Customer data and the insights it provides are crucial to the success of any SaaS organization. Unfortunately, many customer-facing teams in the SaaS industry struggle to extract real value from the customer data at their disposal.

To explore the challenges around leveraging customer data and how to overcome them, we spoke to Irit Eizips — Chief Customer Officer & CEO at CSM Practice and a world-renowned CS Leadership Coach. During the webinar, we talked about:

- What a customer data framework is

- How to create a comprehensive data map

- How to leverage data to scale your CSM practice

Intro

Irina 00:01

Good evening, everyone, or should I say good afternoon, good night, depending on where you’re joining us from. Welcome to our webinar, “The Role of Data in CS: Leveraging Insights to Drive Better Outcome.” I’m your host Irina Cismas, Head of Marketing at Custify, and I’m so excited to have you all join us today.

Now, without further ado, let me introduce our guest speaker, Irit Eizips, Chief Customer Officer and also CEO of CSM Practice. Irit is a widely recognized expert in Customer Success management. And I’m really grateful to have her with us today to share her expertise on leveraging data to drive better outcomes in CS. Irit, welcome to our webinar.

Irit 00:56

Hey, everyone, how are you guys? Thank you so much for coming in and sharing an hour with me and Irina and talking about some very important things like, I don’t know, KPIs, customer data. Who needs that, right?

Irina 01:11

Yeah, Irit. I want to say hello to our guests. I see that we already have three people joining us. Hello, everyone, I’m super excited that you made it, and you’re joining us live. I want to give it a few more minutes. And I want to address some housekeeping items. All the lines are muted for a better listening experience. This is a recorded webinar, and all of you who registered will receive the recording immediately after the event ends. Feel free to ask your questions and use the question tab or even the chat. We’ll make sure that when we are not missing anything. We’ll address your questions during Irit’s presentation if they are in the context of the presentation. If not, we have allocated 10–15 minutes depending on the volume of questions at the end of Irit’s presentation.

And, like always, I want to start the discussion by displaying a poll. I want to set the base for our talk. And the question we prepared today is: how effectively does your organization use customer data for CS? Give me one sec to publish it.

Irit 03:12

Yeah, hope nobody is disappointed that they’re actually going to actively participate in this webinar. And by the way, you know, as we’re going through the questions, where we’re having this chat about customer data, how to collect it — I can see what you’re posting in the chat. I don’t always track it because, obviously, I’m going to speak, but Irina will. So, if anybody’s asking a really interesting question, especially about something that I just said, she’ll definitely try to revert my attention to answering it.

If you ask questions that are not related to what I’m saying, we’re just going to park it until the end. So, stick around until the end. And I want to also say, Irina, before you fire off the poll, I am going to share lots of templates that you can download, videos that I think you should watch, blogs that you might want to read — lots of content through this webinar all the way till the end. So stick around, be prepared to take lots of notes, screenshots, whatever you fancy. I think it’s going to be packed with a lot of good tips for you.

Irina 04:12

Awesome, I see that people already started voting. So, do you see the results of the poll?

Irit 04:35

Got it. Let me vote too.

Irina 04:37

Okay, super. So, 24 people already voted. We give it a few more moments. We have 48 — a pretty close distribution. So, “limited use”/”mostly reactive” — in between “limited use” and “moderate use”. It’s changed: “moderate use, “some strategic decisions.” So I think it’s in between “limited” and “moderate.”

Irit 05:15

Listen, it’s not uncommon. There’s so much data we can collect: who got it right absolutely 100%? I don’t know, very few. I think you need to put a lot of efforts/resources to get it right, and be fully mature in your strategy for that. Most of you have limited data, and mostly using it reactively. I think it’s okay, it’s a starting point. In today’s session, we’re going to unveil a few tactics on how you can make your analysis and data capturing more mature. So, I’m excited.

What Are Customer Data Frameworks & Why Do They Matter?

Irina 06:08

I suggest we kick off the discussion. And let’s start by chatting about customer data frameworks. Can you give us a quick rundown on what they are and why they matter?

Irit 06:23

Okay, so I think first and foremost, I want to share why they matter? I think it’s really important for us to actually really understand that. It’s not just about collecting some data and then doing something with it. And I think when you collect data with intent, your data collection and how you’re using it is going to make a big, big difference. So that’s why I want to start from this.

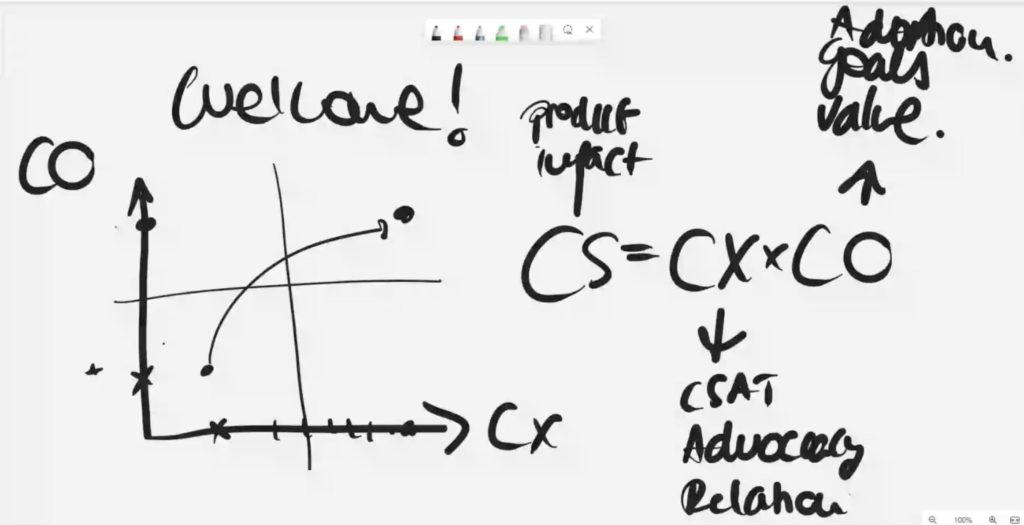

Alright, everybody knows, and if not, then you will see in a second, that the customer success formula is: CS equals customer experience (CX) times customer outcomes (CO). So, what we want to do in CS is to improve customer experience and deliver more and more outcomes over time. So, if right now your Net Retention Rate is lower than 100%, it’s probably because you haven’t figured out the outcomes yet. And so, the value you provide to customers is relatively low compared to your competitors.

Or, the customer experience is poor, or your relationship with customers. There are a lot of accounts that you don’t touch, or you don’t know who to connect with, you don’t know them very well. And so, you might be here, our goal is to get here. A lot of times, we need to not only launch new initiatives, but we need to be able to track whether we are improving over time in our CX score. And then, are we delivering more and more value over time? At a stretch, this is what we want to do. And then we want to do it at scale. So essentially, we want to gauge for productivity and impact. Are we doing the right things? Are we doing it in a scalable way? We want to gauge for customer satisfaction, we want to gauge for advocacy, all these things. Relationships scores — I’ll get more into this later.

And then for CO, we want to say: Are we giving our customers value? Are they reaching their goals? Are they using the right thins? Have they adopted whatever we recommended?” And is it aligned with the processes that they have? And so, when we’re thinking about customers, what data should we be tracking? And what is the framework that we’re looking to impact? This is to really say: do we have an effective customer success framework?

Irina 09:06

Now, because you mentioned this, how can we make sure that what we are capturing is actually relevant? And because, again, you said that there is a lot of data? How do we know what to focus on, what’s important and what’s not?

Irit 09:22

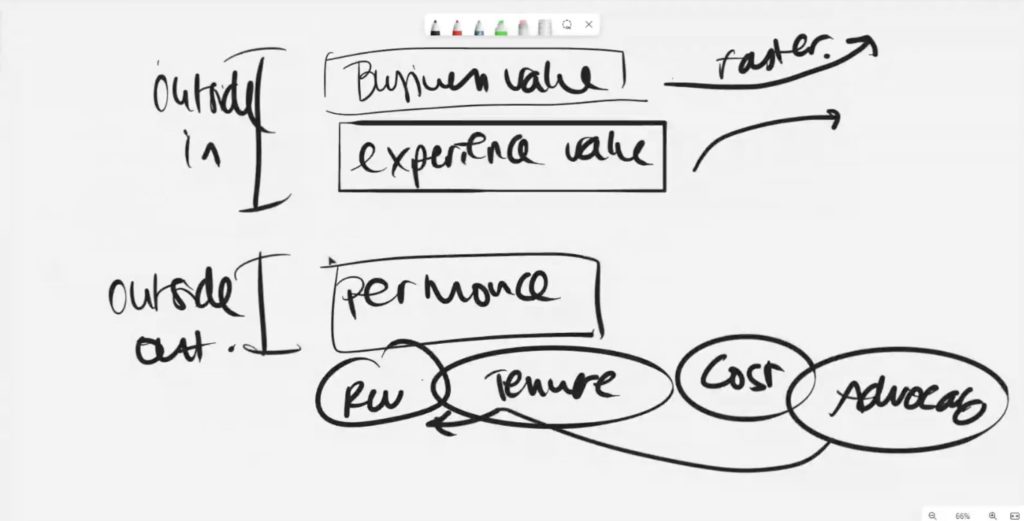

Okay, fair enough. So, maybe I can share a little bit more. Besides this high-level framework, what do we typically do? And then how do we prioritize? So, I think there are a lot of considerations on what to prioritize. But in general, what the company wants you to track is: there’s data that’s outside in, and then there’s data that’s going to be outside out, if you will.

So, first we want to ask: are we providing business value to ourselves to our customers? Do we provide an experience value? And then, does it have any impact? So very much like I said before, we want to track performance/business experience. Over time, experience value is the easiest thing to improve. If you’re going to tackle something first, this is the first thing you want to tackle.

Are we tracking the right things? Is this the right metrics? Let’s talk about it in a second here. Business value, obviously — we want to not only provide value, but we want to have faster value. A lot of times companies would track things like first value delivered, and then performance. This would be like, do we actually impact the company’s revenues? That could be upsells, retention, renewals, even new sales deals. Are we increasing tenure? Do customers actually stay with us for a long period of time? Are we lowering cost? That’s also a key performance for us. And then, are we increasing advocacy, which ultimately helps with the revenue, especially for new logos.

So, how do we know that we’re tracking the right things? First of all, ask yourself: do I have metrics to actually gauge for each one of these three things? [Outside in data] would be more about any kind of Customer Success Initiatives, whereas [Outside out data] is going to be about your business success.

And this is a model that was developed by Deloitte a while back. I think it’s really great to just keep track and then say, out of all the metrics that I have, where am I in red, yellow, or green? I would say most companies are really good at tracking their revenues. And they’re not really great at tracking whether or not they deliver business value, or how fast they do it. Some are really great at experience, because CX has been around for a long time. So in general, if I had to do a market research, probably this one would be in yellow, or green [experience], yellow or green [revenue] and totally red [business value]. This is the state of most of the market.

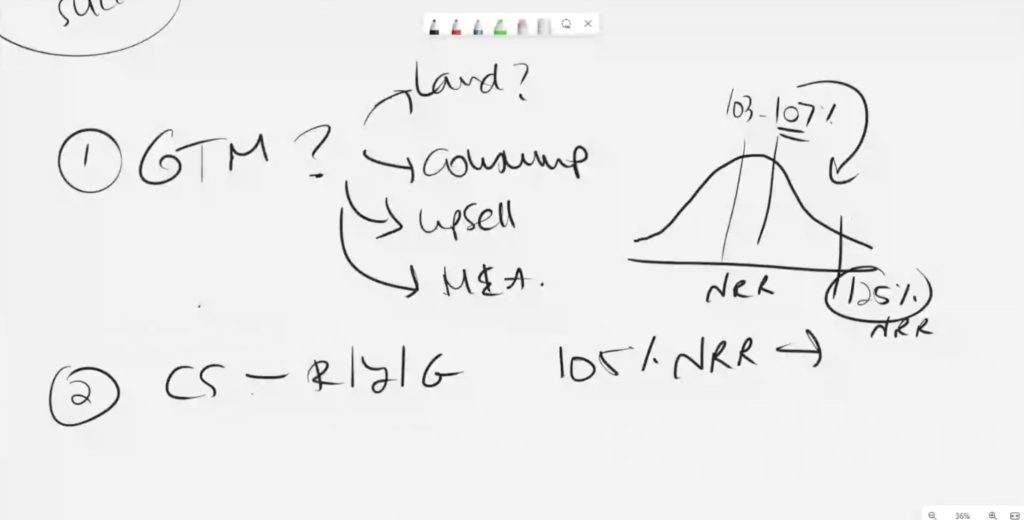

How do you know which ones to track? I think you need to create a plan. You need to ask yourself: what is my company’s go-to-market strategy? How do I map to it? Some companies would say that they’re going to grow using a land-and-expand. Is that your company’s go-to-market strategy? Is it consumption? It could be different things. Might be upsells, it could be through M&As. Whatever it is, your metrics for performance will be derived based on the model.

Secondly, what is the state of your customer success and its maturity? Where are you in red, yellow, green? And I’m not talking about your customers. If you are right now at 105% NRR, you want to get to the top echelon. If you actually had a market research done, and you looked at the state of NRR in the market, there’s very few that are above 125% NRR. And the average is anywhere between 103 and 107.

So if you think that you’re at 107% NRR and it’s really good, I got news for you — the good is above 125%.

So how do you get to 125%? Why aren’t you there? You need to do some red, yellow, greens around different aspects of your customer success framework. You can look at things like adoption and onboarding. But you also could look at different things related to your customer success and say: red, yellow, green, where am I? If you’re in red or yellow somewhere, and you think that might help impact and improve your NRR, then ask yourself: what are the KPIs that I need to track this year and put an effort into to actually have some fields in place in your Salesforce, your CS tools, whatever technology you’re using to keep track on those. And then, discipline the CSMs and other team members to actually insert the data and analyze it on a regular basis.

Once you have a list of KPIs, you want to say: okay, is the data accurate and complete? If it’s not accurate, how do I make it accurate? If it’s not complete? What efforts do I need to make to get it complete? Is it missing completely? And if so, who should be tracking it? And do we need to create fields? What kind of format should be the fields?

But this exercise here will tell you what you should be tracking. What is most important right now? And then, of course, you can always do a sort of Pareto exercise. What would be the impact if I did track these KPIs? If it’s already available, and it’s high impact?

So, if I already have it, whether it’s low or high impact, I’m probably going to start tracking it immediately. If it’s not available, what is the effort of getting it available? If it’s high impact, and it’s not available, go start tracking it immediately. Maybe you need to install an application to track usage and define what usage metrics you’re going to track. Then, get into a dashboard and get some calls to action around it. If it’s not impactful, if it’s just nice to have and it’s a lot of effort to create it — maybe you don’t do it at all. Maybe you wait until next year so you can improve.

Leveraging Data to Measure Business Value

Irina 16:46

You mentioned the business value, and you said that most companies are in the red on that. What’s the data? So, in order to be able to measure it correctly and show the business value, what type of data do you need? And why do you think that everyone is in the red?

Irit 17:35

If I had to take 10 companies and say: “how good are you at tracking business value?” or “how good are you at tracking business?” — whether or not you provide data, you provide value to customers — they’re probably not great at it.

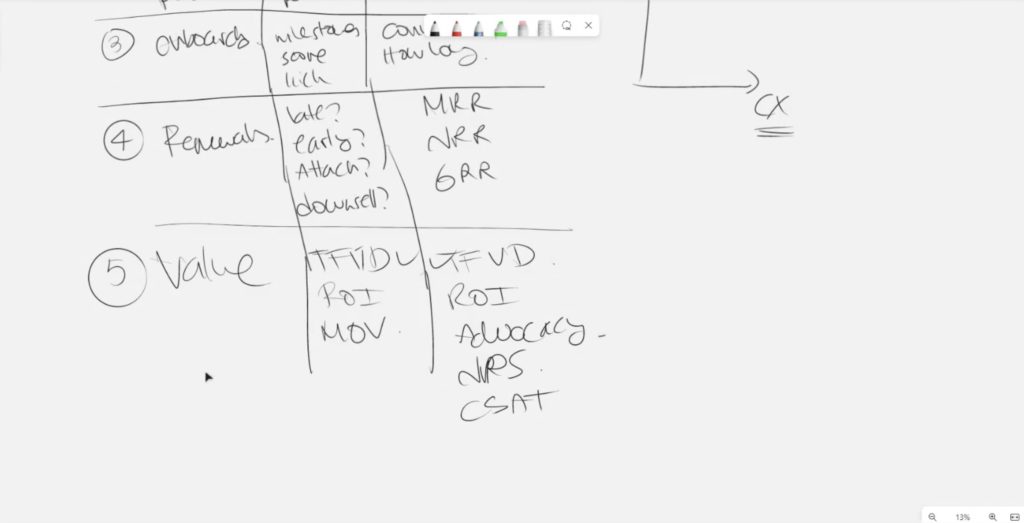

First of all, it’s very hard to track. And every client might be different. So, there’s very few companies that actually have a very disciplined way to track value. And some of them just struggle, because it’s really hard for them to even define what the value is. So, there are a few metrics that you can use for measuring the value you provide to customers. Especially if this is very difficult for you, this might be an approach you want to take. And I have a video on my channel with Chris Sing. He talks about how he created a value score for his customers.

But I mean, you could do a straight-up ROI. I have another video with Eyal Maor who explains how he’s actually tracking ROI calculation for each and every customer on monday.com. And you can do that too, if you have a very simple business model, and you can calculate it, and it’s inside your application. For example, I had another person that had a video with me, they can actually calculate the ROI inside the application. These guys got it down: if the ROI is very clear, and they can calculate it in-app. Or they have a discipline for it and it’s a high touch model — great. That’s usually not a problem.

I think most are in red because they are having a hard time figuring out what their ROI is. Secondly, I think some of them don’t have the discipline to say: what is the time to first value delivered? I don’t know how many companies are actually tracking this. From what I’m seeing, there are not a lot of companies that even track different milestones in onboarding, let alone know how to calculate them. Again, this video with Eyal Maor is actually about really tracking this metric. And I think it allows him not only to track whether he delivers ROI, but how fast he can deliver an initial ROI. So, I think the reason they’re in red is that they’re having an issue understanding the ROI, they don’t have the discipline to track milestones.

The reason I mentioned Chris Sing is like, okay, every company has a different ROI, the use case is wildly different, what can we do? And so what he did, which I thought was really cool in terms of customer value, is he said: look, the value is not just the ROI they’re getting on their business. It’s also if they’re actually using our product and attending training. If they’re getting improvement in their business processes. If they’re consuming all kinds of resources that we have. So the ROI for him was: how much value are they getting from the engagement with us?

Yes, they can just use the tool, but that’s very low-value. What we want is to be a true partner. Can we measure our true partnership with them? So, are they leveraging our consultancy services? Are they reading our blogs, going to our conferences to get exposure to best practices? Are they adding product training so they’re always using the latest features? So, he communicated this back to his customer, created a value score, and shared it with the customer. It was a value scorecard that he created for customers. And because the ROI was a little tough to calculate, he actually had a lot of different aspects for the customers to say: hey, are you getting the most out of our partnership? Are you getting the most value?

Aligning GTM and CS Strategies

Irina 22:17

Awesome. If you do not mind, being on the marketing side, I want to understand what mentioned — the connection between the go-to-market strategy and the CS strategy? Can you provide an example? Let’s take the land-and-expand. If you go with a land-and-expand, how does this type of go-to-market strategy influence CS? How should the CS organization align?

Irit 23:06

Okay, so listen, land-and-expand is a little different from upsell, although maybe upsell is a type of land-and-expand. But, it just means that the company has a really mature upsell strategy. When they first secure a customer, they sell them one thing. But they actually have additional satellites that they can sell: it could be additional modules, it could be additional product.

But when they sell them on it, it’s just this one single use case. It could be also that the single thing that they sell is a single site. And they know that their customers typically have multiple sites. Think about manufacturers, right. They might start with the manufacturing facility in China, but then they might also want to go to Taiwan. And maybe they have one in the US and other areas. Their hope is that if they do a good job in one thing, the customer is then going to expand to additional use cases, site modules, or products. So when we have a customer success organization with a company that actually has that type of use case, we actually need to make sure that we have a customer journey that understands that. We start with this and how we proactively create conversations where we can talk about those different opportunities, capture customer value, etc. And move the customer to add additional modules and product sites along their journey.

And so we need to actually track data that suggests a few things. One is propensity. What is it? How do we know? You know, how do we create a red, yellow, green light or a score that suggests that the customer has the propensity right now to expand? Maybe it’s external data like news that they acquired another company. Or they’re very engaged, they gave us a moment of value, declaring that they had a certain value with us, they agreed to that. We got some wins with them. It could be that they hired a bunch of people, whatever it is. There might be like a score where we can actually gauge for propensity and then start conversations around expansion.

We want to track CSQLs — for those who are not familiar, that’s Customer Success Qualified Leads. So, we want to track CSQLs, whether or not the team is actually closing those qualified leads for upsell. We want to know the conversion rate — so, what was the percentage of them for upsell or cross-sell depending on the strategy. And then we also want to know what was the actual upsell based on CSQLs. And all of those are going to be our lagging indicators of whether or not our CS strategy is correlated with this overall go-to -market strategy.

I’m actually going to show you something that I use with my clients and how I map this out. I have something a little bit more extensive that I do with my clients. But I’m just going to share an example that was shared with us in one of the videos that we did with Dutta Satadip. If you want to watch that video, you’re welcome to watch it on our CSM Practice channel. But basically, what he’s done is he said: Okay, there’s some going to be some input metrics, and then some output metrics. I like to call those lagging indicators and leading indicators. So leading indicators would be: did we have CSQLs? Are we trending towards a better customer experience, so we can have these conversations? And then, output metrics will be: okay, over time, this is what we expect the impact to be.

One thing that I like to add to this type of framework is behavioral metrics. Because we know that sometimes, when we launch a new process, in order to attach ourselves to this framework for mapping ourselves into the go-to-market, we actually need to impact behavior.

So, let’s say we may want to track to just drive accountability from our CSMs — to say, how many CSQLs have you generated? How many times did you do QBRs, EBRs, success plans? Those are behavioral metrics. I think that’s another column that I would add here — if attaching myself to the go-to-market strategy would require some change management. If this is something that your CSMs are doing already, maybe track it anyways just to show that there is a correlation between activities that your CSMs are doing, leading indicators, CSQLs, advocacy, and actual output metrics — which is the lagging indicators, which is obviously how many accounts we actually expand into. So hopefully that gives you a full answer to your question.

Value Measurement vs. Customer Health Scores

Irina 28:39

Definitely, it definitely does. And I want to address two questions from the audience. So, the first one is: in the last example about value measurement, is that similar to customer health scores? How does that differ?

Irit 29:01

Okay, so it differs, because it’s a value score. A customer health score might include other things like customer satisfaction, support tickets — every company is a little different. But I think that the value score is where you drive accountability. You leverage that scorecard to drive accountability from your customer, to leverage all the resources you have available for them. So for example, it’s a recent trend where you have more and more SaaS companies launching an academy for their clients. And so, if clients don’t opt into it, their propensity or ability to be super successful with you and be one of those best-in-class customers is lower. Internal knowledge is never going to be the knowledge that you can impart on your customers based on your experience with so many of them that have a similar use case. So,if you had a value score for your clients, and one of those areas is whether or not you’re leveraging the the online academy that you’ve provided them, and you can show them that their performance is lower than what they want, you can pinpoint and say: listen, you need to be accountable and have X, Y, Z leverage from our resources in order to be more successful.

It’s basically a tool to drive accountability. But it’s also a tool to say you’re not getting the most value out of the relationship. We’re not just a tool, we’re actually here to show you best practices.

And so that’s how it differs from a customer health score. A customer health score is for you the say: my customer becoming best-in-class. I would add things like: is the customer providing us advocacy? That’s not something I would necessarily show a customer. But it’s something that I might derive for myself. I might have a relationship score: do I have an executive alignment with them or not? That probably won’t show to a customer.

But a value score is all about answering the question: do you, Mr. Customer, leverage all the resources that we provide to you so that you can be best-in-class?

Irina 31:11

For sure it does. Another one: would behavioral metrics be good leading indicators?

Irit 31:38

Yeah, I think some people would say that behavioral metrics are a type of a leading indicator, for sure. I sometimes like to separate it. Because I might say: if you do a QBR, then the leading indicator would be a deeper relationship with a customer. So, we’re expecting QBRs or, I don’t know, regular touchpoints with customers to increase the relationship score with customers, which will lead into a higher NRR. Sometimes it’s good to separate.

So, the way that I think about it is: behavioral KPIs are things that are totally in the CSM’s control. And then I can determine whether or not they’re effective by saying: okay, I have three CSMs, they’ve all done 10 QBRs this year, but then some of them were well-attended and some of them were not. Then, maybe it’s a training issue, or maybe the whole thing is not strategically correct. But you want to separate the activities just to say, you know, is what I’m asking my CSMs to do being effective or not. And hopefully, that distills a little bit the difference between the two, in my humble opinion. Dutta Satadip does not separate between them. So, it’s not like a holy grail; you have to separate between the two. That’s my opinion. And you know, that’s how I like to do it.

Connecting Your CS Strategy with Your Data: High Touch Vs. Low Touch

Irina 33:21

Awesome. I’m also watching the time, and I think we went only through 20% of the things that I had prepared. So definitely, we have to do another round, we’ll have a part two, because this is an interesting topic. Now, I want to I want to ask you: is there a connection between the type of customer success strategy a company has and the customer data they collect? For instance, if we follow a high-touch strategy approach, what type of customer data do we need versus a tech-touch approach? Let’s deep dive into two different approaches and give some examples.

Irit 34:14

Listen, maybe we start at a high level, okay. Like what is the big difference between the two? The one thing to remember is that high touch is more consultative. And then, tech touch is more transactional, automated, right? So we’re gonna have a lot more consultative touchpoints in a high-touch model versus a tech touch. The higher the CSM to customer ratio, the more I want to gauge whether my automated tech charge and digital experiences are working. And by the way, with a high touch, I believe we can actually collect more specific data about the customer.

Imagine you have 17,000 customers, and all of them are less than $200 a month in MRR. You might not have a deep relationship with everyone, so you might really look into more engagement metrics and things of that nature. I just wanted to clarify why there’s a big difference between the different data approaches. Let’s make a list of all the different types of data points that we might collect for customer data. I’m gonna make a quick list for you — feel free to take a screenshot. Add more if you think there’s more, because, you know — I know a lot, but I don’t know everything.

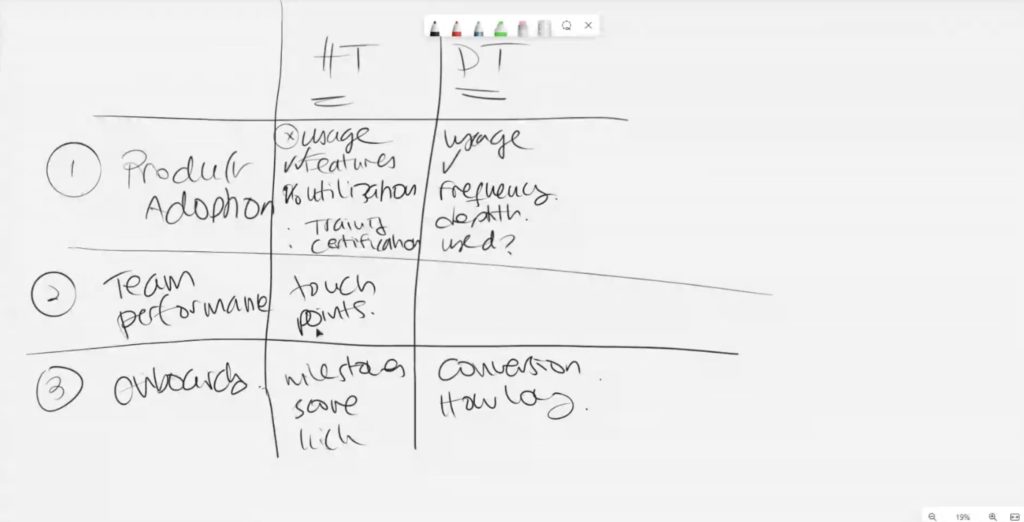

Okay, so one: product adoption. Obviously, both high touch and low touch or digital touch, if you will, are going to collect that. I think the big difference is: what they are going to collect. And so here, what I’m seeing for high touch, we might still collect usage data from the system itself. So usage trends, key features — all of that would be very relevant. The problem is when we have a very high-touch model, sometimes we don’t have access to it. So what do you do: can you actually make a list of the features or modules that they have purchased? If I have a pure digital touch, and it’s like a product, usually, I would just track what features they’re using in the system. It will be harder for me to say what each of them bought. And then compare, you would see that less. So, this is more common here: we actually have specific things like how many users and what the utilization percentage is. Here, I would say, I would look into frequency of usage and depth of usage. And then I would also ask myself: you know, I have some guided in-app tours — is that being used? Is my digital experience being effective or not? Whereas here, I will take a look at, you know, did they sign up for training? Do they have certificates? I’m not saying this is completely true here and here. But this is kind of like trends, if you will, that’s the big difference that I’m seeing. You might have all of them in all of them.

So that’s why I’m having a hard time with your question, because I think it really depends on the company, the type of tool — it’s not so much about high touch versus lower touch. It’s more about: do I have access to usage? What is my solution? Is it an enterprise solution or a product lead solution? I feel like that’s more of the difference. But I’m just gonna list out other things like team performance.

Obviously, if it’s a high touch, I’m going to have more touchpoints. And I would highly recommend asking yourself: am I tracking the key touchpoints with clients? Do I have a dashboard that says: if my guidelines for CSMs are to have two/three QBRs per year, one EBR, and one Success Plan — is my team doing that?

If you don’t have that, do you have a health check? Like a technical health check done once a year? How often do they update the health score if it’s manually updated? Look, you’re gonna have a health score probably on both. But on digital touch, it’s going to be an automated health score. And here it’s going to be a manual one. So that’s what I’m thinking, you know: you’re gonna have onboarding — well, onboarding for high touch might be multiple months with multiple milestones. And maybe there’s a score at the end. And there’s multiple people involved, and it’s a little bit more risky and more comprehensive. Did we do the kickoff, and how long did it take to produce the arc?

So for all these milestones, I’m probably going to ask myself: what was the conversion rate for the onboarding? Was it successful? How long did it take? What are they using in the end? All those kinds of things. And maybe I also have an onboarding survey. By the way, I don’t hear a lot of companies having an onboarding Service Satisfaction Survey. As a side point, I really recommend doing it because at the end of the day, like I said, it’s all about customer outcome and customer experience.

If you’re not gauging for customer experience, what are we doing here?

All right, so then we have renewals. For renewals, if it’s MRR, which is what most tech touches are going to be, then you don’t really have a renewal metric, you’re going to gauge for MRR, maybe NRR, GRR. But you’re not going to have a lot of metrics related to whether the renewals process is a solid one. So here, if it’s annual or multi-year, you’re gonna gauge for how many were late, how many were early, how many of them were actually able to achieve an upsell, how many of them resulted in a down sell. And so, it’s going to be more robust metrics for renewals in a high touch versus a low touch.

And again, don’t catch me on saying “Well, she said, and it’s not true.” This is general trends, what I’m seeing, you know, as I’m working with these customers. What else do I put in here? Okay, obviously, value, we’ve talked about it before. And then product adoption, obviously. It is kind of hand in hand with these things. But time to first value delivered is something that I would probably recommend both of them to track. How long before we believe the customer had an initial value? And then can we calculate the ROI automatically in-app, and we should totally do that as well. Otherwise, we want to definitely capture a moment of value and collect that. In a high touch, it’s going to be much easier. Here, you might want to say: okay, if they’re giving us advocacy, they got value, we’re going to track NPS to see how happy they are overall with the product, with the experience with us. Are they feeling like they’re getting value out of that, CSAT on our training, attendance on training.

All these things give us a sense of whether or not they’re perceived to have value with us. And so, you might want to have almost the same metrics unless you have more things to offer here. And you can have some leading indicators in here as well. So hopefully, that gives you some sense of what I would track — pending if it’s high touch versus low touch here, just as digital touch. But honestly, you know, Irina, it’s a good question. I think you might have more data points in high touch. And sometimes you have more data points in digital touch, especially with what relates to product adoption. And the real question is not whether the engagement is different. But actually, what is it? Are we working with enterprise customers? Or do we have an enterprise solution or a product-lead approach? Those are the type of questions that will ultimately decide what kind of data points will we have to each one of these data pillars.

Irina 43:34

So the most important conclusion I draw based on what you just said is that the data categories are the same, regardless if we are talking about high touch or digital touch, but the KPIs might differ. But when you start thinking of what to track, basically, they’re the same, regardless of the strategy that you have in place. Would that be correct?

Irit 44:05

Yeah, exactly. I think the categories are the same. And you might have different metrics that are available to track, and then different metrics that you may want to track. And so, I think that if you get anything out of this webinar, it’s this discussion.

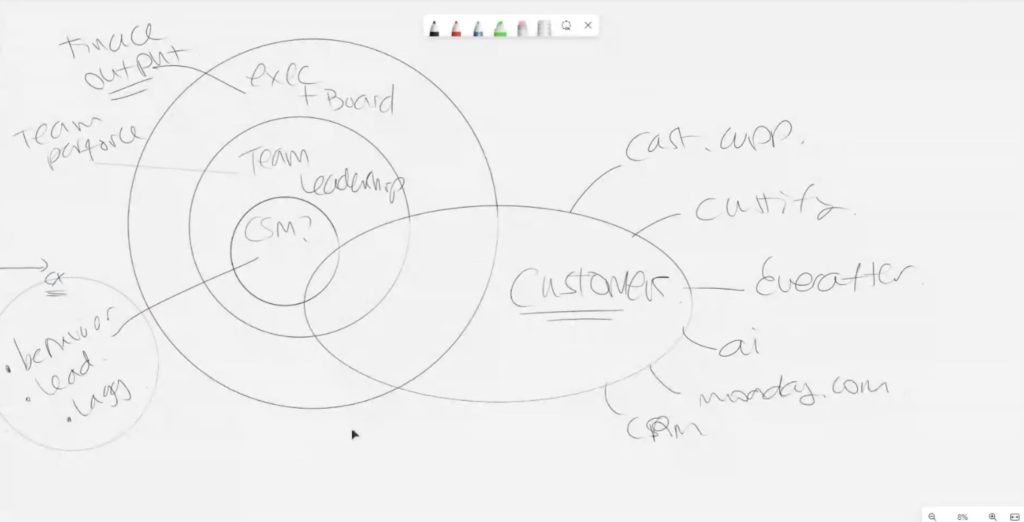

First of all, ask yourself the right business questions. What is relevant for me as a CSM? If you think about it, just to make the right list of KPIs for high touch and then for low touch is not enough.

What you want to think about is: given our engagement model, our product, our GTM strategy, marketing strategy — what would a CSM need to know? And then out of that, what would their team leader need to know?

And then, of course, the executive team and the board would have different questions as well. And what would be key right now to answer is, obviously, based on your red, yellow, green analysis on what to focus on with regards to the GTM strategy. And then finally, you may also want to ask yourself: what do customers want to know? We can’t forget them. Some of the data that’s important for the CSM is also very, very, very relevant for the customer. So, there might be an overlap, especially with the CSM data. But we want to give a thought around what the customers want to know. And then, can we share that in the app or in emails?

There’s out there companies that know have a question, Irina, around what tools we should be using. What’s the ultimate next step? There are a lot of solutions out there that are making it very easy for you to share data with customers in a digital manner. Obviously, there’s Custify and other CS solutions. You can use EverAfter for customer help and just make it permanently available for them in the app, accessible in their customer portal. You have AI tools like Involve.ai that would analyze the data and give your team a lot of data you should share with your customers.

So, those are the kinds of things that you want to say: what would be important for my customers? Obviously, Eyal Maor is tracking it on Monday.com. And he was thinking: well, customers want to know how we calculate the ROI. And he actually created a whole object to just track the ROI on Monday.com.

So, whatever you’re using, whether it’s your CRM system, always think about — what do I need to know, as a CSM? What do the team leaders need to know to make sure that the team is working effectively? What do they need to know to hold them accountable for the customer journey and the initiatives that will impact the GTM strategy? And what do the executive team want to know?

I bet this is mostly going to be your lagging indicators, financing metrics, output metrics, your team performance KPIs — mostly leading and lagging indicators. And these would be behavioral leading and lagging indicators because, look, a CSM will want to know: am I doing what I’m being asked? Is this creating the right impact? And then, how am I impacting the company? Am I on the right track? Am I focusing on the right things? So I think the lower you are, the more you want to know. If you go to the board, they don’t want to know about all these. They just want to know: bottom line, where are we? But then the customer might have different things that they want to know that might not be in any of them. There might be more data points. You have to think about all of these.

Finding the Most Indicative Growth Metrics

Irina 48:33

We have a question from Katherine I posted live. Obviously, all of this data is key for the overall health and experience of the client. However, which data points do you think are the most indicative that the client will renew/grow?

Irit 48:52

All right, listen: there’s no crystal ball. I did a podcast around why your customer health score doesn’t work. Feel free to Google it — it’s also on my website. But man, you know, there’s no crystal ball.

Even if you deploy AI or predictive analytics, and you come up with a formula that calculates great propensity: “If this happens, most likely they won’t renew” — even then you can save a customer.

And so, there’s no formula in the world that would give you the answer to it with 100% accuracy. You can get very close, you could get 80% or 90%. What they found is that if you want to get very close to forecasting things appropriately — like, 2-3% level of accuracy around forecasting renewals — what you want to do is have a really good renewal process. Nail the renewal process! And then, in your CRM application or your CS tool, actually allow for the right fields so that the CSM can update it throughout the year, not only whether or not they expect the customer to renew, but what is the probability of renewal? And then within that, what is the probability of the renewal amount? Is it higher or lower than the renewal? If you have those fields available, and you hold your CSM accountable to update them on a regular basis, and you have meetings around those KPIs — then, most likely, you’re going to get a high-renewal forecast.

And I know I’m not really answering your question. But I just want to call it out because there are too many companies that are trying to create a customer health score that would predict the renewals. There’s no such thing. What we can tell you is that companies that provide the appropriate relationship with the appropriate experience and deliver the customer’s desired outcomes do get a higher ARR and net retention rate overall.

Ownership of Renewal

Irina 51:20

I’m gonna stick to Catherine because we only have eight more minutes, and I want to make sure that we are answering the questions that are coming from the audience. So Catherine asked: furthermore, in your opinion and experience, who throughout the organization should own the renewal aspect? Is it CSM? Is it an account executive? Is it someone else?

Irit 51:48

You know, I know some people have a hard answer on this. And I actually think it really depends on a number of factors. But if we’re on that topic, it really depends on how complex your product is. And then how long it takes to actually sell. So you want to think about these things. Because the more complex the deal is to even renew, the more you want to outsource it. Otherwise, what will happen is that your CSMs, especially in a lower-touch model, will want to become renewal managers. Even for high touch — let’s say they have four accounts, and they’re up for renewal. What happens sometimes is when they own the renewal, they might damage their trusted advisory relationship. And so, for very large companies, enterprise companies, sometimes it just makes sense to split the roles.

Obviously, it’s easier to hire people that know one thing versus a lot of things. It’s harder to hire someone who has sales skills, consultative skills, product skills, technical skills, right?

So, sometimes when companies grow, what they do is they create specialized roles. Then, it’s easier for them to hire for those rules. Now, that being said, if you’re a small startup, and it’s easy to do an upsell, why on earth would you diminish the customer experience? If it’s a click of a button or two to get the upsell done? Give it to the CSM if the renewal is evergreen, which means that it renews automatically and all you need to do is just remind the customer. Why would you set up another team? You want to be very thoughtful of the customer experience with these kinds of decisions. And that’s all I’m gonna say about the topic — there is a full-blown video and blog on my company’s website if you want to explore more about why this is the way this is advised.

Dividing Tasks Between CSMs and Account Managers

Irina 54:15

Super! Now I’m gonna publish another question: How to divide tasks among account managers and customer success managers? At some point, both may collapse involving account management. Do CSMs meeting with customers may lead customers stress levels to decrease?

Irit 54:37

Look, I don’t think every company should have account managers and CS managers. And I definitely don’t think that customer success managers are account managers. I actually have this discussion a lot. by the way. There are a lot of misconceptions around what a customer success manager is and how that’s different. I had a customer success manager telling me: no, it’s the same, I’ve been both. And it’s, like, okay, you know, you’re probably not a customer success manager.

So, I highly recommend watching this interview with this lady, she used to be an account manager, and now she’s a customer success manager. And one of the things that she says in this interview, she goes: listen, when I was an account manager, I had goals every quarter and I had to hit that quota. All of my conversations my team leader were: is the customer going to renew? What are your expansions that you were anticipating? How are you going to hit your quota? Which accounts are you going to contact to get that quota? The whole thing was about the quota. Okay. When she became a customer success manager, that quota discussion was secondary to: what is the health of your account? How can we get them healthier? How can we get them engaged? How can we deepen the relationship? What else do they want to do? How are we going to get them to do it?

You know, it’s a completely different set of questions you’re gonna have with your team leader. So I don’t think the roles are the same. I don’t think they’re driven the same. I don’t think they’re designed the same.

Can an account manager become a CSM? Absolutely. Can every CSM become an account manager? Not so sure. So that’s my answer to you.

Irina 57:47

Yeah, I think that that’s a wrap for today’s webinar. A huge thank you for joining me and to all of you who tuned in live. So, those celebrating Easter this weekend — have a fantastic time. And as it says, don’t hesitate to connect with both me and Irit on LinkedIn. And if you need help with a customer success platform or just want to get some CS advice, feel free to reach out to Custify. Until we meet again. Take care and bye for now. Thank you everyone for attending.

Irit 58:33

Bye guys, big love from me. Happy Easter!