SaaS sales forecasting is a key part of financial planning and analysis for SaaS enterprises. Sales forecasts are important for business leaders trying to make wiser decisions on scaling, hiring, pricing, or divesting.

With accurate SaaS sales forecasting, you can manage growth expectations and make long-term plans for your business.

What Is SaaS Sales Forecasting?

Also called revenue forecasting, SaaS sales forecasting is important to product development, SaaS marketing, and risk management.

This is because SaaS sales forecasts form a basis for future financial groundwork and the performance of any SaaS business. Accurate sales forecasts can help you make the right decisions when it comes to budgeting. You can allocate the proper SaaS marketing budget for your recruitment, email newsletters, or social media campaigns.

Accurate sales forecasts can also influence profitability, cash flow, and risk management.

For SaaS startups going the funding route, sales forecasting is also a prerequisite for investors to gain confidence in the business. Investors need to know if 2-3 years down the line, they are still going to be making money from the venture. They also need to be convinced that the founder’s propositions are backed by quality data.

Challenges to SaaS Sales Forecasting

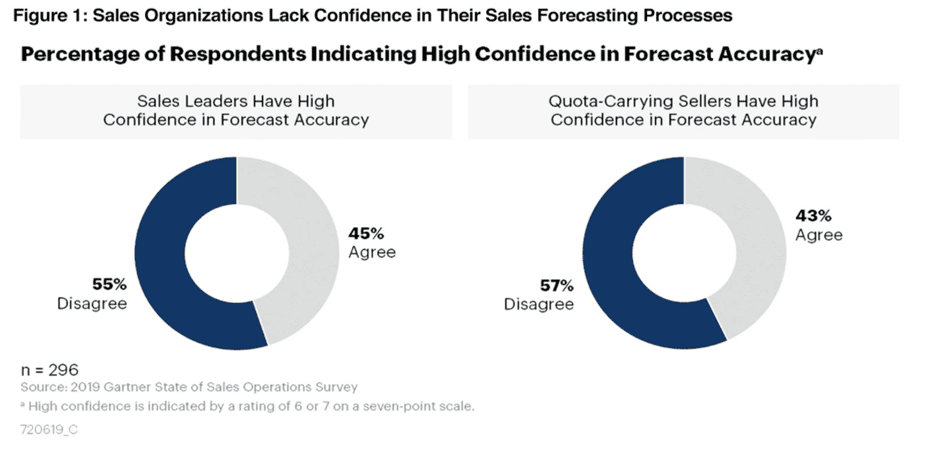

Despite sales forecasting being an essential part of business planning, most sales leaders have low confidence in the accuracy of sales forecasts. The infographic below from a Gartner Survey shows this.

This low confidence by industry leaders is understandable, given that for SaaS products, many variables affect product price. Such variables may include discounts, onboarding costs, features, integrations and add-ons, licenses, etc.

The SaaS business model is influenced by external factors that directly affect its revenues and future projections. These include:

- Economic environment: SaaS businesses are affected by the performance of the economy. During a boom, sales may increase or upgrades and cross-sells might hit highs, while during a recession the reverse is true.

- Laws: SaaS businesses that are non-compliant with regulations such as the GDPR might find their revenues tanking.

- Competition: The SaaS space is highly competitive, and thus, even small price changes from a competitor might directly affect your revenues.

- Seasonality: Demand fluctuations at different times of the year aren’t uncommon with SaaS businesses.

One of the key challenges to SaaS sales forecasting is the availability of clean data. Simple revenue forecasts on a spreadsheet might not suffice over the long term for a large SaaS business. Modeling the forecast may turn out to be complicated and messy, not to mention inaccurate.

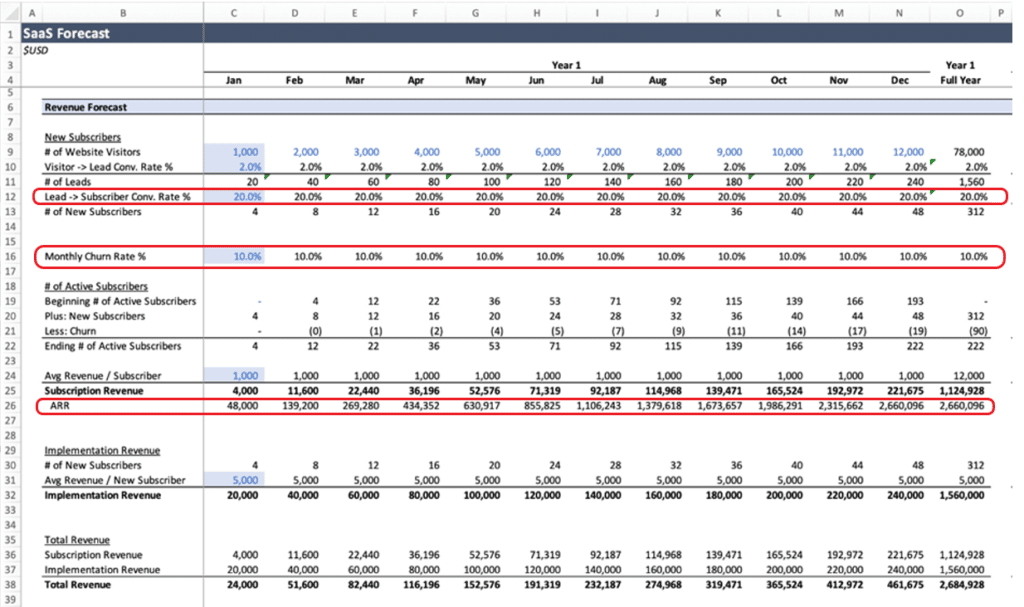

Let’s check out the simple spreadsheet example below.

Without getting into too much detail, we can note the following figures from the spreadsheet:

- “Adds” which is the number of new subscriptions each month.

- “Drops” are a subscriber reduction based on churn.

- A high and low MRR, at $350 and $250 respectively.

- Seasonality, where subscriptions change based on months or cycles.

- A scenario matrix to output different total future revenue.

This SaaS model doesn’t even incorporate data such as expenses, market share, Customer Acquisition Costs (CAC), Customer Lifetime Value (CLV), activation rates, etc. If all these variables and outputs were included, the model would become complex.

3 Methods of SaaS Sales Forecasting

With this solid understanding of SaaS sales forecasting, the question is, how exactly do you do it? Your choice of method should depend on the following:

- Your business model. For example, what does your sales pipeline look like?

- The type of data you collect and how you collect them.

- The kind of metrics you track and how they fit into your KPIs.

That said, here are three major sales forecasting methods you can adopt for your SaaS business.

1. Time Series Projections

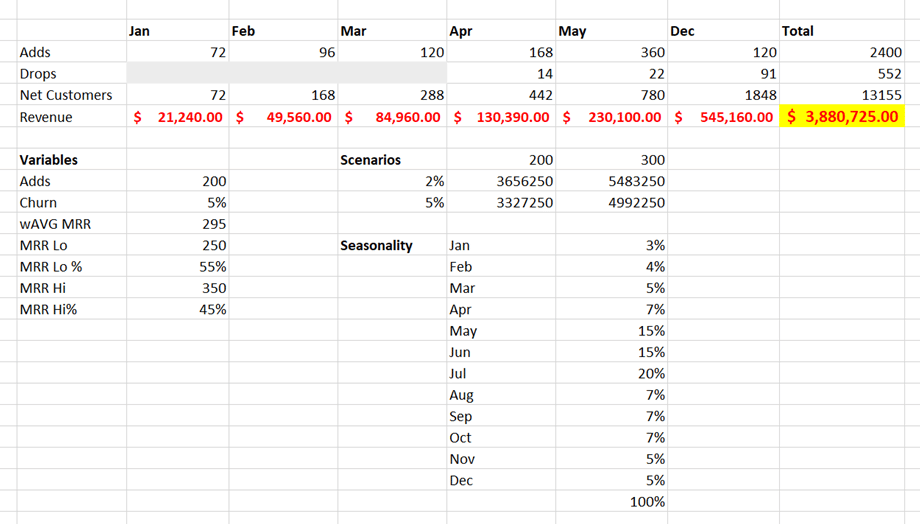

Time series analysis relies on historical sales data to produce revenue approximations of Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR).

In time series projections, it is necessary for relationship trends to be stable and to be clearly discerned. Mathematical techniques can then be used to extrapolate or regress the data. One such technique is the use of a trendline as seen in the image below.

Here, historical sales data forming a trend line can be fitted to an ideal equation for compounding revenue over time. Other time series variables such as seasonal revenue fluctuations and historical churn rates can also be added to the ideal equation.

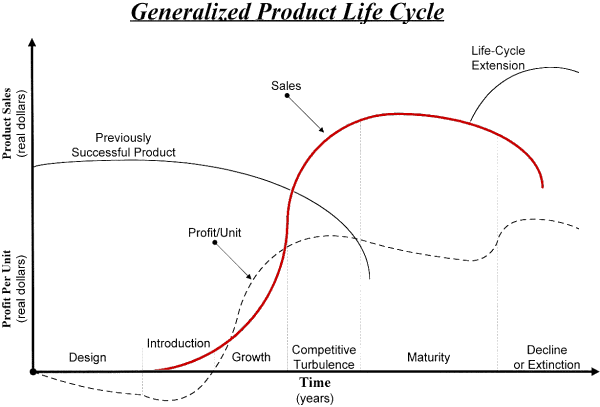

An example of a product lifecycle-revenue model is provided in the illustration below. You can fit the sales lifecycle data of a once-successful but now-retired product into a time series equation to model new revenue data. This is illustrated by the red line below:

A major problem with time series analysis is the fact that the projection becomes inaccurate over a long period of time. Most models are useful for projections under 12 months and become highly inaccurate after two years.

For high-quality SaaS revenue models, different sources of revenue and leakage can be incorporated. These include discounts, one-off maintenance fees, upgrades and downgrades, and deferred revenue.

2. Qualitative Data Forecasting

Qualitative modeling is useful where no historical time series data exists for revenues. In this case, qualitative data obtained through competitor appraisal or market research can provide a good basis for creating a revenue model.

Once the market data is obtained, the data can be fitted to a mathematical time-series model or “educated guesses” made by experts.

There are different ways of obtaining qualitative market data. These include:

- Salesforce polling: This depends on data from your sales reps who have an in-depth understanding of how and when customers buy. Their opinions can therefore be a good starting point for approximating future revenues.

- Expert opinion: A panel of experts may provide their opinion on the market either in consensus as a group or individually to give an unbiased opinion as in the Delphi method.

- Market research: A new or alternative product can be tested in a market by introducing the product to customers, and recording and analyzing their reactions to the product. Market research may also involve polls and the use of surveys.

A qualitative market survey can be distributed as an ad, popup, or email attachment. In cases where you can’t meet the respondents physically, a scannable QR code for your google doc survey will be useful.

The major focus is to have data like this readily available for quality forecasts and decision-making.

3. Causal Forecasting Techniques

Causal forecasting can be thought of as a hybrid of time-series analysis and qualitative methods. They are usually very sophisticated and can be amongst the most expensive revenue models to develop.

An example of how causal forecasting works is how the Federal Reserve Bank predicts economic output for a certain year or quarter. Here, a series of variables that all contribute in some percentage to the output (expected revenue) are plugged into the model to give the output within set parameters.

One such parameter would be your potential share amongst the Total Addressable Market. This is an indication of the maximum total revenue that can be expected from a single market.

All this is not to say you should use only one SaaS sales forecasting strategy for your business. Instead of viewing each method separately, you can also see how you can use all of them together to generate the data you need.

3 Steps to Creating a SaaS Sales Forecast

Now that you know the importance of sales forecasting, follow these steps to build a foundation for your model.

1. Examine Past Sales Performance

This is the basis of the top-line approach to SaaS sales forecasts. The analysis of sales data from previous months can provide us with metrics such as Average Revenue Per User (ARPU) and customer lifetime value (CLV).

SaaS forecasting models can also perform scenario analysis based on increased or reduced subscriptions, pricing changes, and anticipated changes in churn.

Thus, it’s possible to anticipate worst-case business cycles even as you project future growth.

2. Effectively Analyze Your Sales Pipeline Data

If you are a funnel-driven SaaS business, you can use your sales pipeline data as a major source of revenue projection data.

As an example, let’s say 1000 prospects move from leads to customers within a 6-month period and a 10 percent conversion. Hence, you can expect that within one year, you will have acquired 200 customers translating to sales.

Locking this in with the performance of your sales reps will give you a much clearer picture of what revenue you can expect, based on your sales pipeline data alone.

3. Measure Marketing, Sales Performance Metrics, and KPIs

Sales performance metrics and KPIs may or may not feed into your model directly. Others may simply provide qualitative insights for your SaaS sales forecasts. Let’s summarize a few of these metrics:

- Churn rate: A good annual churn rate is between 5% and 7% with a monthly churn rate of under 1%. An annual churn rate of over 20% would be a red flag for any SaaS owner.

- Negative churn: SaaS business owners love this term. Negative churn happens when your expansion revenue (meaning newly generated revenue) is greater than the revenue lost from churning customers.

- Inbound leads and conversions: Inbound leads directly affect conversions and thus bookings.

- Customer Acquisition Cost (CAC): Is it comparable to other similar SaaS businesses? Does the CAC exceed your average revenue per user and what is the breakeven point?

Additionally, metrics such as Customer Satisfaction (CSAT) and Net Promoter Scores (NPS) are part of customer success for your business, and can also provide important parameters for your revenue model.

Factors and Data to Consider in Sales Forecasts

All that said, in general, there are several factors you need to consider to create accurate sales predictions for your business. Let’s go over them:

- Conversion rate: Determine how many of your leads turn into paying customers to make accurate forecasts based on marketing and sales efforts.

- Historical sales data: Watch out for trends in data recorded in previous years.

- Market share changes: Determine the impact on sales of changes in market share and opportunities based on your competitor’s moves and your own moves. Do you have a product that’s about to be released, for example?

- Market shifts: Look at macroeconomic trends and understand how these impact your forecast sales ceiling. For instance, if unemployment is up, your ceiling will probably be lower.

- Seasonality: Consider how the holidays will influence your sales.

- Sales cycles: You need to determine these so you can factor in potential delays that can impact sales.

- Internal changes: Were there internal business decisions that can affect sales? For instance, did the company acquire new technology recently? Or did it hire more employees?

- Regulations and compliance: Determine the existing regulatory landscape. If there are major changes, these may affect your sales.

The more of these factors and data you consider, the more accurate your sales predictions will be.

In Closing

SaaS sales forecasting is designed to give businesses more insight into their cash flow, profitability, business processes, and competitiveness. Not only is it important for businesses to streamline their operations, but it can also help such companies secure funding.

To recap, we’ve talked about what the process entails, what a sales forecast looks like, and the various components that may be included there. We’ve also covered different methods such as the time series, causal, and qualitative strategies.

Finally, we’ve elaborated on the key considerations you should be aware of in creating your own SaaS sales predictions.

Hopefully, with these tips and steps, you can now begin to implement a successful SaaS revenue model for your business.