Where is the value of a customer?

Is it in their monthly subscription? Their purchases? Their customer reviews?

Maybe it’s in the recordings and case studies they helped you make. After all, how many new SQLs did you get because of those?

Regardless of what you deem most important, the customers’ value to a business is a complex calculation that transcends simple account metrics. Today, we’re going to look over a formula that’s integral to the healthy development of a company: customer lifetime value (CLV).

To sum up how the article is going to go, you’ll find an overview of CLV, several ways of calculating it, and an in-depth section with ways to improve and maximize your CLV. All sprinkled with common quips and concerns the larger business world has about this elusive metric. Shall we start?

What Is Customer Lifetime Value (CLV or CLTV)?

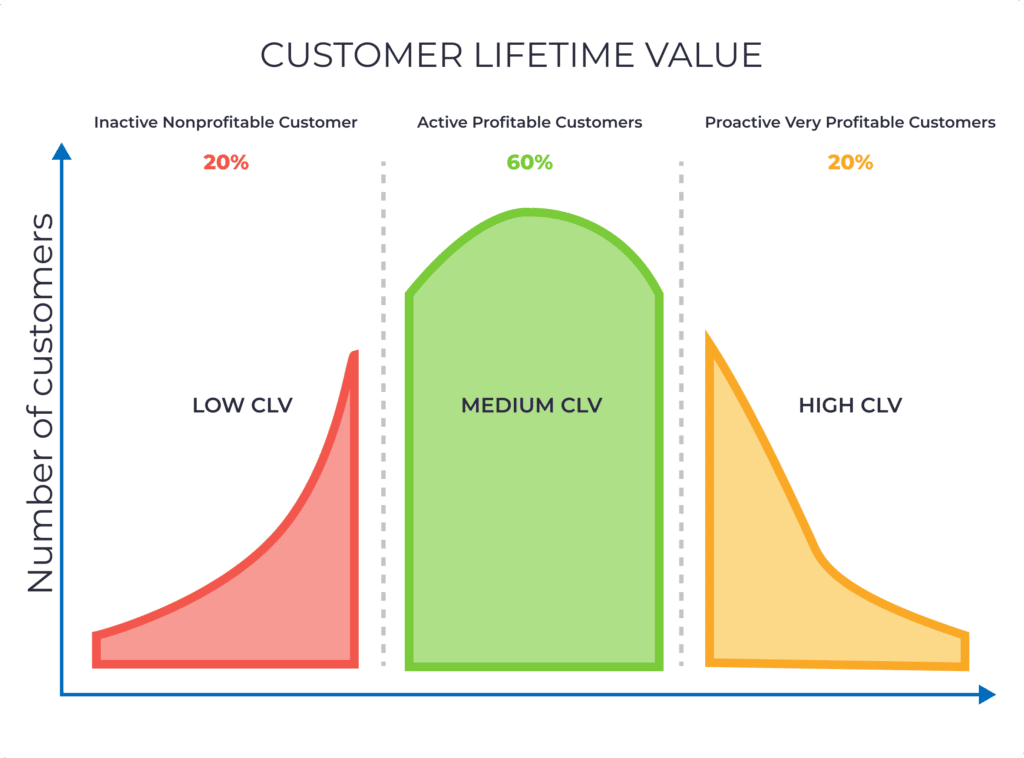

Customer lifetime value (CLTV) is a business metric calculated through a predictive formula that determines customers’ average expected value to a company throughout their professional relationship. The methodologies are numerous and complex, and the opinions on them equally so, but at its core, CLV is an informative number that has the power to shift a business’ focus from revenue to relationships.

In customer success, service, and experience, CLV is a driving force because it effectively gauges the efficiency of all three efforts into a tangible, quantifiable metric. The resulting number objectively shows not just the value of fostering customer relationships, but also how much money one can reasonably spend on those relationships while still turning a profit.

With 72% of organizations naming customer experience as a top priority and CX spending expected to reach $641B in 2022, CLV is a perfect metric to track:

- The efficiency of CX and CS initiatives and what money can be allocated to improve it

- How expensive customer acquisition is compared to the revenue that customer will potentially bring in

- Whether the amount of money companies put into CS and CX is too low, just perfect, or too high, based long term calculations and predictions

- Whether there will be more money in the near future to redistribute among initiatives that can increase CLV

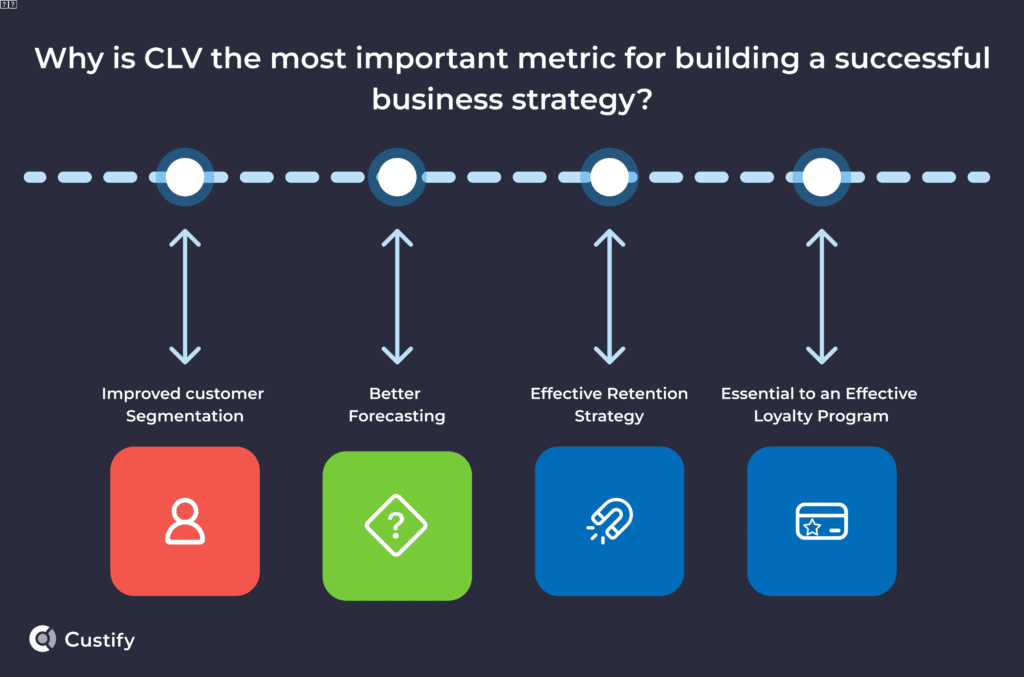

Why Is Customer Lifetime Value Important?

According to Adroll President Scott Gifis, optimizing for CLV is one of his three most important “quick-win tips” to improving retention:

“By optimizing your customer lifetime value, you may realize that you’re spending huge sums on acquiring customers because you haven’t made enough of an investment in your loyalty programs. For example, if your customer acquisition cost (CAC) for a net-new customer is 30% of your first sale, then it makes sense to provide discounts and promotions to your past customers at 10-20%.

You’ll need to think differently about how you measure and attribute various programs. Vanity advertising metrics and surface-level attribution models, such as last-click, need to be replaced with more comprehensive forms of measurement. It’s vital to make an investment in truly understanding your CLV and separate out the cost per acquisition (CPA) for new and repeat customers. You’ll probably find that you’re burning a lot of dollars that you could be sharing with your customers via loyalty programs, and driving faster, more sustainable growth.”

CLV is the most comprehensive metric used in business analytics. Other indicators such as number of new customers, cost per acquisition, retention rate, CR% are crucial to your company analytics, but CLV integrates all of them for each individual client. It’s simply the anticipated profit you get from each consumer. One metric to rule them all.

Is Customer Lifetime Value actually useful?

Generally speaking, customer lifetime value is a great metric to track. How useful it is, well that tends to vary based on:

- the methodology you pick for your CLTV formula (see below)

- the age of your business, product, and services

- the accumulated experience of your customer-facing team-members

- how well your customers understand your product and its value

Let me explain with an example:

You’re a startup and you pick the predictive formula for CLV and try to integrate it into your reports. Not only will the factors in your formula be incomplete, irrelevant, or completely missing – you’ll spend a lot of time calculating it (inversely proportional to how large and experienced your team is).

In the end, it won’t tell you much because startups change – it’s in their nature. Your predictions will be irrelevant, and that time will have been wasted as soon as the next big product update goes live.

The question then becomes:

How to use Customer Lifetime Value (CLTV)?

As explained above, CLV can actually waste time and money if used improperly—which is the exact opposite of what we’re trying to do. So, once you have the CLV metric in place, here are the best ways to actually use it in your day-to-day business activities:

- Tracking business profitability in one metric

- Improve client segmentation

- Evaluate customer loyalty

- Measure marketing budgets vs customer ROI

- Tracking product fit vs customer segment

- Benchmark metric for any efforts deemed to improve profitability

- Discover your most profitable acquisition channels

- Identify the most profitable customer or customer segment

- Prioritize customer complaints

What’s the Difference Between CLV and LTV?

If you’ve heard of CLV, you’ve definitely heard of LTV. Many use them interchangeably while others track different things through them.

It’s true, both CLV and LTV mean the same thing – the average value of a customer for their entire professional relationship with a business. However, here’s where differences appear:

- LTV is often used as an aggregate metric – the lifetime value of the average customer or the net profit of the relationship between the customers and the brand.

- CLV, on the other hand, represents the individual lifetime value of a customer.

To us, the difference here is more about methodology than terminology. The base formula for a single customer’s lifetime value can be helpful in certain situations and can inform internal reports and processes. It’s also a good substitute if you don’t have a simple, predictable sales cycle.

That being said, the aggregate metric is the more popular one, the one included in business reports, and the one which venture capitalists and investors use for LTV:CAC ratio calculations to determine the profitability of a business.

Speaking of calculations:

How to Calculate Customer Lifetime Value

There are four ways of calculating customer lifetime value, each with a different approach and suited for different scenarios. For example, the Basic method of calculating CLV is best for on-the-fly calculations and quick reports.

Let’s examine them in detail:

CLV Methodologies and Formulas

1. The Basic CLV Formula

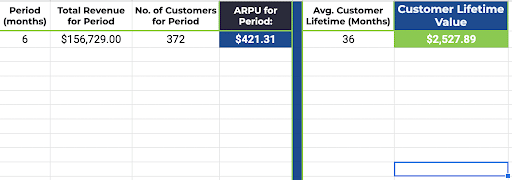

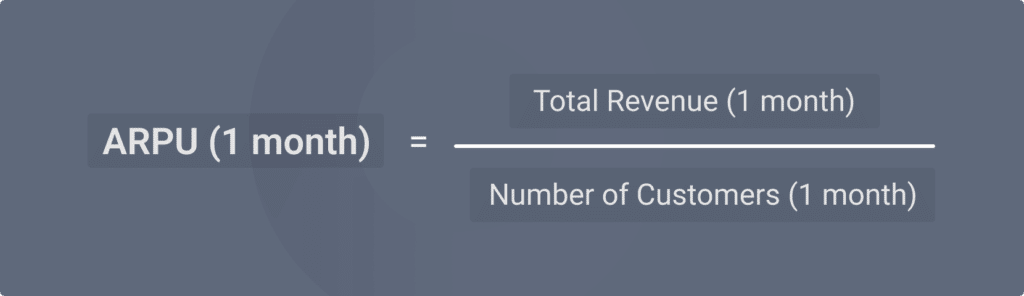

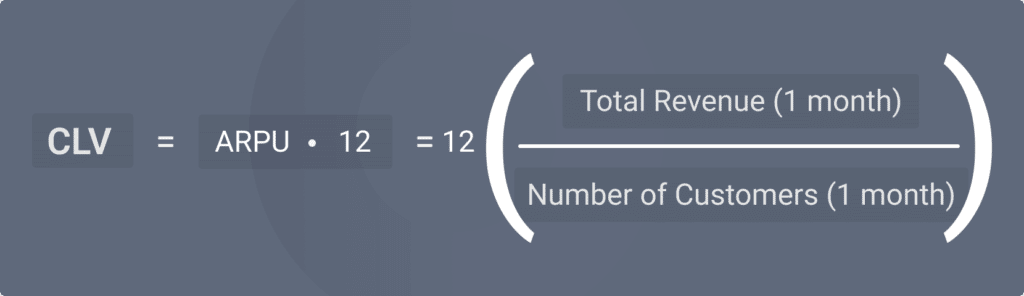

The simplest method to calculate CLV is the historical formula, based on the Average Returns per User:

Where:

Same as ARPU, but for the average length of the customer relationships. Assuming the average length of your customer relationships is 12 months, then the CLV formula becomes:

The basic, historical CLV formula is great for:

- Quick, on-the-fly calculations

- Small teams that need to monitor CLV

2. The Cohort CLV Formula

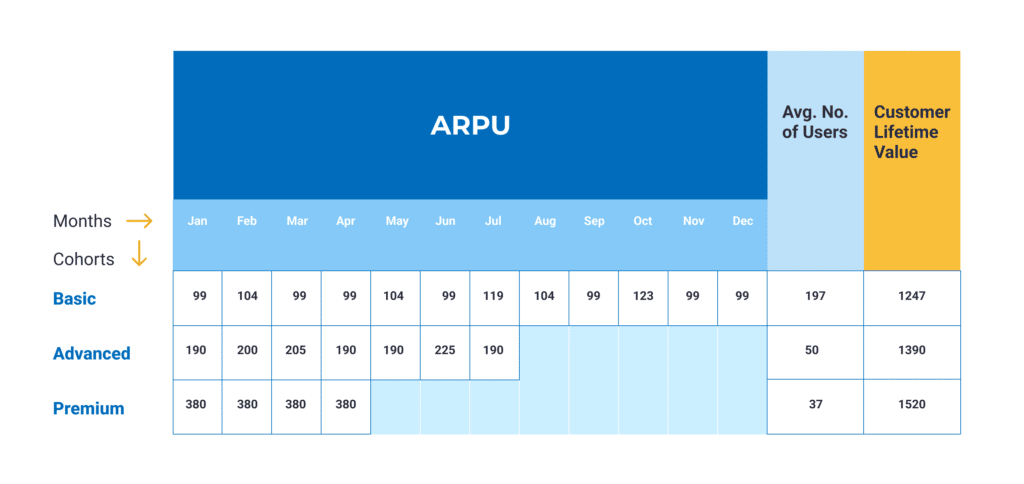

An evolution of the Basic CLTV formula that uses ARPU, the cohort version calculates different CLVs based on segmentation. You can use time or other metrics to separate your users into segments, but by the end of this analysis, you’ll have a great comparative view that will hopefully provide some unique insights.

It’s best to work on an example:

- We have three cohorts of users: basic, advanced, and premium, each corresponding to a specific account type in our SaaS product.

- The basic subscription is $99 per month, the advanced one is $190 per month, and the premium version is $380 per month.

- Customers can add features monthly, priced at $5, $7, and $10.

- The average customer relationship lasts 12 months for basic users, 7 months for advanced users, and 4 months for premium users.

Using the ARPU-based formula above, the results look like this:

Reviewing the table above, we can clearly see the cohort methodology of calculating customer lifetime value has some advantages:

- The analysis shows the most valuable cohort, or in this case subscription type. If this were a real CLV calculation, we’d be able to tell that:

– a Premium account is more important for this business than a Basic or Advanced account. Even if a basic account keeps adding extra billable features every few months and a Premium account cancels after 4 months, the company still earns a bigger profit from the Premium one.

– By factoring in the average number of users, Basic accounts immediately shoot up, earning far more for the business compared to the other types of accounts.

NOTE: the specifics of your CLV analysis will naturally depend on your business and billing models. - This will change based on your business and pricing models, but the insights you can glean will be equally valuable.

- The analysis shows ARPU per month while highlighting the impact of extra features.

- While complicated to look at, the technical know-how needed to create a Cohort CLV report is not that advanced.

There’s also a significant disadvantage to performing a cohort CLV analysis:

- Since it uses existing metrics, the analysis can only be completed on a historical basis, therefore predictions based on it are going to be slightly inaccurate, but not as inaccurate as the basic CLV formula above.

The cohort analysis and historical CLV formula is great for:

- Complex predictions using basic calculations

- Medium teams that can afford the time to create a complex table like the one above

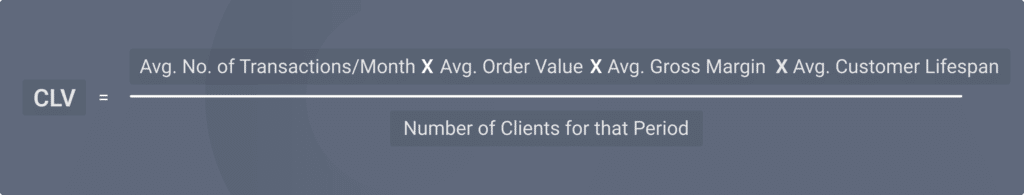

3. The Predictive CLV Formula

Our personal favorite, the predictive value CLV formula is very complex, but also the most useful from a business perspective. It mixes a lot of other complex metrics to form the most accurate predictive model for customer lifetime value.

So if you’re wondering whether you can predict CLV – the answer is yes, mostly. This formula is your best shot at a relevant prediction, but also still just a prediction, not a view into the future:

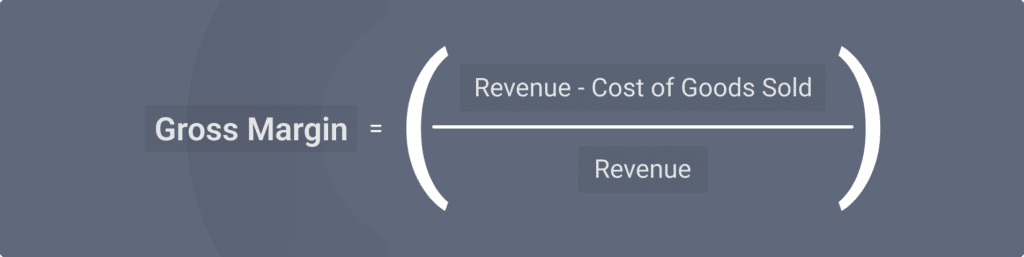

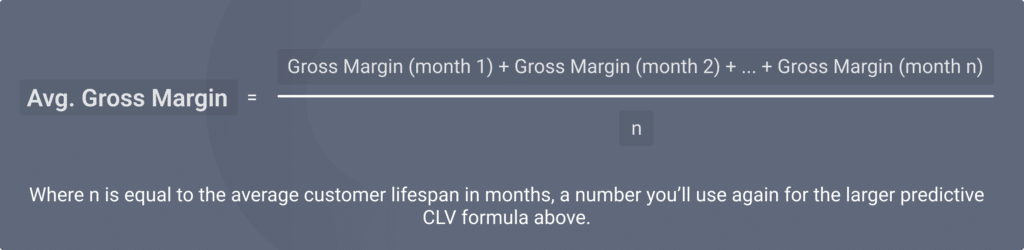

The only complex factor to calculate here is the Average Gross Margin, which you can get by using this formula:

The predictive CLV formula is great for:

- The most accurate prediction based on multiple sets of data

- Getting a full picture of your CLV, with all relevant metrics factored in

- Complex reports, overviews, strategies

- Venture capitalists and investors

How to Calculate CLV in Excel / Sheets

We’ve compiled a publicly-available spreadsheet containing the basic historical CLV formula, ready to copy-paste into your Excel or Sheets document.

- For the Cohort Analysis, you need to create your own version of the table we added in the Cohort analysis section.

- For the Predictive CLV equation, you will first need to manually calculate your average gross margin. Then, you can simply calculate your CLV as all other factors in the predictive formula are values you should already have.

Troubleshooting: Can Customer Lifetime Value Be Negative?

You may have run any of the CLV formulas we’ve listed above and the result turned out to be negative. What happened?

First of all, don’t panic. Your CLV formula can return a negative result. It’s usually one of three possibilities:

- You’ve spent too much on a customer compared to the value they bring to your business

- There is something wrong with your formula. Check to see if any of the factors in the CLV equation are negative and go backward from there to see what’s wrong. CLV cannot be negative if none of the factors that make up the CLV formula are negative.

- Your spreadsheet cell is in the wrong format. We’ve not seen this ourselves, but I know from experience that sometimes cells that are not correctly formatted will return negative results.

How to Increase Customer Lifetime Value

To improve your CLV, you can honestly pick any of the tactics we present in our Customer Success Strategy guide. But for right now, we’ll summarize the top ones that directly affect and increase CLV.

1. Streamline Your Onboarding Process

It all starts with onboarding. The best chance you have of a high CLV for any account is if you make sure they understand your product, the value it brings to them and their business, and exactly how it helps them achieve their goals.

Holding onboarding calls, conducting product tours, helping customers with setup – all are valuable for your users and will turn up the ROI for that account for the foreseeable future. You also need to make sure there’s a proper handover from Sales, so that you, as a CSM, have the necessary info to move forward with efficiency.

2. Prioritize Upsells, Cross-sells

The most straightforward way to increase customer lifetime value? Actually increase their value by upgrading their account or adding features they might need. Great CSMs know when, where, and how to present upgrade offers so that it’s advantageous to the customer.

Don’t force the issue, however. Throughout the customer lifecycle, there will be plenty of times where extra features would be beneficial – so be on the lookout and relentlessly pursue those opportunities when they appear.

3. Start an Incentivized Referral Program

To increase CLV with referrals, you’ll need to tweak the formulas to factor them in, but it’s undeniable that referral revenue is a clear way to increase value of a customer.

Incentivized referral programs typically consist of three phases:

- You come up with an incentive to encourage customers to refer their friends and business connections.

- Your customers start bringing in leads.

- Those referrals turn into clients and the original customers receive the promised rewards.

4. Evolve It into a Loyalty Program

For your next customer success magic trick, you can turn your referral program into a loyalty program by adding loyalty rewards, standardizing referral bonuses, and generally treating your best customers appropriately.

Turning retained accounts into loyal customers has a lot of benefits:

- They’ll stay with you longer, increasing CLV

- They’ll be more inclined to make more purchases, further increasing CLV

- They’ll notice the special treatment and actively promote your business to their friends

- They’ll come to you for any concern, leading to more upsell and cross-sell opportunities, increasing CLV even more

5. Rave about Every Update

You know that moment when you launch a cool update? Everyone’s talking about it, they love the features, praise the stability improvements, and notice the bug fixes. But you, as a CSM interested in increasing the CLV of your customers, need to rave about the update.

That means:

- Being markedly excited about new features

- Loving the stability improvements

- Praising the bug fixes

Overall, imagine you’re selling your own update – you have to be the first person to praise your product and actually mean it. That will set the tone for how your users view the new update, how they talk about it, and how they value your relationship moving forward.

6. Create a Community

Humans are predominantly social and need a sense of belonging, with community holding a special meaning for us. So – bringing your most loyal customers into a group – either on Discord, Slack, Workplace, or any other online platform you prefer – will make them feel like they belong with you and are part of something bigger. This, in turn, will increase their average lifecycle as a customer and maximize your CLV.

7. Create an Offboarding Script with Counteroffers

If your churn rate is worrisome, consider creating an offboarding script complete with counteroffers. That way, you can attempt to save accounts that have their foot in the door.

Simply set up interviews, be ready with your script, and roll the dice to see who will stay and who will leave.

Note: be cautious when selecting your counteroffers – if you pick the wrong ones or offer too many, you may be actively decreasing your CLV, and that’s the opposite of what you want.

Note: How to Maximize Customer Lifetime Value?

The best way to maximize CLV is to adopt all the methods for increasing it that you can reasonably fit into your workflow. Optimizing onboarding, offboarding, upsells, referrals, and more simultaneously is a surefire way to increase CLV as much as possible.

Creating a voice of the customer program is also a great way to increase the lifetime value of a single customer. By prioritizing the feedback from one of your best-fit clients, you’re potentially increasing the CLV for all your customers at the same time.

Keeping Customers for Life

Now that you’ve hopefully understood how to calculate CLV and how it helps you in your business decisions, you’re much better equipped to secure the financial future of your business.

One of the main topics of interest for CSMs has always been the ROI of customer success:

- how to increase ROI

- how to manage the attribution side

- how do I prove the value of CS efforts

The answer? CLV. One powerful metric that can help you tackle all these questions while also getting invaluable insights into your long-term profits, and learning why your work matters. And with these answers up your sleeve, nothing can truly stop you from achieving greatness.