Our new webinar episode brings together two Customer Success experts De’Edra Williams, EdTech SVP & Advisor for Women in CS, and Saahil Karkera, Vice President of Customer Success at Oaky. Irina Cismas, Custify’s Head of Marketing sat down with them and uncovered actionable insights on various topics, including:

- Crucial data points

- How CS and Sales should collaborate

- How to align metrics with business goals

- How to use AI for aggregating data

Intro

Irina 00:03

Hey, everyone, welcome. I’m so glad you could join us today. I’m Irina Cismas, Head of Marketing at Custify, and your host for this webinar. Earlier in my career, I often faced a challenging question after delivering a marketing campaign: “What would they have bought even without your marketing initiatives?” No matter how well I was armed with the numbers, it felt like I couldn’t convince the senior management team of the incremental effect that the marketing team brought to the table. This was incredibly frustrating. It was at that moment I realized that building a narrative that resonates with senior management is often underestimated. I guess everyone who joined us online today and those who registered share the same pain.

In the following hour, together with De’Edra Williams, former EdTech SVP and an advisor for Women in CS, and Saahil Kakera, VP of Customer Success at Oaky, we will explore ways to help you better sell the value you bring internally. Thank you, De’Edra and Saahil, for taking the time to speak with us today. Saahil, I know you allocated this hour even on your day off, so thank you once again for your time.

Before we dive into the topic, I want to address a few housekeeping items. This is a recorded event, and everyone who registered will receive the recording online. We value your participation, so please feel free to address all the questions you have. They are a priority for us. We will try to address them in the context of the conversation or at the end during the dedicated Q&A session.

Lastly, this conversation about a topic based on your feedback is very important and relevant. It doesn’t need to end with this webinar; it goes beyond it. We will reach out to provide tailored resources and tools to better arm you whenever you are building a business case or supporting the internal value of the team.

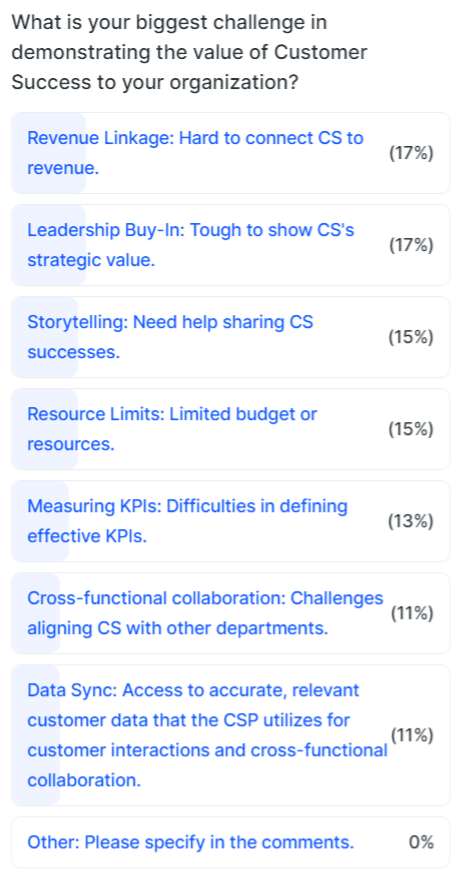

Speaking of tailored solutions to your challenges, all three of us want to make this conversation relevant to your needs. I’m going to publish a poll now, and I invite you to vote and let us know what the biggest challenge is when you try to prove internally, not only the CS value. Give me one moment to publish the poll that we have prepared.

Irina 03:37

Okay, is it published? Can you see it? Yes? Okay, perfect. You can vote now, and you can check multiple options. It’s not limited.

Leadership buy-in

Irina 04:10

Okay, perfect. We’ll give it a few minutes for everyone to engage. For those of you who joined later, what you see on the screen is a poll. We want to make this conversation relevant for you, so we’ll start the discussion by asking: What’s the biggest challenge when you are trying to prove the value of the CS team? I see Saahil is laughing; it seems that we have issues like revenue linkage, leadership buy-in, resource limitations, and data management. Now that I’m seeing the distribution, I think we should have limited it to only one option to address the biggest challenge, or we should organize a serious follow-up session to tackle them one by one. A few more seconds, if you guys agree, and then we can start. I also want to say hello to everyone.

However, I see that out of about 50 people in the call, only 33 have voted, so maybe the remaining 17 or so, please drop in your vote as well. It helps us a lot. Don’t be shy, because this conversation is for everyone. Go ahead and vote; it’s anonymous.

Now, I think we have ‘leadership buy-in’ as the biggest challenge, with almost 20% of the votes. If you guys agree, I would like to start the conversation. De’Edra, I want to ask you: why do you think leadership buy-in is such a hard challenge to overcome? I’ve closed the poll, not sure if the voting changed, but why is leadership buy-in so hard to get?

De’Edra 06:30

No, thank you for that. As a customer success executive, I count myself in that category, not because it’s hard for me to understand—I grasp the strategic value of what we do—but I believe that many leaders, especially within the C-suite of major corporations, including some who work in our field, struggle to recognize that customer success is inherently strategic. We exist primarily for the benefit of both internal and external stakeholders. First and foremost, our role is to ensure that our customers are deriving optimal value from our solutions. That’s the external stakeholder aspect. From an internal perspective, we must collaborate cross-functionally with all other lines of business.

In my humble opinion, Customer Success is the one entity that intersects all business areas within a company. For an executive leader, this can be challenging to grasp. You have this one organization within your company that is almost like a superhero—it can swoop in to ensure a customer is benefiting from our solutions and also sit down with the product team to provide valuable insights for intelligent decision-making about our products and services. But for an executive leader, understanding this multifaceted role can be difficult. I’ll stop there and see if Saahil has anything to add. But I believe it’s really because we wear so many hats; it’s challenging for leaders to fully understand our role.

Saahil 08:17

Do you want me to join in? As De’Edra mentioned, there’s a lot to unpack here. The challenge is especially compounded in early-stage startups and Series A companies, often because first-time founders may not fully understand the dynamics; it’s usually either sales-led or product-led, which brings a very different mindset. What I’ve observed over the last eight or nine years, working exclusively in this space, is that Customer Success (CS) often reports to sales and is seen primarily as a support team. That is the label we deal with day in and day out.

However, I also think it’s partly because of the narrative we in CS have been promoting. We often talk about support tickets or boast about completing 10 QBRs in a quarter. Fantastic, but what outcome did that bring to the company? Unless we start thinking and speaking in terms of the traditional strengths of sales—showcasing the value they bring—that’s where I think the buy-in becomes very challenging for us, especially during difficult times when we’re asking for resources. We are always seen as cost centers, not revenue centers.

I always advise first-time CS leaders to stop focusing on support metrics. Instead, talk about the number of CSQLs you have generated. Work with your sales counterpart to showcase the deal velocity of those CSQLs. That’s how you build a narrative and demonstrate strategic value to your leadership team.

Irina 09:54

De’Edra, go on. You wanted it to add something.

De’Edra 10:03

I heartily concur with that. One of the topics we’re likely to explore later in this call is the shift from being seen merely as a cost of goods sold, as Saahil mentioned, to being recognized as leading customer success from a revenue perspective. We’re talking about moving from product-led growth to customer-led growth, where our actions are driven by revenue considerations rather than just support issues, as Saahil pointed out. We’ll delve into this more deeply later in the call. I just wanted to express my agreement with these points.

Connecting daily activities to business outcomes

Irina 10:36

You mentioned something that ties directly into my next question. I often hear CS leaders struggle to connect day-to-day CS activities to business outcomes. Let’s get into specifics. You advised against focusing on support metrics, but how can we effectively link daily activities to business outcomes? What’s your take on this, Saahil?

Saahil 11:20

I think any good CS leader should first sit down with the commercial and leadership teams to really understand where the company is headed in the next two-year time horizon. I believe five years is too long, as a lot can change in that period. Engage with your CFO to understand the metrics they aim to prove to the board, if you have one. That’s how you start to learn. Many may not be familiar with the concept of a KPI tree. Your first task is to map all of your leading and lagging indicators and start building that story.

A short anecdote from earlier in my career: our product was helping customer service agents respond to tickets faster, and we were really promoting that. However, the VP of that department never really engaged with us because, for him, the value lay elsewhere. We had to go back to the drawing board—KPI level one, level two, level three—and eventually, we shifted our narrative. That’s essentially how you do it.

Irina 12:25

De’Edra, how do you create a smooth transition between daily activities and business outcomes? I know that CSMs are extremely busy; at the end of the day, they’re swamped with tasks, yet the leadership team may not always see the value they provide, and they still need to prove themselves. How can we make this transition smoother for them?

De’Edra 12:59

I agree with everything Saahil has said. I would also add that, from a CS leader’s perspective, we must tie customers’ desired business outcomes to the revenue they generate and ensure that we can measure how quickly those customers reach value.

One of the things we’re going to discuss, something I highly praise, is customer time to value. When you can accelerate a customer’s time to value, you will have a customer who buys more from you. This will generate additional revenue. More importantly, their retention rates and sentiment will be higher.

The metrics we talk about, like NPS and CSAT scores, reflect customers who will advocate for you. I love Saahil’s KPI tree, but it’s also crucial to link those KPIs from the customer back to the KPIs that you, as a success leader, monitor. When your customer achieves value at an accelerated rate, you will see increased revenue and improved retention. These are metrics you can include on your CS dashboard to present to your leadership.

Aligning metrics with business goals

Irina 14:18

Speaking about the metrics, Saahil, how do you ensure that the metrics you include in your reports for the leadership align with the business goals?

Saahil 14:29

It’s such an interesting point that you mentioned there about time to value. That is exactly the KPI we are now working on delivering to our board. So, it’s going back to the drawing board, asking a lot of customers what value means to them. Because at the end of the day, it’s a customer KPI. It should not be a vanity metric.

The customer should feel, ‘This is exactly what I bought the product for; I’m getting it,’ and that should correlate with your retention numbers, like intervention or expansion dollars. That’s where I think you need to really understand how you can link and correlate those two specific metrics from a storytelling perspective. As a result, the leadership team or the GTM team will start shifting their narrative, saying, ‘Because CS is optimizing the time to value for our customers, and you could do a cohort analysis. With each cohort, that number keeps getting better, and that’s how you can showcase your value to the leadership team and to the board.

Irina 15:31

I’m going to ask both of you, because I saw in the chat, and I know that we agreed that regardless of our prepared discussion points, we’re going to adapt to what the audience is asking. What I’ve seen from Giselle regarding pulling the customer time to value is exactly what I’m interested in learning more about. So, I want to spend a bit of time on this. You mentioned that you are in the process of defining this customer time to value. Let’s go a bit deeper. What was your thinking process? How did you approach it? Then, I’m going to pass the same question to De’Edra to either complete or maybe present a different view. Let’s discuss this.

De’Edra 16:20

Lovely question. I think, just as we are facing the challenge where everything ties back to revenue, our customers face the exact same challenge. So, the question to the customer should be, ‘At what point would you consider our product successful? Is it when you reach a certain milestone or number? What is that number? When would it be too late, and when is it too early?’

By having several such conversations across your Ideal Customer Profile (ICP) segment for sure, but also throughout your entire customer base, you can determine that customers expect to reach a certain outcome within a specific period after starting to use the product. This, in my simplistic definition, is time to value. It’s their number, their metric, and that’s what you track.

So, through customer interviews, can you track this within your product? It involves tying both qualitative and quantitative data together to come up with the complete picture. I think the biggest takeaway here is that you could use this as your brand promise. Your sales team can sell this as a guarantee: using our product, you’re guaranteed to get value within this period. It’s a very effective way to build your story.

Irina 17:38

Do you think we can have different time-values, different time-to-values, or different definition for a time-to-value, depending on the customer use case?

Saahil 17:51

You can go, De’Edra.

De’Edra 17:55

I’m seeing some of the notes here, and thank you, Giselle, Victor, and Vicky, for your notes. It aligns with what Saahil said, but I want to delve a bit deeper as it’s something I’ve really worked on with my teams—it’s about building out journeys for those customers. To your question, Irina, yes, the time to value for a customer is specific to their journey. What we do is identify what we call ‘moments that matter’ throughout that journey, which are defined by the KPIs specific to your customer.

Within that customer journey, and I appreciate that you tie it to the ICP because it’s critical, your customers will indicate what their moments that matter are—those things that generate value for them. Once you determine those milestones, which need to be based on SMART goals—specific, measurable, actionable, relevant, and time-bound—you can drive value for your customers.

Following this, as Saahil mentioned, once your customer hits each one of those milestones, you can use it to evangelize their successes. You can create customer stories that sales and marketing can utilize, but it’s all based on the customer journey. To answer your question, the time to value for your specific customers should differ because they have different KPIs.

Saahil 19:41

Can I just add one more thing? I think each customer, depending on your product, can have multiple points or aspects from which they derive value, right?

And I believe that’s exactly where sales and CS need to work extremely closely together. Mapping out those expected outcomes during the sales process, and ensuring your onboarding journey aligns with those expected outcomes is crucial. It can’t be that the customer expects to achieve outcome A, but your onboarding is focused on outcome B, and then they’re left wondering, ‘But wait, that’s not why I bought the product.’ This is where that recurring impact conversation comes into play.

And just like De’Edra mentioned, at each of those important moments, you create opportunities for advocacy asks, you develop case studies, and by the end of the year, they’re thinking, ‘Wow, I’ve really got a great product. I need to retain, renew, and expand.’ So I’m just adding that context.

De’Edra 20:34

No, I love that. And also you can roll all of those insights into a dashboard that you present to your leadership. So again, you’re continuing to prove your value throughout that customer journey. Yes, absolutely.

Advocating for new metrics

Irina 20:50

I really love the fact that you mentioned metrics, and I want to dig deeper into metrics, KPIs, and also data points. In some cases, traditional financial metrics do not fully capture the value of the CS department. How do we advocate for new metrics? How do we convince leadership about what’s important and what’s not?

De’Edra 21:18

It’s going to go back to something Saahil said, and we’re so in sync on this. In one of my previous roles, when I joined the company, my metrics or OKRs were rolled into sales. I immediately went to the CEO, whom I reported to, and expressed my desire to separate them because our metrics should be aligned, yet distinct from sales. I proposed four key metrics for my team, each based on the broader OKRs set by the company.

First, I focused on revenue and revenue growth, incorporating the CQSL that Saahil mentioned, with specific metrics tied to each CQSL. Second, the emphasis was on adoption and utilization, which extended beyond just using the tool to ensuring optimal engagement with it. Third, I aimed to enable our team to advocate within customer organizations effectively, succeeding in getting customer stories that could be published—a significant achievement, as these insights could be leveraged by sales during their cycles and by marketing to build campaigns. Lastly, the fourth metric was about ensuring that our team was driving value for our customers.

These were not necessarily traditional customer success metrics, but I used them to build dashboards, not only to present to my CEO but also to the board of a Series B company. I hope this answers your question about advocating for different financial metrics beyond the usual ones seen in customer success.

Irina 23:26

Saahil, I want to pass this question to you as to you as well.

Saahil 23:32

I agree with everything the others mentioned, so I won’t deviate there. I believe it’s crucial to present metrics and numbers at different layers and levels. What might interest a team lead or CRO could be completely different from what your CFO or the board finds relevant. Indeed, we should avoid having too many reports to prevent analysis paralysis, much like De’Edra mentioned. My top-level report includes just four metrics, all linked to revenue, with a particular emphasis on an industry-specific standard similar to G2 but tailored for the hotel industry. That’s our gold standard to always aim for.

These four or five metrics are what I present each quarter, using storytelling to link and drive initiatives that support these metrics and numbers. For example, if retention is dropping quarter on quarter, I point out that it’s due to specific challenges. Then, we can strategize with the product team on how to address these challenges. This approach also depends on how mature your company is with metrics and reporting. If they’re not, it’s actually a great opportunity for you to start creating those reports and metrics, which positions you as a strategic, forward-thinking CS professional in your company.

Irina 25:02

I want to address a question we received in the chat about KPIs and metrics. Specifically, what are the KPIs and metrics that you report at each level? You both mentioned financial metrics, but can you delve deeper and share exactly what you present in the reports? I’m going to pause to give you a chance to provide complete examples for the audience. First, I’ll ask you, Saahil, and then De’Edra, as she might have different ones to share. After that, I want to tackle a question from Giza in the chat about concrete KPIs and metrics, since this was specifically asked by the audience.

Saahil 25:50

Yeah, that’s a good question. Our main company metric is net revenue retention (NRR), so we track that overall number along with the sub-metrics, which include retention numbers, expansions, downgrades, and so on. It’s important to note that a lot of companies lump everything into one bucket, but you really need to track this as granularly as possible.

One mistake I’ve noticed from earlier in my career was only tracking output metrics like NRR, without enough consideration for the input metrics. For example, how many customer success skills were generated? How many calls actually led to that opportunity? At the management level, these are the five numbers we track.

At the team level, we focus on weekly input numbers, like how many calls were made and how many expansion opportunities were created. At the end of the day, it’s a numbers game, a conversion funnel. Without enough renewal calls, you might see increased churn; without enough expansion calls, you miss opportunities for your sales team. So, we report on these two different layers within my team. De’Edra?

De’Edra 27:08

I’m going to add to that. We track those metrics as well, but one that is rarely discussed within customer success yet is vitally important is customer lifetime value (CLV). Sahel touched on this when he mentioned ICP, which I see a question about from Gisele, so I’m happy to expand on that. Understanding cohort analysis, which you mentioned earlier, is also crucial.

In my previous role, I was often told about the great strategic customers bringing in significant revenue. I sat down with the CRO, to whom I reported at the time, and asked about the customer lifetime value of those strategic customers. The response I got was a blank stare. I questioned whether they really understood the cost to serve because you may have a customer generating substantial revenue, but if the cost to serve that customer is also high, it changes the equation.

The metric I focus on is identifying customers within those ICPs that have the greatest customer lifetime value. I conduct trend analyses and build out cohort reports. This cohort analysis allows my team to prioritize customers within the ICP that have the highest customer lifetime value and the lowest cost to serve. These are our most profitable customers, and that’s where we focus our efforts. I see Saahel laughing; I don’t know if that’s a good thing or if it’s because…?

Saahil 28:40

You mentioned something that I think is spot on. Often in CS, we’re good at anecdotally complaining about not having enough resources, but when it comes to proving it, we lack the metrics and numbers. For instance, if we talk about our onboarding teams being overwhelmed, do we know the unit cost or effort required to onboard a customer? And how does that look across different customer cohorts, or different types of customers? In these strategic operational layers, you really have to become a mini data analyst to truly understand and articulate these issues.

De’Edra 29:18

I call it a data ninja. Quite frankly, I call it a day to 90.

Saahil 29:21

Exactly. But indeed, there was a nice question about ICP, so I’ll leave either that through to guide the conversation. But it’s very interesting.

Sales + CS collaboration

Irina 29:30

Let’s start with this: Gisele asked if we can address the collaboration between sales and CS, and the importance of having a solid ICP, especially during the sales handoff and implementation phases. I know that the ICP conversation and aligning sales and CS during handoff is a tough topic.

De’Edra 30:01

Yeah, this one is critical. Sahel mentioned something important about documenting the value drivers for our customers throughout the sales cycle. He suggested, and I agree, that customer success must be integrated into the process. At a startup I worked for, I proposed to the executive leadership team and the VP of Customer Success to develop an engagement model tied to the customer journey from lead to handoff and beyond. We defined areas owned by each functional unit within the company, ensuring that Customer Success had a role at every stage of the customer lifecycle. This helped us identify critical moments and value drivers, ensuring a smooth transition at handoff.

Regarding the Ideal Customer Profile (ICP), I’ve found that sales leadership and the C-suite often focus primarily on revenue when identifying strategic customers, overlooking other crucial aspects. In my last role, I worked with the VP of Sales to refine our understanding of the ICP beyond just revenue, focusing also on customer lifetime value and the cost to serve, which are essential for identifying truly strategic customers. This collaboration between sales and customer success is vital but can be challenging, as also noted by Kyle in his comment.

Saahil 32:32

Plus one to everything De’Edra mentioned. I’ve always said that acquisition is easy, but retention is significantly harder. Over the last eight or nine years, I’ve noticed that the Ideal Customer Profile (ICP) is often built from an acquisition perspective, not retention. This usually means it’s led by sales and marketing, rather than being a CS-led effort, which I think it should be. From a broader economic viewpoint, VCs are now more interested in retention numbers for your ICP. It’s not just about the overall Net Revenue Retention (NRR); they want to know if your ICP numbers are strong and sticky with your ideal customer profiles.

Like De’Edra said, it’s crucial to have a company-wide perspective on ICP. It’s not just for marketing or sales; it’s for the entire company. Another challenge is getting buy-in from the entire organization to work with the ICP as part of a company-wide strategy. Everyone needs to opt into it, and you can’t have teams going rogue. This responsibility and accountability extend across all departments, including product development—considering which features we are building that serve the ICP.

When you start this analysis, as De’Edra suggested, you should see better Lifetime Value (LTV) numbers for your ICP customers. For those new to CS, like someone mentioned from Barbados, it might seem basic. If you’re starting, avoid analysis paralysis. Begin simply: interview your customers, map the data of product users, and create three buckets—customers who are performing well, those who aren’t, and those who are churning. This will give you a rough draft of what an ICP looks like.

Then, collaborate with your CEO and CFO to examine Customer Acquisition Cost (CAC) and LTV numbers. This approach will give you a solid picture of who your ICPs are and who you should be targeting.

Irina 34:46

De’Edra, you go on. Did you want to say something?

De’Edra 34:52

No, I see something that’s in the chat, and you may come to it later. So go ahead.

Irina 35:01

We can we can tackle them.

Saahil 35:04

Is it the question about sales?

De’Edra 35:10

We were laughing because we’ve been in this business for so long. Saahil, like you, I’ve had some really wonderful collaborations with sales, but I’ve also faced challenging ones. Addressing Gazelle’s question about who takes the lead from an ICP perspective, that was spot on. In my last company, sales initially brought us what they called their strategic accounts. I suggested we delve deeper to understand not just the cost to serve but also the customer acquisition cost for these accounts, which ties into their customer lifetime value.

My team and I organized a workshop to define our ideal customer since we’re the ones who need to retain and grow these accounts. Given that my entire team had a CS-qualified lead (CSQL) quota, along with retention and renewal revenue targets, they had a lot on their plate. They created a wishlist of their perfect customer—essentially, what an ICP really is. We then shared this with sales, comparing it to their strategic accounts. Surprisingly, fewer accounts than expected matched our ICP, which wasn’t just a dream list but was based on concrete metrics like revenue and retention.

We presented a dashboard showing how these ICPs align with strategic customers and possess a higher customer lifetime value, indicating they would likely be more profitable and sticky. Sales saw the value and agreed it made sense to develop a partnership focusing on these customers. This approach fostered our collaboration.

I hope this addresses Gisele’s question about leading the ICP discussion and how we collaborated to align our strategies.

Saahil 37:31

Yeah, just to add one more piece here, salespeople are heavily driven by numbers and quota attainment. As De’Edra mentioned, if you can demonstrate how focusing on the ICP can improve deal velocity, which salesperson wouldn’t want to hit their quota quicker and more frequently, right? It’s important to think from their perspective and identify which metrics will be impacted if they focus on the ICP.

In my previous company, one exercise revealed that we were targeting the wrong customer base. Our ideal customer profile (ICP) was actually more aligned with SMB-type companies, but our sales team wasn’t skilled or educated in selling to that kind of customer, resulting in very low deal velocity. We had to make tough decisions, letting go of some salespeople and bringing in others who had experience with that kind of customer. This change led to improved quota attainment, shorter sales cycles, better retention, and other positive compounding effects from aligning our efforts with the ICP.

De’Edra 38:45

No, it’s interesting when you talk about deal velocity because it directly relates back to time to value. Statistically, customers who reach value quickly are more likely to make additional purchases and have higher retention rates. From a deal velocity perspective, if sales works closely with you to clearly identify the true value during the sales process, customers can achieve value faster. This results in closing more deals in shorter sales cycles and achieving higher revenue gains, which is a strategic improvement. Moreover, the cost to serve these customers is lower because you’re dealing with existing customers, rather than incurring new customer acquisition costs, which Saahil highlighted from a CAC perspective.

Aligning the team with the ICP

Irina 39:38

Saahil, I have a question for you from Danny. He asked how you would recommend aligning the team with the Ideal Customer Profile (ICP) and customer journey in a startup, where there is often much less structure—not just in processes but also in terms of team roles and separation of duties. Since you have experience working with startups, your insights would be valuable.

Saahil 40:00

Absolutely, I can share what works for me, acknowledging there are many ways to approach this. Understandably, no one likes being told to change their ways, especially in a startup where you might not have all the data points you need. So, you often have to rely on anecdotal information and work with what you have. Think about which metrics matter to whom, just like you consider what matters to your customers in terms of value.

For example, marketing teams are driven by MQLs. You could approach a marketing director with the idea of generating a certain number of MQLs by introducing them to the ICP concept. If you frame it around addressing the same pain points throughout the customer journey and optimizing the time to value, that can drive alignment.

You don’t need thousands of data points to start; sometimes just a few will suffice. If you’re using a platform like HubSpot, many of these metrics are pre-built. All you really need is one sales colleague you’re good friends with. Sit down with them, buy the pizza, grab the beer, and start running through those numbers together. Building this understanding will take time and must be done alongside your other duties, but in the longer term, it will streamline your tasks and help you become more strategic in your role.

Crucial data points

Irina 41:29

Can we discuss some concrete examples of important data points? We all encounter a myriad of metrics, but often when we’re in front of the computer, the challenge becomes, ‘Okay, how do I actually access the data I need? Where do I find it, and how can I improvise to collect it?’ Data acquisition is a common struggle for CS professionals because they don’t directly own the data; it lies at the intersection of marketing, sales, and product, requiring them to chase it down. Even a data ninja can’t perform their magic without the necessary input information.

Let’s start by identifying key data entry points. Then, we can discuss how to effectively collect and consolidate these data points. What strategies and tools can we use to streamline this process and ensure CS teams have the information they need to be effective?

De’Edra 42:34

One critical aspect we need to be aware of is data hygiene, regardless of the platform being used—whether it’s an Excel spreadsheet, a CRM, or a CSP. It’s essential to reach a consensus on what data is crucial for a complete view of the customer. Sahel mentioned HubSpot, which offers an extensive range of metrics. I’ve worked with Totango, Gainsight, and others, but ultimately, the effectiveness hinges on everyone’s understanding of the minimum necessary data and clarity about what that data should represent. For instance, having sales enter only a customer number without insights adds little value. Similarly, if a customer success team is developing a customer journey without integrating value drivers related to key metrics, you won’t achieve a comprehensive 360-degree view of the customer.

Therefore, the first step is establishing robust data hygiene and defining clear data standards. This should be a company-wide initiative to ensure consistency, no matter who is inputting the data. We need clear guidelines on the essential data and how to maintain its quality. Starting with strong data hygiene and clarity is foundational.

Saahil 43:56

Yeah, I completely agree. I think crap in, crap out in that sense.

De’Edra 44:03

Yes, garbage in and garbage out.

Irina 44:05

Yeah, garbage in, garbage out—automated garbage is exactly what you get with poor data input. But more seriously, I’ve yet to really find a company that has their data completely sorted out, unless it’s Snowflake, which operates fully on a product-led growth (PLG) model without a CS team. For the rest of us, the approach is to start where we are and incrementally build and refine our data points, continuously running analyses.

Returning to the topic of the Ideal Customer Profile (ICP), this isn’t a one-off task. You need to revisit your ICP every six months, putting it through the litmus test to see if your metrics still align. There’s no shortcut—it’s an ongoing process that requires persistent effort and adjustments.

De’Edra 44:51

No, I wholeheartedly agree with that. It can never be a one-time event; it must be a reiterative process. Much of this involves looking back, which is crucial, especially for those new to customer success. What we’re doing today will evolve, and that’s the beauty of our field. There is an evolution to every metric, every framework, and every strategy, like the success plays someone mentioned. These elements are constantly evolving, and to be successful, you need to remain nimble and agile.

Saahil 45:21

The key point, and I’m sure De’Edra would agree, is to avoid falling into the trap of analysis paralysis. You don’t need a thousand data points; you won’t be able to act on all of them. Eventually, you might experience trigger fatigue or data fatigue, which is a real issue when you’re overwhelmed and unsure of what to focus on. Instead, think from the customer’s perspective: identify the specific data points needed to drive desired outcomes. That should be your primary role as a CSM. Start by determining those crucial data points, collaborate with your product team to access them, and then continue to build and refine your approach throughout the process.

Irina 45:57

What are your data points? What are your data points that are over, which data points are important for you sail to give an audience a starting point to relate?

Saahil 46:08

For us, our brand value proposition to customers is that we generate revenue for them, and fortunately, we can track that figure in black and white. I feel very fortunate that we have access to numerous data points to monitor this. We then analyze these figures to see how they vary across different customer segments and parts of the onboarding journey. For example, we look at whether certain segments reach revenue goals faster.

Of course, there are some data points we lack, which leads us to collaborate with the product team. We specify which data points are needed to reinforce our value proposition to customers. These same data points can also be leveraged by the sales and marketing teams. This integration helps us use the Ideal Customer Profile (ICP) to align all these teams effectively, enhancing our overall customer success strategy.

Irina 47:01

De’Edra, in your case, what data points are you using to build and support your metrics? What’s the foundation for these metrics, and how do you ensure they are effectively helping your team?

De’Edra 47:14

First and foremost, much like Saahil mentioned, our approach is centered on delivering value to our customers as they go to market. We focus on how our solution can help customers achieve value at an accelerated rate. Identifying those milestones is crucial, as they help us pinpoint opportunities for upsells and cross-sells, ensuring optimal adoption. More importantly, these milestones allow us to recognize potential triggers related to retention and revenue growth.

The primary step is determining the value drivers for each customer, which must be identified by the customers themselves, not us. This is crucial and cannot be emphasized enough. Once we understand these value drivers during those critical moments, we can identify CS-qualified leads (CSQLs), which typically have a higher retention or close rate than marketing-qualified leads (MQLs). This is a vital aspect that drives significant value for customer success.

In terms of retention and renewal, we aim to ensure that our value delivery aligns with the customer’s goals and objectives. These are the key data points and metrics we focus on to guide our strategies.

Saahil 48:34

Just to add to that, it’s important not to rely solely on superficial metrics like login frequency, as it’s not a reliable predictor of customer engagement or satisfaction. For instance, a user might log in one day, complete all their tasks, and then not log in for the next week. Does this indicate they are achieving their desired outcomes? Not necessarily. Conversely, frequent logins might occur because a customer is preparing to churn, perhaps by exporting all their data.

So, it’s crucial to dig deeper into the metrics. Keep tracking key customer-specific metrics that truly reflect value and engagement. This involves layering different metrics to gain a comprehensive understanding of customer behavior and their potential future actions

De’Edra 49:08

But I do want to add to that, because one of the things we look at is the distinction between adoption and utilization. We define a customer that is adopting as one who has signed on and received the license. However, from a utilization standpoint, what we see as an indicator, to your point, is if they have not logged on, that’s a churn risk. But then there’s the rate at which they are actually utilizing or optimizing, and that’s why I keep going back to the optimization piece. When we feel like a customer is not fully optimized or utilizing the tool, that is a churn risk as well, and it’s a metric that we measure. So, I agree with you that you could have customers who log in at an 80 to 90% rate, but if they’re not fully utilized, how much of that utilization is tied back to their login? What are they building out? That is also a metric that we follow. But again, it’s not necessarily a metric that I’m rolling up from a revenue perspective, but it is a potential churn risk, and it also poses a retention risk.

Saahil 50:11

I think Excel is not very valuable, because you also want to have actions taken out of it, and that’s what I think having a customer success platform comes really handy, right? You can use commercial data, product use data, and then empower the CS teams to take the right action.

De’Edra 50:29

I agree with you, but I also want to be realistic, especially considering many questions in the chat are about startups. Both you and I have experience working in startups, where those advanced tools and methodologies might not be available. At the foundational level, if you’ve only got an Excel spreadsheet, use it to capture some of these data points. That’s a start. However, while I’ve used Power BI and absolutely love it, not everyone has access to such tools. We have to acknowledge that not all startups can utilize sophisticated platforms like Power BI right away.

Irina 51:05

I have to mention since Saahil brought up a CSP platform, a big thank you to him. I know my sales team would appreciate it—yes, we do have options for startups that might find our entry price point challenging, and our sales team is very accommodating. They’re always eager to engage with startups, understanding that budget constraints can be a hurdle. However, I’ll leave further details to our sales team to follow up on.

Since we only have seven minutes left, I want to make sure we address Giselle’s point. Earlier in our discussion, she mentioned that one of their challenges is engaging executive sponsorship and ensuring support for their initiatives. Could both of you offer some advice on this? Also, there’s another question in the chat we need to address. Who would like to start with some advice for Giselle?

De’Edra 52:21

I’d like to follow up on your question about executive sponsorship, Giselle. Are you referring to internal stakeholders or external? This is important because my definition of executive sponsorship involves seeking buy-in from executives within your customer’s organization.

From my experience, it’s crucial to tailor interactions to the customer’s journey. We’ve moved away from traditional QBRs and EBRs in favor of what we call ‘Core Meetings,’ or Customer Objective Reviews. These meetings are designed around the customer’s business drivers and how our solution supports these goals. Executives don’t just attend these meetings; they are eager to participate because they see real value in how the metrics we discuss align with their priorities. This approach has been effective in engaging executive sponsors by focusing on what truly matters to them from a value perspective.

Saahil 53:38

Absolutely, I think plus one to what De’Edra mentioned. We conduct what we call Business Impact Reviews, which are very similar in nature. One approach I’m a big fan of is starting to map different stakeholders within your customer organization and then building out a KPI tree. This is crucial because your product might impact the ultimate goal that the sponsor cares about, but not necessarily the input metrics of the actual users.

We use a concept called the ‘chain of pain.’ It’s about understanding the consequences if a user doesn’t meet their target—essentially, who is affected down the line if targets aren’t met. This helps in building a compelling narrative and story. For example, in a previous company, while we initially focused on improving response times, over a longer time horizon, we significantly improved the company’s NPS. But building that story took a year of speaking with customers, validating assumptions, and gradually building up that narrative. There’s no quick fix; gaining sponsorship backing from your customers involves thorough engagement and building out these stories.

De’Edra 54:43

I’ll add to that, particularly addressing a common challenge that sales teams face: going broad and deep within an organization. Sales may focus on a specific line of business, but with customer success—echoing Saahil’s point—it’s crucial to understand not just the ‘chain of pain’ but, more importantly, the value drivers for different lines of business or individuals across the company. What are they trying to achieve, and how does our product or solution meet those goals and objectives?

What we’ve managed to do is identify lines of business that are not fully utilizing our solution and then pivot to another line of business within the same company. There, we not only allow them to utilize what wasn’t being maximized by the first department but also look for additional opportunities to generate revenue. This approach is a core function of customer success and a critical part of our expansion model. It involves not just focusing on one business unit but expanding into others by understanding the stakeholders and their value drivers across the organization.

Using AI for aggregating data

Irina 56:03

De’Edra, since you are on the screen, we have a question from Liz. She asks about any experience in using AI to manage the challenges of aggregating data and communicating ROI to external leadership. How can we use AI to facilitate this process?

De’Edra 56:26

I think one one of the tools that my team has used previously, is we were building out success plans. It’s another CSP, but we were building out success plans based on those customer journeys and based upon the insights that we were gathering from those customer conversations, the technology can make recommendations around what success plays we should utilize within customer success and then those are actionable insights that the customer success team can use during their interactions with the customer.

So for example, if we know that the customer, a lot of our customers, want to understand how to enhance the customer experience, like how they can use our solution to do that, and what the AI can do is, say, based upon your drivers and based upon the customer experience that you’re trying to achieve, these are some ways that you can use our tool to enhance that in customer experience. That’s value that you can provide to your customers. And more importantly, if there is a solution set within our product wheelhouse that our customers are not fully utilizing, the AI can make recommendations based on the customer’s desired business outcomes or whatever challenges they’re trying to address. So yes, you can absolutely use AI to do that. Of course, you’re obviously using a tool that gives you that capability.

Irina 57:47

Saahil, we have one, I would say last question, because we only have one minute. Remy asked: how can CS impact the quality of new customers that are coming? Are you comfortable answering to this?

Saahil 58:05

Like I mentioned already, right? It’s starting with creating an ICP alignment with or within the whole organization. What I always try to do is create a graph, also in whatever CRM system you’re using, where after the whole organization has agreed to sell only to ICP, we start tracking the deals that are coming through, right?

Are we still signing non-ICP customers? And ideally, one easy way to track this is if that trend line is going downwards, if they’re staying flat, okay, that commitment was nada. If it’s actually going up, it’s the worst outcome you can hope for, right? So that’s one way. Hey, this is how we can impact your sales number. This is how you can meet your quotas. Do we agree that we will only sell to ICPs, and then you track this weekly, monthly, quarterly, and that’s why you would report, hey, this month we sign X number of non-ICP customers. For some it might be confronting, but I do think it’s a worthwhile thing to showcase to your sales leadership as well.

Irina 59:05

Guys, I hate to be that girl that says that our time is up, and we didn’t even discuss about one important topic. How do we build a business case, and how do we show that ROI?

I had some questions prepared, so I’m gonna basically asking you, if you guys accept our invitation to continue and do a follow-up, and if the audience, who is still live considers, is it important? Just give us some thumbs up and we’ll make it happen.

I would say, a follow-up part two of this conversation. And we’ll, we’ll continue. Let’s see, because I don’t see what the guys said on the chat. Okay, so we do have, thumbs up. I’ll sync with both De’Edra and Saahil, and in a few weeks from now on, depending on their time and their availability will organize and will announce part two.

Thank you both for taking the time for this, what I consider to be an insightful conversation!

De’Edra 1:01:23

Thank you guys. Take care!

Saahil 1:01:25

Thank you. Thank you. Bye, bye, bye.

Stay tuned for part two of the webinar with Saahil and De’Edra!