are a team effort – you should brainstorm most of these with your colleagues and come up with a final list that meets most, if not all, of the team’s approval.

- Establish all your details and desired outcomes. Before you set out to conduct a CBA, you need to settle on the scope of your action, decision, and analysis. Think things like:

a. What am I actually trying to decide or evaluate with the CBA?

b. What are my goals for the action item?

c. What are my goals for the CBA?

d. How can I structure the CBA in a way that’s most conducive to my overarching goals? - Determine all areas that will incur costs. Next, brainstorm and write down all the potential costs.

- Determine all the potential benefits. Once you have the costs, move on to benefits.

- Assign a hard-sum to each cost and benefit. After you have both lists, simply assign a cash value to all the benefits and costs. This might imply a lot of back and forth and spur heated arguments – it’s normal, so be ready for some pushback.

- Write down the reasoning for each cost and benefit. At the end of the day when everyone agrees, don’t just write down the numbers. Instead, dedicate a separate section of the CBA to writing down the reasons behind your cash estimates. People 1-3 years down the road will thank you.

- Key in all stakeholders and include their reasoning. For all the brainstorming decisions, make sure to include all relevant stakeholders as they might have insights into areas you have no knowledge about. For example, don’t forget to key in marketing when it comes to GTM research, pricing positioning, and more.

- Finalize your cost-benefit analysis by putting everything together. Once all details are ready to go, simply display them in an easy-to-read spreadsheet or PPT report. Your only goal here is for pertinent profitability information to be understood by all stakeholders who will see the report. You can always make a second report with more hard data for those who want to delve deeper.

Cost-Benefit Analysis Template for SaaS / Customer Success

This template can be an invaluable tool for Customer Success leaders in the SaaS industry. It’s designed to aid in strategic decision-making and focuses on evaluating the costs and benefits of critical decisions, such as hiring a new Customer Success Manager (CSM) versus acquiring a Customer Success Platform (CSP) tool.

The template is structured into several sections:

Company Data:

- Required Rate of Return: The minimum return expected by the company from the investment.

- Tax Rate: The applicable tax rate for the company.

Initial Investment: Costs incurred with the project by year.

- Hardware: Expenses on physical equipment.

- Software: Costs for software purchases or subscriptions.

- Development: Costs associated with developing the project.

Benefits: Expected gains from the investment by year.

- Direct Sales: Revenue directly from the project.

- Incremental Sales (from promotions, partner participation, etc.): Additional sales generated indirectly from the project.

- Reduced Costs (travel, customer service): Savings in operational expenses.

Costs (Excluding Initial Investments): Ongoing costs after the initial investment.

- Cost of Sales: Costs directly related to producing goods or services.

- Maintenance: Costs to maintain or update the project.

- Project Management and Support Costs: Expenses for managing and supporting the project.

- Advertising Costs: Marketing and advertising expenses.

- Depreciation on Capital Expenditures: Reduction in value of the initial investments over time.

Totals:

- Net Benefits (Costs): Total benefits minus total costs.

- Tax: Taxes applicable on net benefits.

- Value After Tax: Net benefits after tax.

- Depreciation Added Back: Adding back depreciation for cash flow analysis.

- Cash Flow: Net cash generated or used.

- Cumulative Cash Flow: Total cash flow over time.

Evaluation Metrics:

- Net Present Value (NPV): The present value of net cash flows, discounting future cash flows at the required rate of return.

- Payback Period: Time taken to recover the initial investment.

- Benefit-Cost Ratio (BCR): Ratio of the present value of benefits to costs.

Each section is meticulously designed to capture all facets of the decision-making process. Direct and Indirect Costs sections ensure a thorough financial evaluation, while the Benefits sections help in recognizing both tangible and intangible gains. The ROI Estimation and Priority sections are crucial for weighing financial returns against strategic importance, facilitating a balanced and informed decision.

Extra FAQs about CBA and BCR

1. Is cost benefit analysis quantitative?

A cost-benefit analysis can be predominantly quantitative if those conducting it focus on the aspects of decision-making that have a hard cash value. If other, less-tangible aspects are considered, such as the moral and ethical issues surrounding that decision, CBAs become far less quantitative and more useful, particularly in public companies, governmental organizations, and customer-facing teams such as CS.

2. Why should I do a cost benefit analysis?

A cost-benefit analysis can be a useful tool for getting a birdseye view of the profitability of a decision. When you don’t know whether to proceed with a course of action, or when the arguments surrounding that decision become emotionally charged, a CBA can help bring an objective view to the table.

3. Why is a cost benefit analysis important?

Without CBAs, many decisions would either be left up to simple guesses, experience-based intuition, or other types of analysis such as market research. A CBA is an essential strategic framework that proves invaluable when wrestling with high-level business decisions.

4. Why is a cost benefit analysis particularly important for SaaS?

Every major product change in SaaS can be helped by an objective cost-benefit analysis. Without one, SaaS leaders are effectively fumbling in the dark.

5. How often should I repeat a CBA in a SaaS company?

For businesses in general, and particularly for SaaS companies subject to rapidly changing market trends, CBAs should be repeated at least annually, as well as for every major new decision with a high potential impact or high urgency, such as new products, new product features, big organizational changes, or changes to the pricing model.

6. Is the cost benefit analysis an example of utilitarianism?

As said previously, if you only focus on the cash value of an action, CBAs can indeed be very cold, utilitarian, and quantitative. This was the gist of Steven Kelman’s critique in 1981- leading to an official 2011 research paper written in response.

For a broad range of individual and social decisions, whether an act’s benefits outweigh its costs is a sufficient question to ask. But not for all such decisions. These may involve situations where certain duties—duties not to lie, break promises, or kill, for example—make an act wrong, even if it would result in an excess of benefits over costs.

– Steven Kelman, Cost-Benefit Analysis: An Ethical Critique

Cost-benefit analysis is commonly understood to be intimately connected with utilitarianism and incompatible with other moral theories, particularly those that focus on deontological concepts such as rights. We reject this claim and argue that cost-benefit analysis can take moral rights as well as other non-utilitarian moral considerations into account in a systematic manner.

– Rosemary Lowery and Martin Peterson, Cost-benefit analysis and non-utilitarian ethics

What’s Your BCR?

Have you calculated your benefit-cost ratio? Looking good? If not, consider upping both your NRR and overall effectiveness with an advanced customer success platform and give yourself the power to keep customers loyal for many years to come!