Seeing your hard-earned customers drift off the radar into another competitor’s arms is an outcome no brand desires. However, this silent defection often begins with subtle signs of disengagement, reduced activity, or unmet expectations, long before the cancellation.

If you’re going to break the churn cycle, you have to at least see and think things the way your customers do. Or you end up losing them to someone who does.

In this article, we’ll:

- Explain the types of churn.

- Share expert opinions on what actually goes on in the mind of a churning customer and break down the psychology of churn.

- Explore why customers are unlikely to speak out.

- Conclude with the most effective win-back tactic you can implement immediately.

A 2023 Industry report shows that 65% of company revenue comes from existing customers. You know what automatically happens when this customer base shrinks due to an unfixed churning pattern? Poor revenue stream, increased CAC, and loss of customer lifetime value.

Let’s get to the root and fix it.

Types of Churn: Voluntary vs. Involuntary

Depending on the context, you can have around four different types of churn, which include:

- Customer churn

- Revenue churn

- Voluntary churn

- Involuntary churn

Learn more about each type in our Churn Guide.

For this piece, we’ll primarily address voluntary and involuntary churn.

Voluntary Churn

This is when customers actively stop patronizing your service or product due to:

- Dissatisfaction.

- Better alternatives.

- Unmet expectations.

- Poor experience.

- Cost variations and non-flexibility.

- A shift in personal needs.

Voluntary churn is not surprising, given that 72% of customers say they will switch to competitors after one bad experience. So, if you’re going to save the day, you have to deliver a thorough and pleasant customer experience.

Involuntary Churn

Involuntary churn remains a major challenge for businesses.

Why? Well, because you’ve done everything to address your customer needs and gone all in.

However, they still defect for reasons like:

- Customer-side payment processing failure during subscription renewal or new product checkout.

- Unsuccessful payment retries over time.

Customer-side payment processing failure could be due to an expired credit card, insufficient funds loaded on the line, or incorrect card details. In other cases, it could be due to a communication barrier, where the client misses their notification renewal.

But hey, who cares if the error was from the customer side or your end? What matters is that each “payment declined” message frustrates your SaaS tool users, triggers your system to disrupt their workflow, and results in client drop-off.

Involuntary churn playbook (checklist)

- Smart retries: 1h → 24h → 3d (change acquirer/descriptor if possible).

- Pre-dunning: notify expiring cards 14 & 3 days prior; in-app banner.

- Multi-rail payments: card + ACH + PayPal + local methods (where relevant).

- Grace period: limited access for 3–7 days; keep automations running.

- One-click update: secure billing link; no login required.

- Alerts: “Payment failed” as a red health input; CSM notified after final retry.

- Post-recovery tagging: measure recovered ARR and the retry that worked.

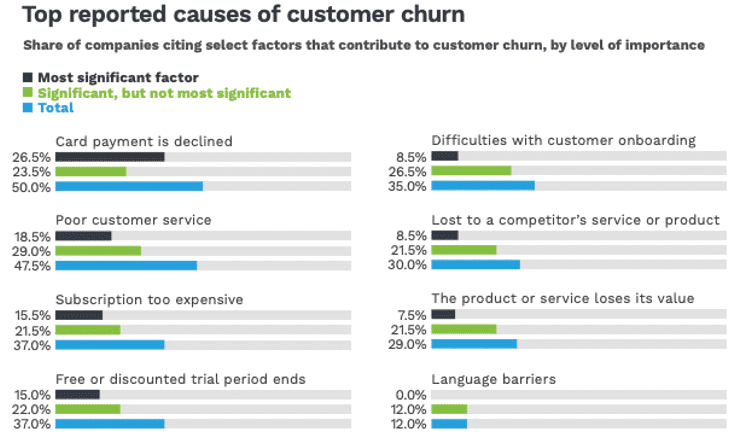

In a State of Subscription survey by PYMNTS and PayFlex, payment failures result in 50% of involuntary customer churn.

Source: PYMNTS

Interestingly, subscription-based businesses, a model most SaaS brands adopt, face steeper card decline rates, often shooting as high as 18 to 20%. This eventually results in revenue and customer churn.

Considering these benchmarks and the fact that it’s often overlooked, it’s a glaring fact that involuntary churn can cause more harm than voluntary churn.

Essential Churn Formulas:

Logo churn = Lost customers ÷ Customers at start of period

Revenue churn = (MRR lost to churn & downgrades – expansion) ÷ MRR at start

Net revenue retention (NRR) = (Start MRR + expansion – churn & downgrades) ÷ Start MRR

Involuntary churn = Accounts lost to payment failure ÷ Total accounts

*Track them monthly by cohort for clearer diagnosis.

The Psychology of Churn

Edward White, Head of Growth at beehiiv, believes, “There’s something constant about voluntary churns: emotional detachment starts long before drop-off. I break this process of detachment down into initial friction, disengagement, evaluation, and the decision to leave.”

- Initial Friction: First, there’s an unmet expectation from the product or service. Or maybe cost is starting to look boggy. Whatever the cause of voluntary churn is, put it here.

- Disengagement: At this stage, signs like reduced usage or interaction frequency begin to pop up. Your client is just using the software out of necessity, and emotional connection, including trust, starts to dwindle gradually.

- Evaluation: There’s an active comparison of your product with competitors. Who’s better, cheaper, faster, and all that. Customers also have increased doubts about value for money or relevance.

- Decision to leave: This is where the straw breaks, and it’s usually due to a final trigger event such as a price hike or poor support. There’s a mental shift to an alternative provider.

“You can resolve issues quickly in the first two stages with simple, personalized outreach. By the third and fourth stages, customers mentally detach and explore alternatives, which makes winning them back more costly and less effective.”, Edward adds.

The only silver lining? This whole process of voluntary churning can take weeks or months to reach the final stage. That’s enough time for you to pick up the signals and quickly get to work.

What about involuntary churn?

Unlike voluntary churn, involuntary churn is not confined to psychological stages.

- Your customer is all fine and good until they find it challenging to make a successful payment for subscription renewal.

- Then they try repeatedly, or they’re not even aware of the payment failure.

- They get disconnected from the tool, which causes their service delivery to falter.

For SaaS customers, tool disruption is the leading cause of a bad customer experience, and half of customers say they will immediately switch to another vendor after only one episode, according to Zendesk’s benchmark data.

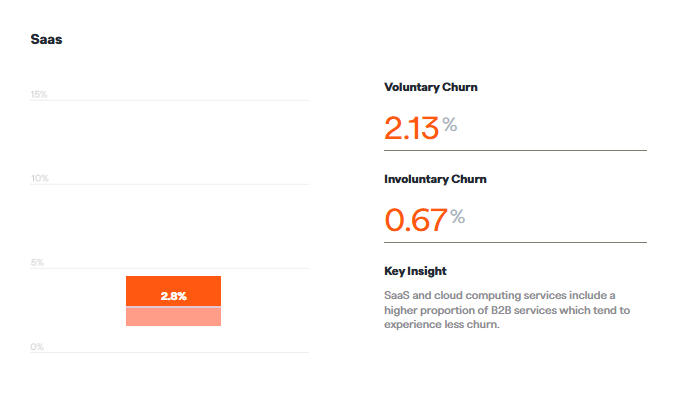

Source: Recurly

While it’s challenging to drive the involuntary churn rate from the 0.67% annual SaaS average to 0%, you can still nip it down significantly if you introduce proactive measures like:

- Automated payment retries to recover failed transactions before accounts lapse

- Real-time dunning notifications that alert customers immediately when payment issues occur

- Multiple payment options to prevent card-specific failures from disrupting service

- Grace periods with limited functionality to give customers time to resolve billing problems without complete service disruption

It’s not always about what you did wrong

Churn isn’t always caused by poor experience or product dissatisfaction. Sometimes, you’re doing everything right, and that’s the problem.

“We thought the biggest risk was losing people who were unhappy. Turned out, the bigger risk was losing people who were too happy. They’d find the exact info they needed, close their account, thinking they’d ‘completed the mission,’ and disappear. We never built a reason for them to stay – so our success became our churn engine”, Emily Carter, Senior Customer Support Specialist at Searqle, says.

To fix that, you need to:

- Redefine success as an ongoing journey, not just one milestone. If they finish setup, give them optimization tips. If they research a topic, offer them advanced analytics or templates.

- Guide them to the next step right after they complete one. After the first step, show them exactly what’s next, like a checklist, quick start workflow, or “what to do now” prompt.

- Suggest upgrades that feel natural, not pushy. If they completed a basic task, point to premium analytics, automation, or collaboration features. Simply tie it to what they’ve already achieved.

- Make progress visible by using dashboards, progress bars, or milestone badges to show how far they’ve come and what’s ahead.

Why Most Won’t Tell You Before Churning

Stanislav Khilobochenko, VP of Customer Services at Clario, says,

“Churning starts the moment there’s friction. However, most of the time, you only notice it when the customer has already left and stopped engaging completely. No heads up or calls in. Just a drop-off alarm blaring loud in your ears when it’s time for quarterly reports.”

A 2023 report by Coveo backs this up. According to the survey outcome, 56% of over 4000 respondents say they rarely or never complain about a negative customer service experience. They simply go on a hunt for the nearest competitor.

“Churning customers, however, give off signals like reduced logins, delayed responses, or disengagement with key features, which often fly under the radar because they don’t feel urgent. By the time you realize what’s happening, they have already shifted their trust, attention, sometimes even their budget elsewhere, and your competitor is holding the golden trophy”, Stanislav continues.

So, it’s not that they don’t want to tell you. It’s just that they’ve communicated it through different signals, which you possibly ignored. And now:

- Customers don’t believe their feedback will matter if their signals didn’t matter in the first place.

- Feedback feels like extra work. To be honest, it is, especially if your support process is not well-streamlined.

- They don’t want confrontation. Support can be a lot of back and forth.

- Or possibly worse, they’ve already mentally moved on. No need to call in again.

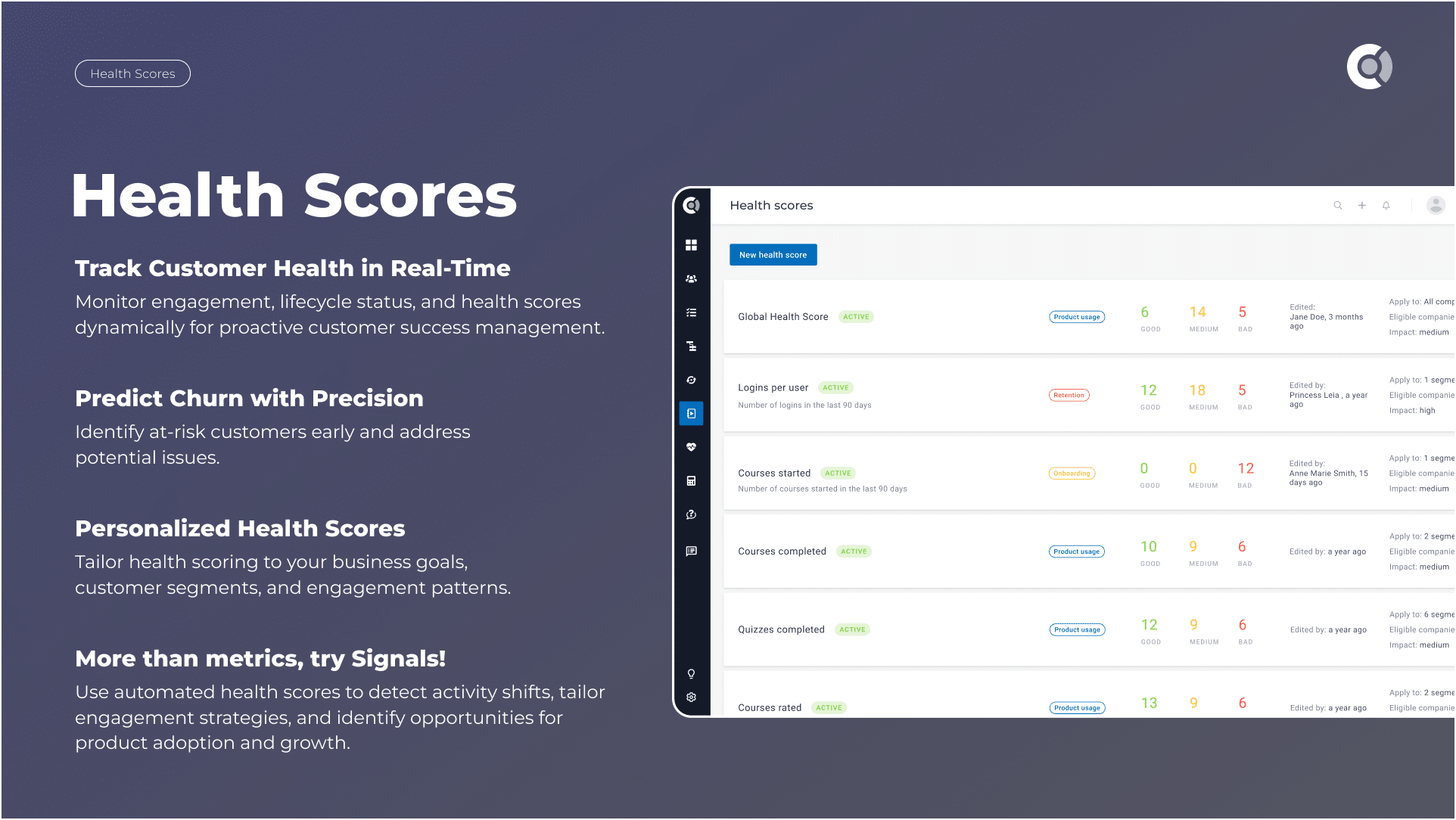

You want to avoid such outcomes and become your brand’s hero? Raise your antennas to pick up every single signal, even when client sentiment is green. This includes:

- Login frequency: < 1 login in 7 days or −30% vs 4-week baseline → At-risk.

- Feature adoption: Core-feature usage below P80 of peer cohort for 2 weeks.

- Engagement: No response to 2 messages across 2 channels in 10 days.

- Support: 2+ repeat tickets on same topic in 30 days.

- Billing: 1 failed payment event → Start dunning; 3 failures → limited access.

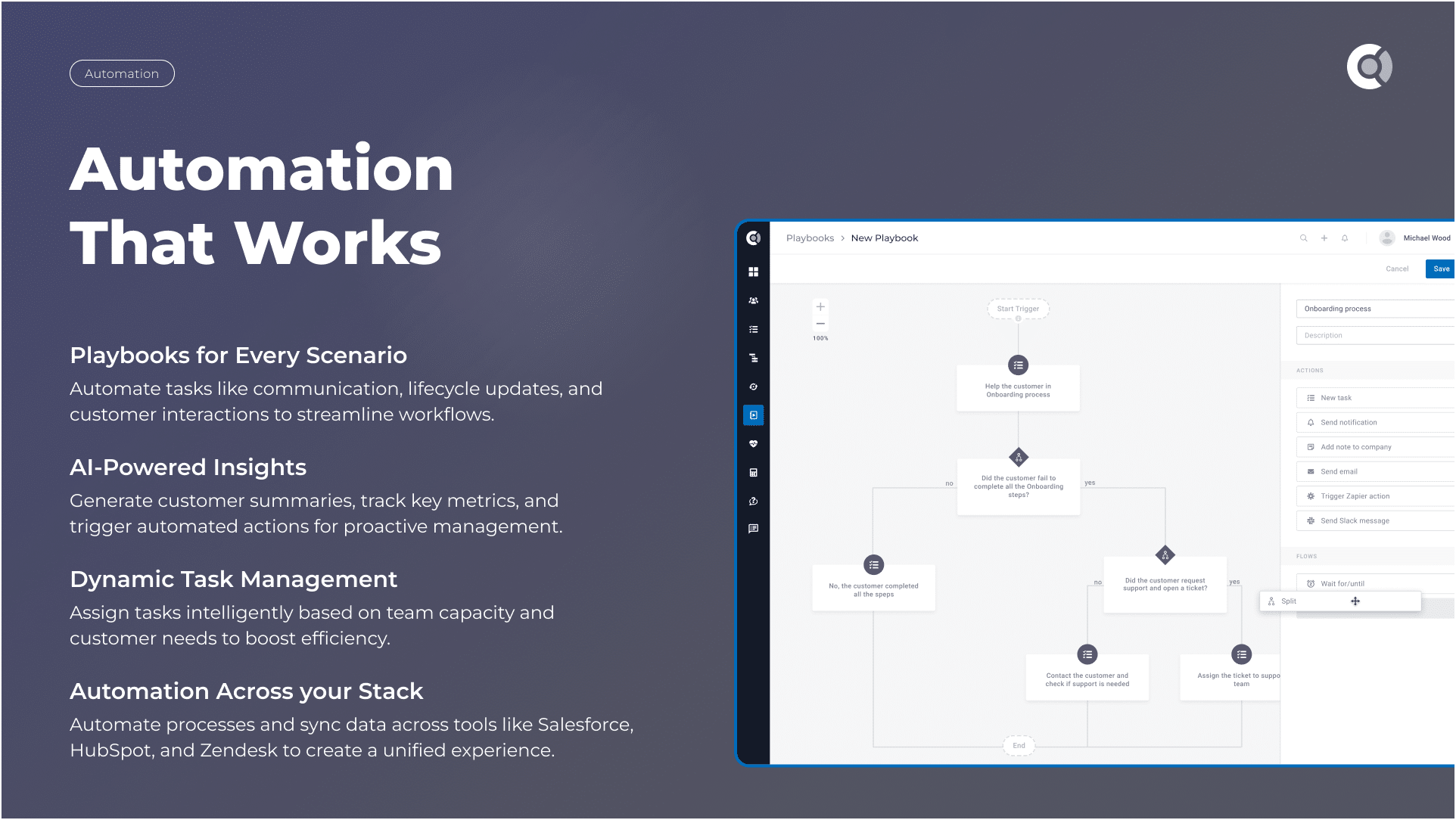

How to wire these signals in Custify

- Health score inputs: logins, feature usage, ticket repeats, NPS/CSAT → weighted per segment.

- AI playbooks: trigger save-sequences from dips (e.g., “−30% usage for 14d”) with approve-to-send emails/tasks.

- Alerts & QBR recap: Slack/email alerts on risk; share a portal/QBR deck to reset value.

What overlooked churn signal ended up costing the most

Customers. That’s what overlooked churn signals cost. But beyond that:

- Your customer acquisition cost shoots up.

- CAC payback period gets stretched.

- Brand momentum slows down.

- Overall lifetime value takes a hit.

Let’s take Dropbox, a SaaS pioneer in cloud storage and sharing, as an example. 2024 Q4’s report highlighted a growth in the company’s total revenue of about 6%. Revenue per paying user also jumped to $138.83 from $134.53.

However, there was a problem. Paying users decreased by over 50,000, or 0.05 million, quarter-over-quarter. That’s revenue churning, which can result from involuntary churn reasons, such as payment failure, or voluntary churn causes, like price inflexibility when backdropped against the economy.

Houston, the CEO and co-founder of Dropbox, also admitted to the growing churn rate, which, in the short term, stopped shy of affecting the company’s total revenue, thanks to increased revenue per paying user.

Although I was proud of last year, Q4 was a challenging quarter, some of these challenges were expected.

For instance, we continue to see the broader economic backdrop impacted both our Teams and document workflow businesses, as customers are being more cautious with their spend and exhibiting higher levels of price sensitivity. This resulted in reduced levels of gross new licenses and upsell activity, alongside higher churn and downsell.

Drew Houston, CEO, Dropbox

The file-sharing brand released its earnings calls for Q2 2025, which showed a slight increase. Despite the strong growth, Dropbox’s shares fell by 1.17% in the closing hours of trade, reflecting investor concerns over the future.

That’s justified given the increasing rate at which users are adopting late-to-the-race competitors like The Median SaaS and NextCloud, both of which are capitalizing on competitive pricing. The company’s forecast also anticipates a 1.5% drop in paying users in the following quarters.

So, overlooked or underaddressed churn signals not only cost you customers and more expenses, but they also affect and influence the decision of your capital source—the investors.

Every churn is a gift to your competitor

Looking at Dropbox’s case study, a significant number of the quarterly 0.05 million users are likely exploring cheaper alternatives. Each one of these churns carries away not just their subscription fee but also the potential upsells, referrals, and lifetime value your team worked so hard to build.

Another notable but non-SaaS case study is X (Formerly Twitter) and Threads. Some months into 2023, after X’s takeover by Musk, millions of users migrated to Threads. Whether you compare website traffic, app installation, or measure adoption, it was obvious X was in a churn crisis, and Threads was riding on its wave.

Every user exit tells a story, and those stories often fuel a competitor’s growth. So, it’s either you become your competitors’ PR or you take proactive measures discussed in our Churn Guide to prevent attrition in the first place.

The most effective win-back tactic

Your chances of winning back a churned customer depend on whether they’re already engaged with a competitor or not.

Win-Back — What Works Best (3-Touch Sequence + KPIs)

Before we jump into messages and offers, set yourself up for relevance. The aim is to speak to the exact reason they left, and to do it quickly—without adding friction or noise.

1) Prep (do this before any outreach)

A bit of upfront prep makes every touch more credible.

- Segment by churn reason: price ▸ value unclear ▸ product fit ▸ support friction ▸ involuntary (payment failure).

- Pull account context: last active date, most-used features, plan, seats, tickets/NPS, champion contact, open opps.

- Choose a matching incentive: annual savings/temporary discount ▸ premium feature trial ▸ white-glove migration ▸ extended grace period (for billing failures).

- Timing window: start within 7 days of churn; stop after 3 touches unless they engage.

2) The 3-Touch Cadence (copy-paste and tailor)

Keep it human, specific, and short. As Eric Do Couto, Head of Marketing, Visualping, puts it, there’s no need for “long curves and stories… go simple. Address them by name, reference what they used most, and acknowledge their concerns.”

Touch 1 — T+7 days | Value refresher (email)

Purpose: Remind them of outcomes they achieved and show what’s new that solves the old friction.

Subject: [First name], we fixed the thing that slowed you down

Body:

“Hi {{first_name}}, when you used {{product}}, your team {{impact metric, e.g., cut time-to-onboard by 32%}}. We’ve shipped {{feature}} to address {{their friction}}. Here’s a 60-sec walkthrough: {{link}}. Want me to switch your workspace back on for {{7 days}} so you can test it?”

Touch 2 — T+14 days | Personal Loom + one next step (video or call)

Purpose: Humanize the outreach; prescribe a single, concrete action.

Script (60–90s):

“Hey {{first_name}}, I’m {{your_name}} from {{company}}. I noticed {{usage pattern before churn}} and {{new feature/fix}} now covers that gap. If we restart your account, the one thing I’d set up first is {{action}}. I can do it for you—say yes and I’ll enable it.”

Touch 3 — T+21 days | Offer + exit ramp (email/SMS/LinkedIn)

Purpose: Make a targeted offer or provide a clean opt-out.

Copy:

“Last note from me, {{first_name}}—if price was the blocker, I can extend {{X% annual}} or {{1 free month}} so you can validate {{goal}}. If the timing isn’t right, reply STOP and I’ll close this thread.”

Channels & timing:

Start on email, then add the channel they used most (Slack, LinkedIn, SMS, phone). As Josh Howarth (Co-founder & CTO, Exploding Topics) says:

“There’s no hard and fast rule against combining two or more channels. What matters is that your message reaches them in the place they want it.”

Trigger outreach within a week of churn while memory and context are fresh.

3) Map incentive to churn reason (quick guide)

Tie your offer to the specific friction; here’s how to frame it briefly before your bullets:

- If value was unclear, prove ROI with a near-adjacent case and hands-on setup.

- If price was the driver, reduce risk and decision friction with a time-boxed deal.

- If a competitor pulled them, show a differentiator they can test immediately.

- If support was the issue, guarantee faster paths and a named CSM.

- If billing fails, make recovery effortless and keep their setup intact.

Cheat sheet:

- Value unclear → use-case case study + hands-on setup.

- Price sensitivity → annual savings / temporary discount / lower-tier trial.

- Competitor pull → differentiator preview + white-glove migration.

- Support friction → 30-day priority lane + named CSM.

- Payment failure → one-click billing update + grace window; keep data intact.

4) KPIs & stop rules

Give the team a quick narrative, then the metrics so ops can land it:

- Measure what matters: Reactivation rate, time-to-reactivation, 90-day retention for reactivated accounts, recovered ARR, and ARPA vs pre-churn. Track reply rate by channel and keep unsubscribes < 1–2%.

- Efficiency lens: Cost-to-win-back vs new CAC should be lower.

- Respect: stop after 3 touches/no response; honor legal/security constraints and DNC lists.

5) (Optional) Automate it in Custify

A one-line intro helps the bullets land: once you’ve validated messaging, automate for speed and consistency.

Trigger: status = churned OR payment_final_failed.

- Playbook: auto-create T1/T2/T3 tasks; prefill emails with last-used features & outcomes; generate a 60-sec script.

- Alerts: Slack the owner on reply/payment update; tag Recovered on success to track impact.

- Measure: dashboard tiles for reactivation rate, recovered ARR, 90-day retention of win-backs.

Fix the Root Cause (before you scale win-back)

Brief framing helps the list feel purposeful: win-backs fail if you don’t remove the original friction that pushed them out.

- Close gaps in onboarding and value realization.

- Stabilize support loops (speed, first-contact resolution, repeat issues).

- Align pricing and plan fit to what they’re actually using.

- Reduce payment friction (multi-rail methods, dunning, smart retries, grace windows).

How Custify operationalizes this

Connect your CRM + product events + billing signals to Custify. Map churn “tells” (logins, adoption, repeats, failed payments) into a health score, then trigger AI-assisted playbooks (re-activation, save offers, value recap) and real-time alerts to Slack/email.

Use a shareable portal/QBR to align on next milestones and close the loop.

Wrapping Up

The trick to business success is to gain customers faster than you lose them while also minimizing your churn rate. You might not be able to dial churn to zero completely, but every improvement makes a big difference in your business growth and revenue.

To minimize churn, pay attention to the signals your customers give and use platforms like Custify to track customer churn risk. For involuntary churn, provide alternative payment options, implement a dunning strategy for failed payments, and send timely reminders before billing cycles.

Paradventure a customer churns, kick off your personalized outreach wheel and pull them back before they disengage entirely. A well-timed email, a loyalty incentive, or a targeted offer can rekindle interest and remind them why they chose your product in the first place.