When a SaaS company thrives, it does so because it has customers. But when those customers start to leave, everyone scrambles to fix their issues, often overlooking one of the most important SaaS metrics: customer retention cost.

Without factoring in the spending needed to keep customers, nearly any SaaS will be stumbling in the dark. Yes, you might end up retaining those customers, but how much did you spend in the process?

How much money is that account actually making you? Is your venture still financially viable? Is the business still solvent?

To answer these and more, let’s do a deep dive into Customer Retention Cost:

- I’ll start by breaking down customer retention as a whole before going into CRC, CRR, and related metrics.

- Then it’s time to actually put CRC to use and learn how to measure it, what the CRC formula is, and how you can use it.

- Onto the main section of the article, where I’ll review tactics for lowering CRC without creating delivery gaps or sacrificing service quality.

- Last but certainly not least, I’ll answer some hotly debated questions on the topic of CRC in the hopes of helping you master this metric!

What Is Customer Retention?

Customer retention represents the combination of strategy, tactics, personnel, and tools that companies use to keep their customers happy and satisfied with their products and services. The ultimate objective is to cultivate long-term relationships, transforming patrons into enduring, “retained” clientele.

Within the SaaS market, customer retention has, in recent years, become a standard approach to growth, with 18% of companies investing more on retention than acquisition. All efforts in this direction have thus been handled by the Customer Success team, traditionally the one responsible for reducing customer churn. You can also think of retention as the direct opposite of churn.

For measuring, tracking, and planning, customer success managers typically rely on multiple CS metrics. Chief among them – the very subject of this article – customer retention cost:

What Is Customer Retention Cost (CRC)?

Customer retention cost, or CRC, is a metric representing the total expenditures directly related to customer retention efforts. This can include any costs incurred from customer engagement tools to account management efforts and the entire customer success overhead.

CRC ultimately provides an actionable KPI for very complex and multilayered efforts, enabling the CFO and other C-suite executives to understand precisely how your customer retention strategy is performing.

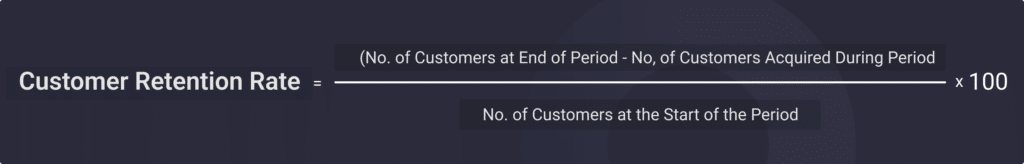

What Is Customer Retention Rate?

Customer retention rate, often simply referred to as customer retention, is a percentage metric indicating how many of your customers you’ve retained over a given period, excluding the customers acquired during that period.

Customer Acquisition Cost Vs. Customer Retention Cost

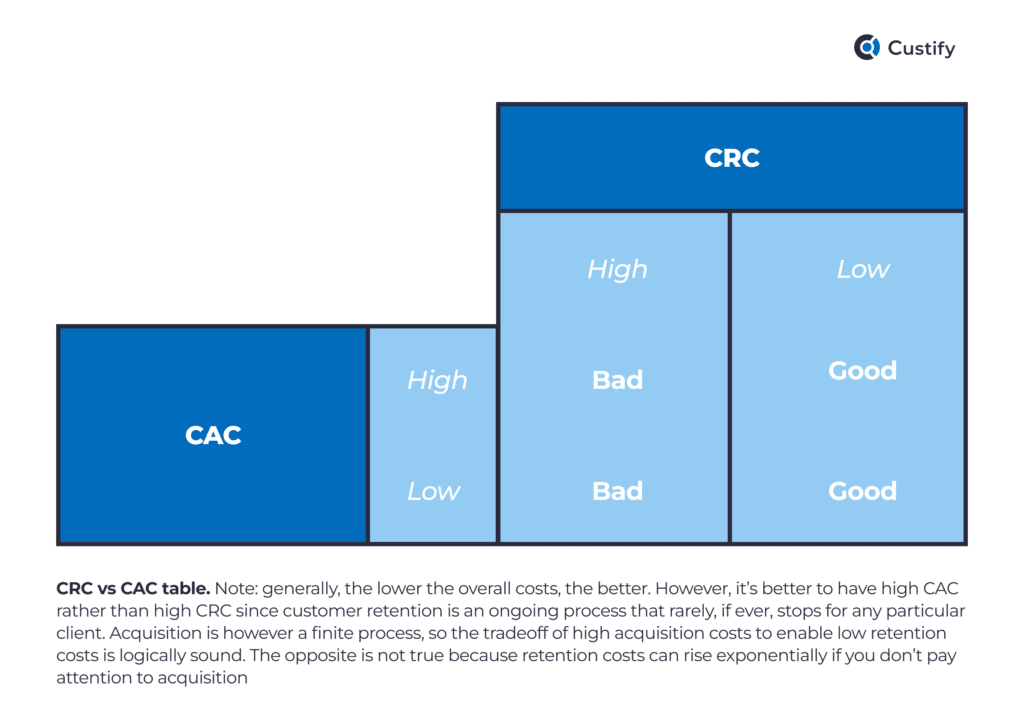

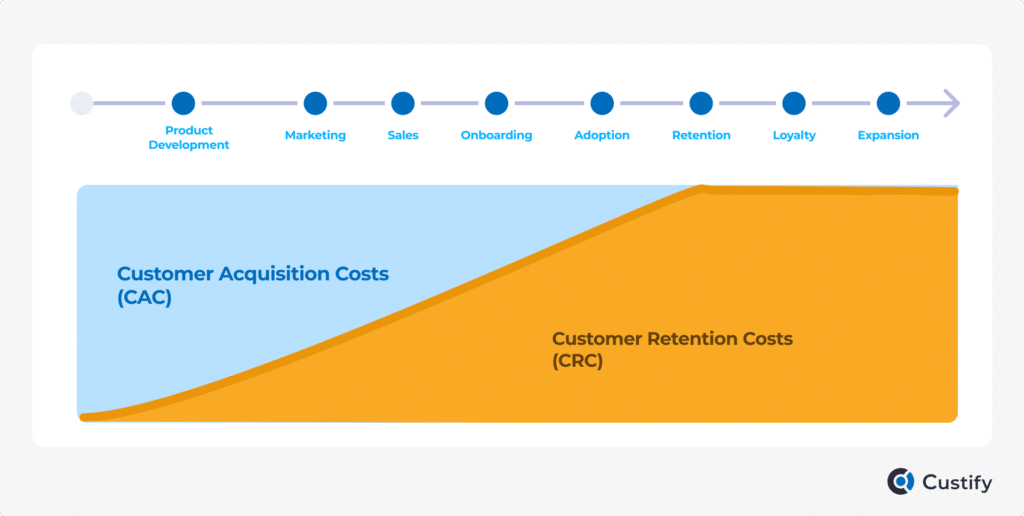

One of the metrics most often compared to CRC is, naturally, customer acquisition cost (CAC). The main difference between the two is that CRC is an overall metric for your retention efforts, while CAC is traditionally calculated as an average acquisition cost per customer. To effectively compare them, you either have to calculate a CRC per customer (divide CRC by active customers) or an overall CAC (multiply by customers acquired over the same period). The two are also directly opposed as metrics in SaaS, if not at open war with one another during budget meetings.

However, you should always look at them as directly related, since a high CAC will likely lead to a high CRC because of account complexity, while a low CAC might also lead to a high CRC due to false product expectations and poor onboarding.

So what’s the catch? Well, by working together, those tasked with acquisition and retention can find a balanced approach that:

ensures customers have a positive experience from the marketing stage all the way to adoption and expansion

- doesn’t overwhelm customers with information in the initial stages

- doesn’t pass on customers with false expectations to CSMs

- doesn’t pass on bad fit customers to CSMs

- allows for productive collaboration and communication at scale

Typically, customer retention costs are significantly lower than customer acquisition costs, which serve as a basis of comparison when discussing ROI. Retention also improves loyalty and, therefore, may cut its own costs over time as customer stickiness grows along with your team’s experience.

What factors into customer retention cost?

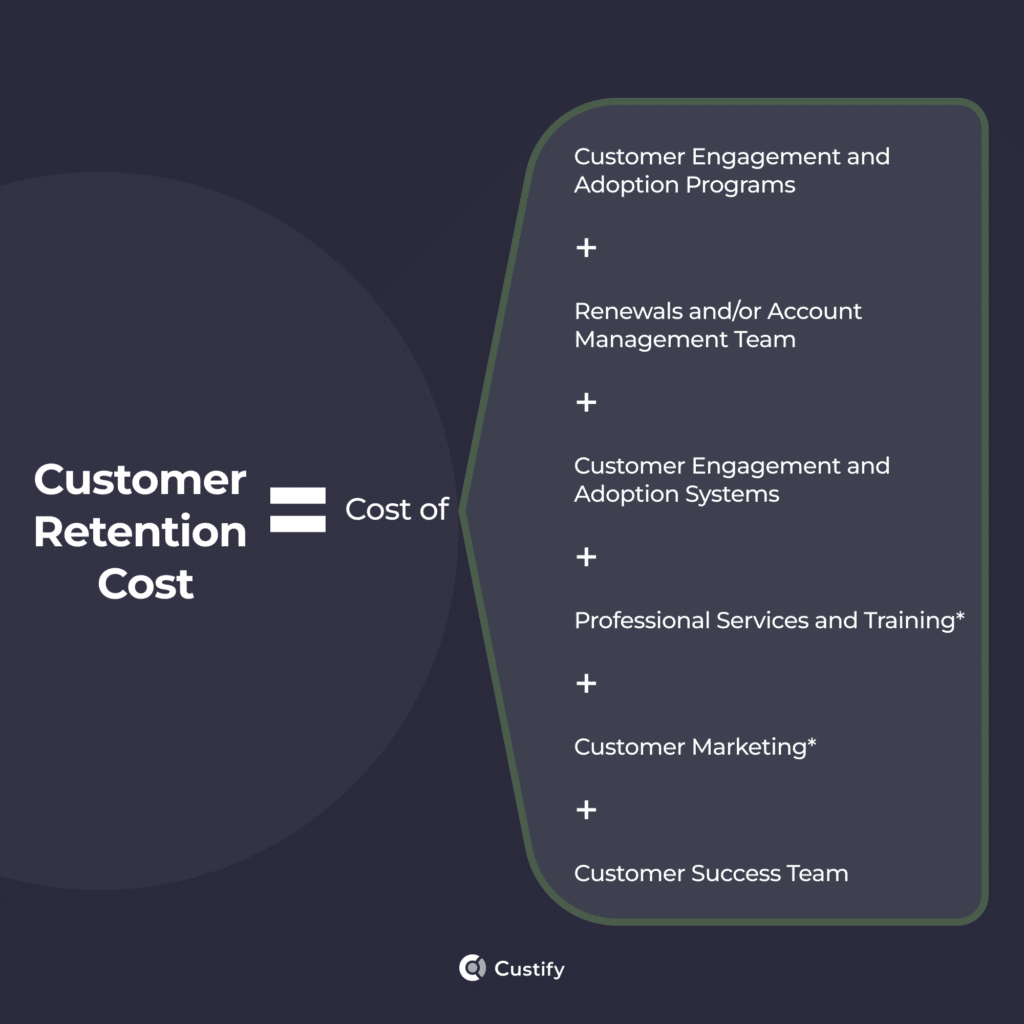

The usual suspects for your customer retention cost sum should be:

- The cost of customer success (including personnel expenses and any overhead costs).

- The cost of account management and renewals

- The cost of customer engagement and product adoption efforts (such as proactive engagement, product guides, and more)

- The cost of services and training (if you offer any to customers)

- The cost of customer marketing (such as customer upsell marketing campaigns, if it’s something you do)

Voices in the CX space have argued that customer support should also be part of CRC, but the general consensus is still that customer service and other professional services fall under COGS (Cost of Goods Sold).

How to Measure Customer Retention Cost

Customer Retention Cost Formula

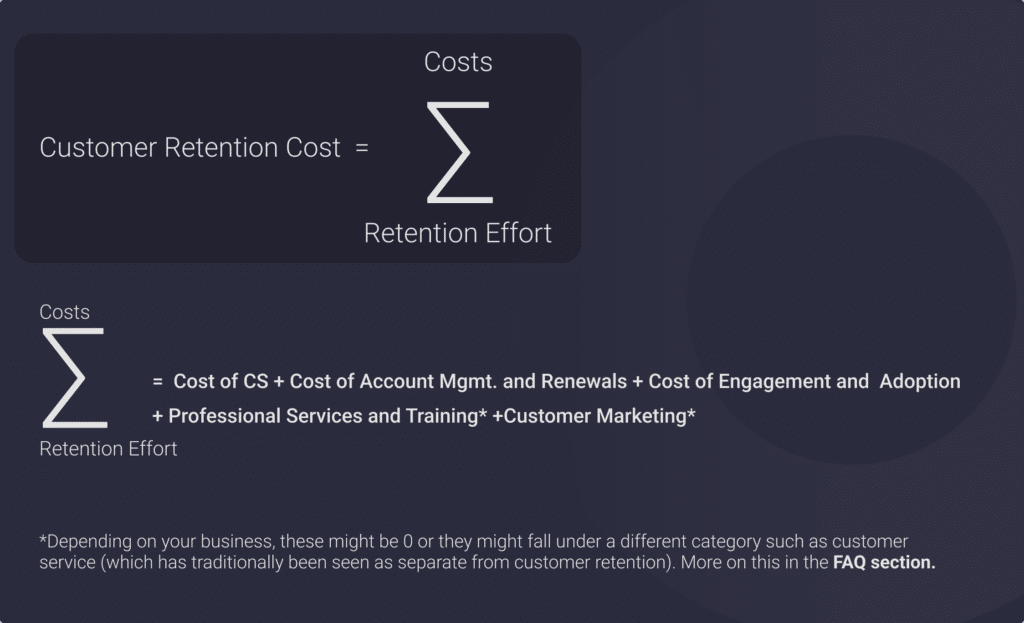

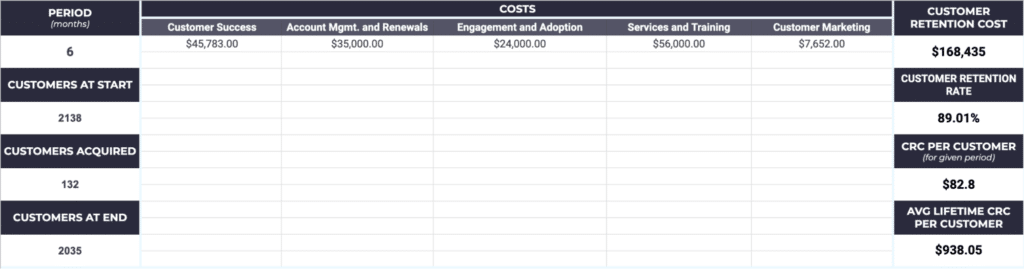

Essentially, the customer retention cost formula is a sum of all retention costs by retention effort. So you’ll be adding up everything from customer success costs to account management and renewals and all the way to customer marketing, if that’s something you’re doing.

Here’s a spreadsheet template we put together to help you calculate your CRC and rate more easily:

Use this CRC template for your next QBR.

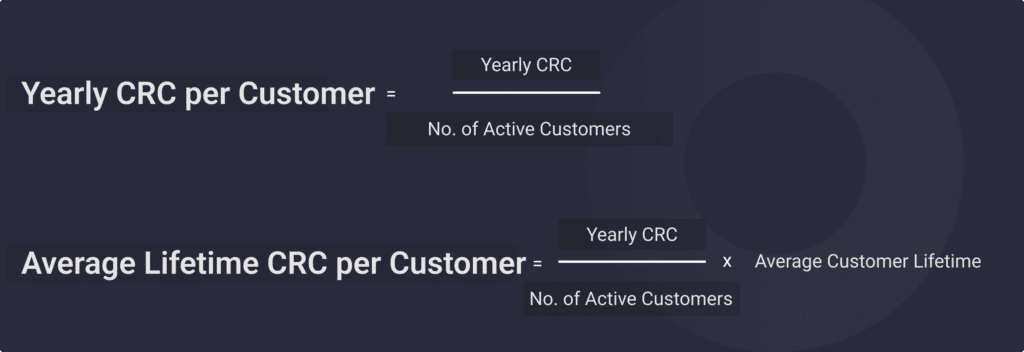

Other CRC formulas you might find useful are:

You can also calculate these in the CRC excel template above. Remember that your customer lifetime should, in theory, be longer than the period for which you’re calculating CRC, but the formula should still work. Once you’ve got an average lifetime CRC, you can use that number as a KPI / benchmark for your customer lifetime value (CLTV) – anything above your CRC should be green, anything below red.

Tactics to Lower Customer Retention Cost

1. Actively review feedback from your customers

According to a recent report on the State of Personalization, 62% of business leaders believe their customer retention has improved as a direct result of CX personalization efforts. Despite that, 72% of business leaders push personalization without considering what customers are actually after (2023 CX Trends Report). If you’re not listening to customers’ feedback, you’ve got no way of knowing how to even go about that, and the cost of retention will increase.

That’s why I always recommend starting a VoC initiative to gather relevant info and use it to drive personalization, put out product updates and fixes, and generally drive your customers’ business forward by simply improving your product, services, and overall offer.

If you’ve got the time for extra research, a RATER model evaluation might be a bit of an overkill, but it’s also one of the most advanced ways of gathering highly specific and actionable customer feedback by analyzing up to 97 questions and statements on customer perceptions and expectations of your business.

2. Prioritize and optimize onboarding

We hold these truths to be self-evident, that customer onboarding is the most powerful and customizable part of the customer journey, and CSMs should focus on optimizing it. Yet despite the business sector’s track record of deprioritizing onboarding, it seems companies are finally catching up: 50.3% have a CS-led onboarding function, while 42.3% have an independent onboarding team (2023 State of Onboarding Report).

Yet, you might be wondering why onboarding is so high up on a list of tactics to lower retention costs. The answer is simple: it’s better to overspend on onboarding as it minimizes retention costs at scale, since customers will be trained to use and see the value of your product and services, and won’t require as much encouragement to stay with you.

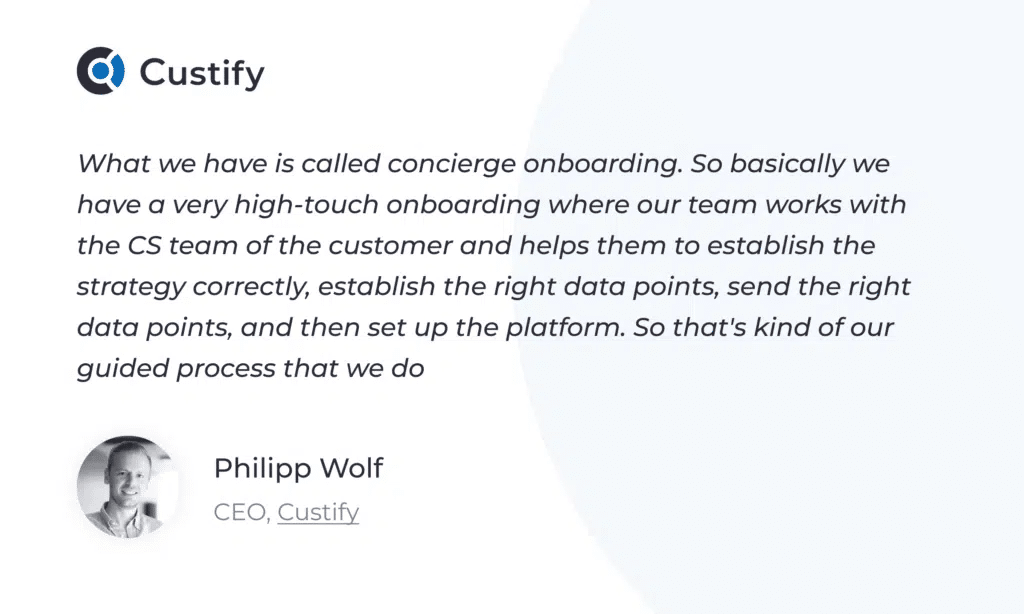

So go for a low-touch product tour, a high-touch 60-minute one-to-one call, or some form of very high-touch concierge onboarding. Find what fits for you and become a master at it!

3. Remove distractions to focus on the customer

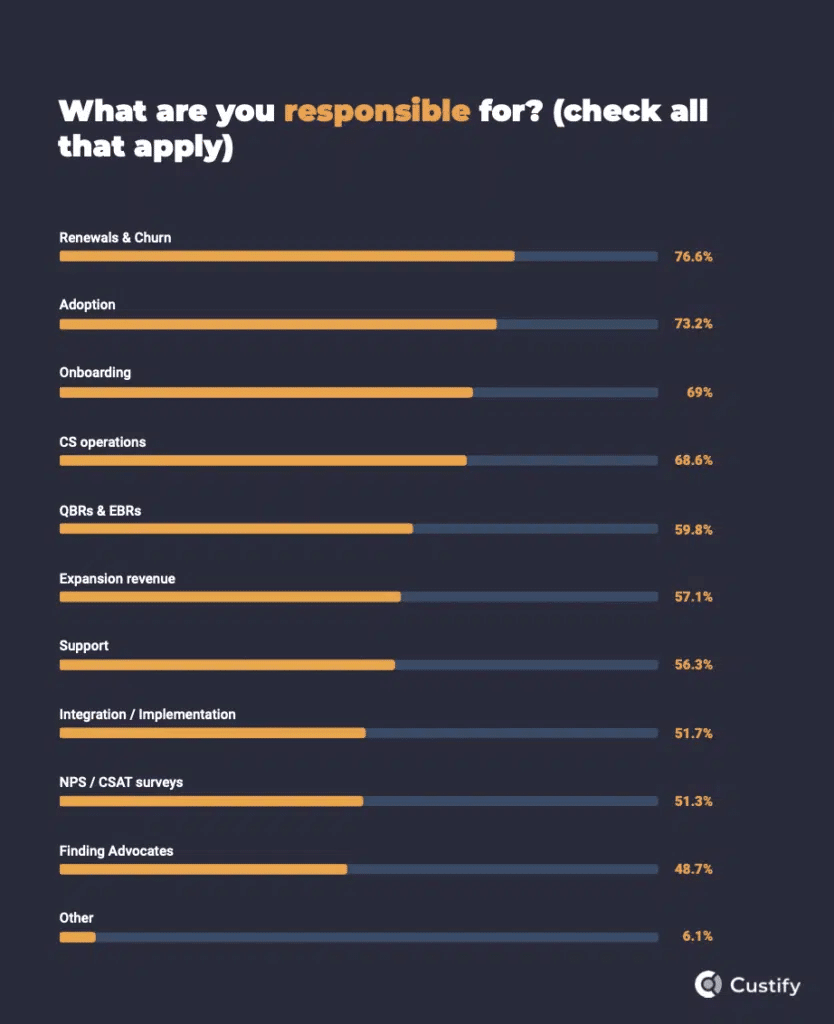

Our research into Quiet Quitting in Customer Success has shown CS teams are responsible for too many things:

Considering the data above, it’s a wonder CSMs can keep going when they’re supposed to be handling customer support (not their business function) at the same time as renewals, onboarding, adoption, and more. This also 100% increases the cost of retention efforts due to overworked and unproductive CSMs.

To help thin out CSM workflows, consider making use of automation and AI to get repetitive and menial tasks out of the way. Once that’s done, you’re free to refocus on customers and their needs with increased clarity and purpose.

4. Be deliberate about your pricing strategy

A smart way to mitigate the cost of retention and essentially increase profitability is by integrating your average CRC per customer into the price of the product. If you’re able to charge more or optimize the cost of the product in order to add that in, you’re basically set for growth.

Some pricing strategies and models that can work to your advantage here are Skim Pricing (high initial price, lowering over time) and Prestige Pricing (luxury, high-end price).

5. Invest in features that drive customer stickiness

Some products are simply so good that you can’t envision life without them. That’s what we in business call customer stickiness. It’s essentially the practice of making your product so good it becomes essential to the day-to-day life and work of your customers.

Want an example? The simplest one is email – once you’re onboarded on a particular email client, it’s very hard to switch because you would be losing access to your existing inbox, address book, calendar, conversations, and so on.

Therefore, in the same vein, try to make your software as indispensable to your customers as email. That will naturally lower your retention costs by lowering the possibility of customer churn.

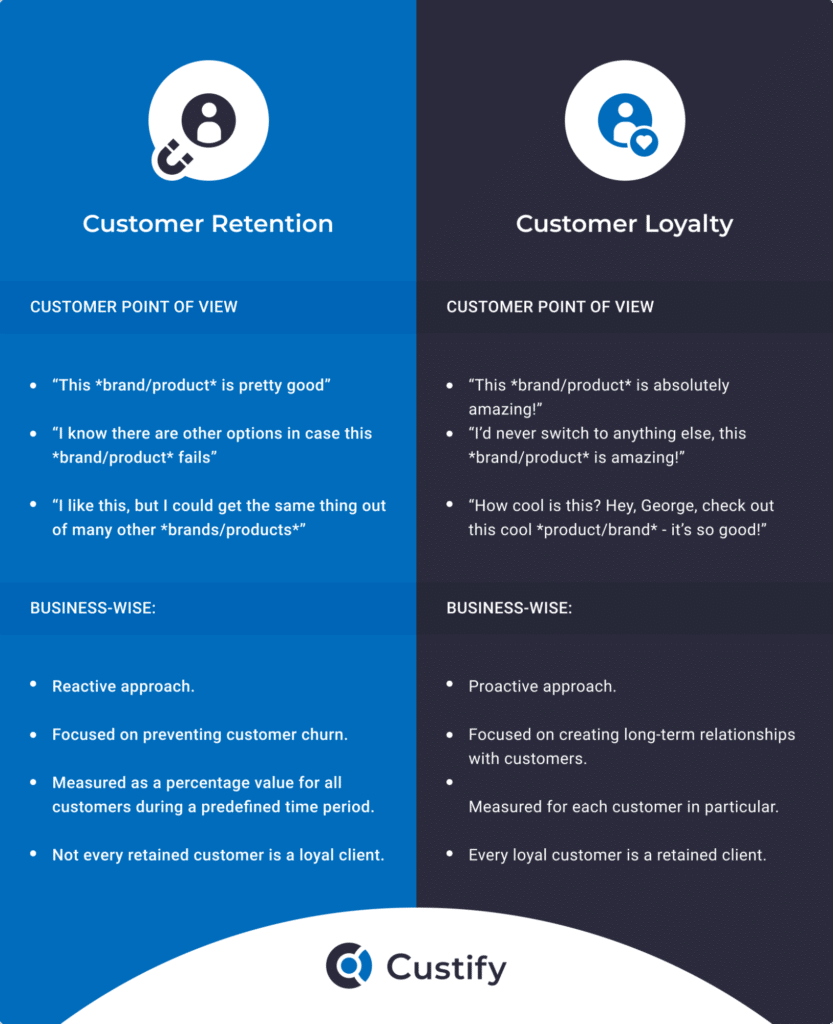

6. Move beyond retention and start a loyalty program

Customer retention is great, but you know what’s better? Customer loyalty. The natural evolution of retention, loyalty is the stage at which customers are satisfied with your product so much that they leave rave reviews, recommend it to their friends, and are actively invested in your business relationship.

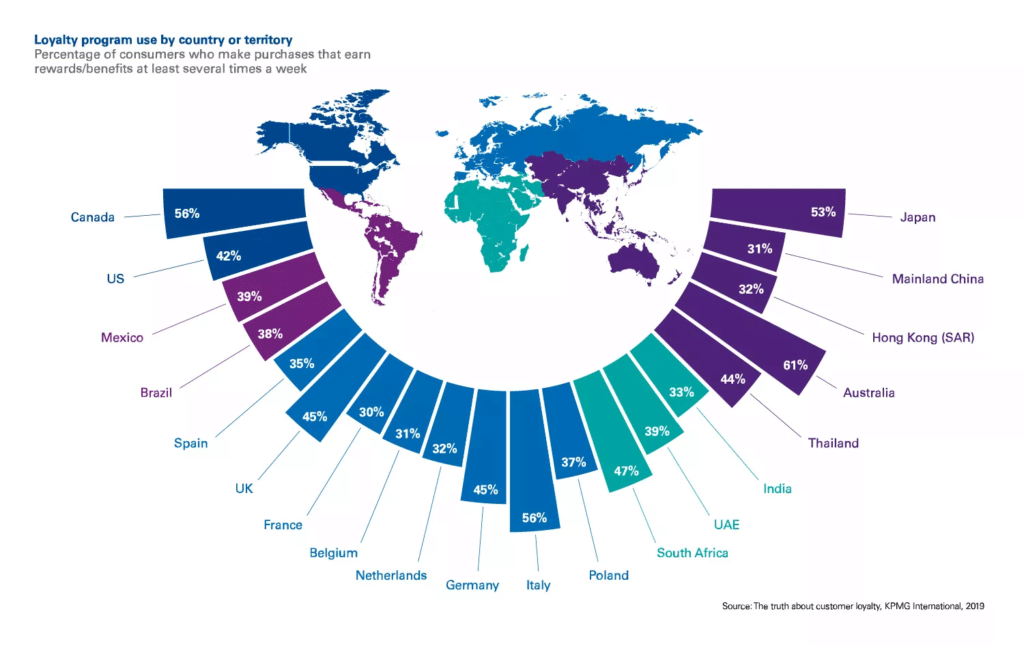

So consider starting a customer loyalty program – find ways to reward your customers and prioritize their needs and outcomes. This will kickstart retention and help you turn customers into loyal adopters of your products and services. What’s more, loyalty programs might work better depending on your market’s geographical distribution:

Loyalty program distribution by country. The lower the percentage in your market, the higher the potential ROI of a loyalty initiative, as customers might not expect such positive CX and, as a result, improve their perception of your business. Source: KMPG.

FAQs about Customer Retention Cost

1. Why is tracking CRC important?

If you have a retention initiative or teams that are essentially handling customer retention, it’s vital to track CRC in order to know the profitability of your efforts. For example, a high CRC won’t make sense if you’re a bootstrapped SaaS, so you should find cost-effective tactics for encouraging retention (such as using a product tour software).

2. How difficult is it to retain a customer?

Short review of typical retention tactics and how difficult and complex they can become for CSMs, listing challenges, leading into the section with advice

The answer here largely depends on your product and services:

- What’s your offer?

- What’s the value customers get out of your product and services?

- Do they usually achieve their goals with you?

- What’s your price point?

There will always be challenges and obstacles in the way of your retention goals, but retention as a whole should be fairly simple. For every type of product or niche, as long as you’re keeping your promises, you can find a retention tactic that works for your budget. That can be anything from low-touch product tours to high-touch one-on-one sessions.

3. Does CRC decrease over time?

Yes! Usually, the more time passes for an account, the more they’ll understand and value your offer. Naturally, you need to keep the product and services up-to-date and as bug-free as possible in order to secure that, but the turnaround will see your CRC decrease significantly for that account.

Furthermore, if you handpick your retention tactics to enable scalability, you’ll be investing in tools, systems, and processes that can work for years to come. That means costs will go down on their own without you having to sacrifice service quality.

4. Why isn’t customer support part of CRC?

As said just above, customer support costs are traditionally part of COGS and it’s likely the best way to account for it. Why? Because when you’re developing a product, you need to ensure the product continues to work and does so in a way that meets customer expectations. Therefore, customer support is an essential cog in your product machine and must be treated as such.

5. Should you add the cost of professional services to CRC?

It’s really up to you and the kinds of services you offer. If those services are part of your core offering, then they should be part of COGS. If they’re add-ons and essentially extensions of your product or core service, they can be counted into CRC. You should also consider the revenue you get from these services when making this decision. If the services have a price point and actively bring in revenue, maybe count them as part of COGS.

6. Is customer marketing part of CRC?

It depends on how many of your marketing efforts are geared toward customers vs. your audience and prospects. Customer marketing can be a powerful tool for retention if you give it the attention it deserves, such as by:

- Researching and publishing studies that your customers can use.

- Organizing webinars on trending topics within your niche.

- Organizing client meet-ups and conferences.

- Launching integrated marketing campaigns for new features and updates.

While all of these can be great at convincing prospects, it’s smarter to build them with your customers as a target audience. If you’re writing for them, you can go into more detail, be more technical, present more actionable insights, and showcase your product. It’s a choice between talking down to your customers (if you’re not writing for them) and meeting them on the same level (if you are). Any leads that see your marketing materials as too advanced are more likely to be impressed than to click away.

If this is where you’re at with your marketing, then including the expense in your CRC comes naturally. If you’re not at that stage yet, it’s a good idea to wait.

Summing Up

Customer retention cost, or CRC, is one of those metrics that keep the SaaS world spinning. Because without effective cost analysis, nobody can predict when the bankroll will end.

But there’s hope – there’s a multitude of tactics for lowering CRC, and most of them should be fairly easy to implement.

If you liked this guide and found it helpful, please share it with your team! And for more deep dives like this one, make sure you’re subscribed to our newsletter!