Getting new users is no easy task. And it’s expensive. Not to mention time-consuming.

Luckily, keeping the ones you have happy is none of those (in theory, at least).

That’s why this article focuses on customer retention. More specifically, on a metric that is not just essential but often the difference between a never ending standing ovation and a slow fade into the shadows of other SaaS companies.

We’re talking about Net Dollar Retention (NDR). Throughout this article, we’re going to demystify NDR and show you how your expertise as a Customer Success Manager plays a starring role in enhancing it.

Are you ready?

Importance of Net Dollar Retention in SaaS and its reflection on customer satisfaction and financial health of the company

Okay, so what’s the deal with NDR? You, out of all people, know that SaaS businesses need repeat customers. So far, so good. But how can you tell if those repeat customers are enough to sustain a healthy expansion?

Well, that’s where the NDR comes in handy. This metric highlights two critical aspects of your SaaS:

- The growth your SaaS generates without getting new customers.

- The overall satisfaction of your customers in relation to the actual value they’re getting from your product or service.

What’s more, NDR is also a pivotal metric for investors. It helps them gauge the right valuation for your business, considering your growth rate and potential for sustained success.

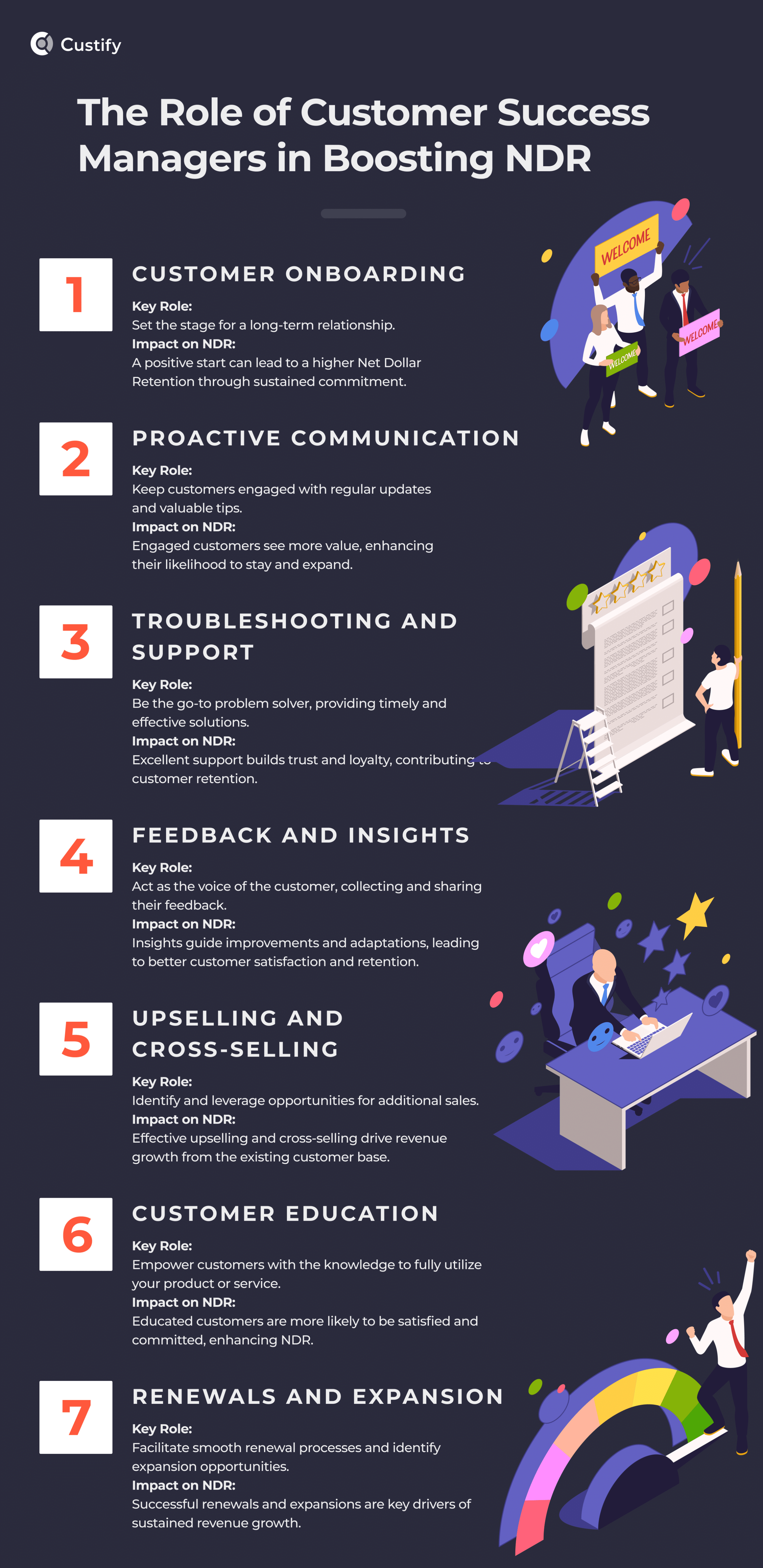

The role of Customer Success Managers in improving NDR

Now, you may wonder where you, the Customer Success Manager, fit into this whole NDR puzzle. Well, you’re not just a piece – you’re the glue that holds everything together.

- Customer onboarding: Your journey begins with the customer’s very first steps. You play a crucial role in ensuring a smooth onboarding process. This sets the tone for their entire experience. A great start can lead to long-term commitment and higher NDR.

- Proactive communication: This is your secret sauce. Regular check-ins, progress updates, and sharing tips and tricks keep your customers engaged. When they see the value in your service, they’re more likely to stick around and expand their usage.

- Troubleshooting and support: When issues arise, you’re the hero who swoops in to save the day. Timely troubleshooting and providing excellent support not only solve problems but also build trust and loyalty.

- Feedback and insights: You’re the ears and eyes of your customers. Gathering feedback and insights on their needs and challenges is vital. This information is gold, as it helps your company improve and cater to customer preferences, which can lead to higher NDR.

- Upselling and cross-selling: As a CSM, you’re in a prime position to identify opportunities for upselling and cross-selling. When you spot the potential for customers to benefit from additional features or services, it can lead to increased revenue and, in turn, boost NDR

- Customer education: Empowering your customers with knowledge is a superpower. Teaching them how to make the most of your product or service not only enhances their experience but also solidifies their commitment.

- Renewals and expansion: The finish line for every customer journey is renewal. Your proactive efforts can make renewals a natural choice. Moreover, by identifying expansion opportunities, you can drive growth in your customer relationships, further improving NDR.

As you can see, if your NDR shines, it’s because of your magic.

What is Net Dollar Worth Retention (NDR) in SaaS

Did you know Net Dollar Retention is also known as Net Negative Churn? It makes sense if you think about it, since the opposite of revenue retention is revenue churn.

Your NDR quantifies upgrades, downgrades, and churn to calculate the amount of returning revenue you generate from current customers over a defined period of time.

‘Isn’t NDR much like customer retention rate?’ – you may wonder like a fine observer.

Well, not quite. Let’s take a practical example.

Say you’ve got 1000 customers paying $10/month to use your product. If you lost 100 of them, your customer base would drop by 10%. Your revenue also. However, if 200 of your existing clients were to upgrade to a $20/month plan, your net dollar retention would go up despite you having lost 100 clients.

Does that make sense?

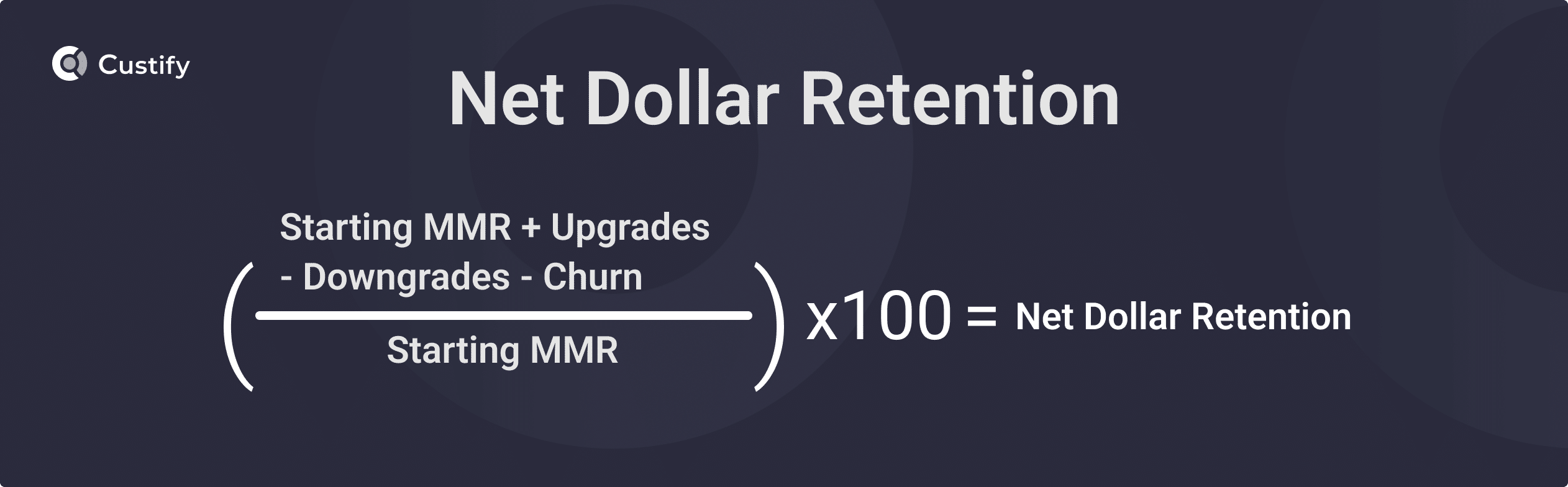

How to calculate your NDR

Now that we’ve seen what the Net Dollar Retention is, let’s take a look at the formula for calculating it.

Let’s give a quick definition of the other metrics necessary for calculating it:

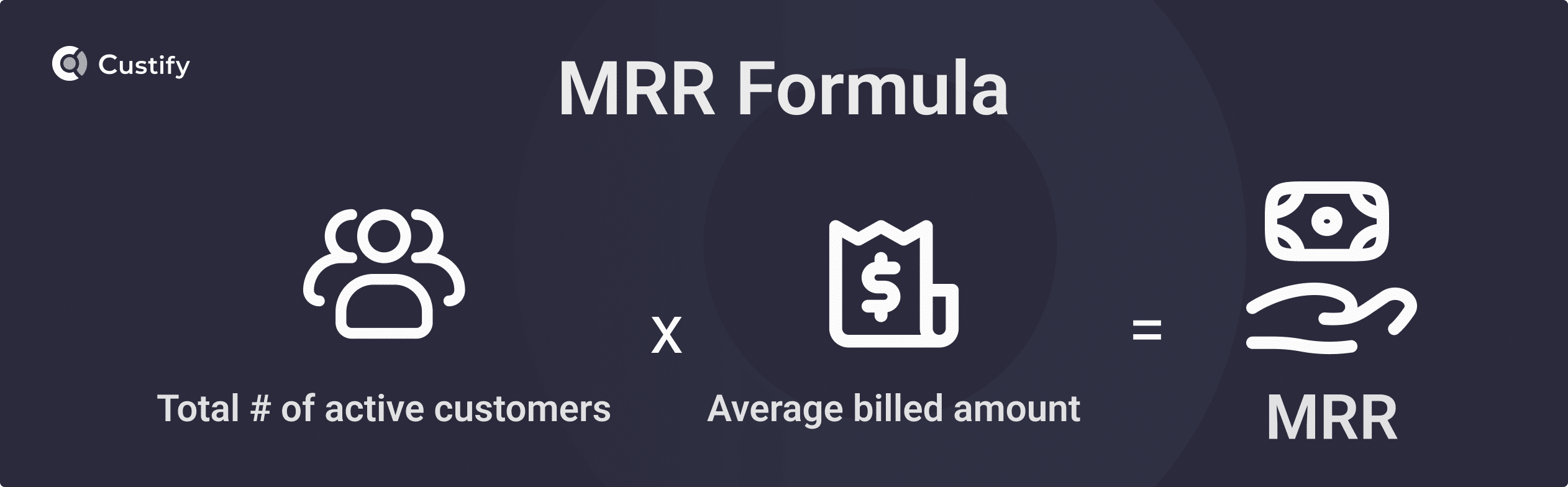

MRR: The estimated amount of recurring revenue your company can generate each month.

Upgrades: All the extra revenue your business makes from upgrades from upsells, cross-sells, and add-ons from existing customers each month.

Downgrades: The loss of revenue caused by downgrades of your existing clients in a month.

Churn: The amount of recurring revenue lost during a month due to cancellations.

Comparison: NDR vs. Net Revenue Retention (NRR) vs. Gross Revenue Retention (GRR)

Net Dollar Retention (NDR) and Net Revenue Retention (NRR): These two are essentially twins. They measure the same thing: how well your company is maintaining and expanding revenue from your current customers. Think of NDR/NRR as a comprehensive health check, considering not just the customers who stay with you (renewals) but also those who choose to spend more (upgrades) or less (downgrades). It’s like looking at a garden and seeing not only which plants are thriving but also which ones are growing new branches.

Gross Revenue Retention (GRR): This metric is like focusing solely on the plants that are just surviving, not necessarily thriving. GRR tells you about the revenue you’ve managed to keep without considering any additional growth from upselling. It’s like making sure none of your plants are dying, but not necessarily checking if they’re blooming or bearing fruit.

In a nutshell, while GRR is all about holding onto what you already have, NDR stretches beyond to include the extra fruits your efforts are yielding. Understanding the difference helps you balance between keeping your existing customers happy and finding ways to make them even happier, leading to more business growth.

The table below features all the key differences between NDR and GRR.

NDR vs GRR

| Aspect | Net Dollar Retention (NDR) | Gross Revenue Retention (GRR) |

| Definition | NDR measures revenue growth from existing customers, including upgrades, cross-sells, and downgrades, but excluding churn. | GRR focuses on the retention of revenue from existing customers, excluding any form of expansion revenue. |

| Components | - Upgrades- Cross-sells- Downgrades | - Retained revenue |

| Excludes | - Churned Revenue | - Upgrades, cross-sells - Churned Revenue |

| Purpose | Indicates overall revenue growth or shrinkage from existing customers, reflecting upselling and expansion success. | Highlights the company’s ability to retain its existing revenue base, focusing on customer satisfaction and loyalty. |

| Interpretation of Values | - Above 100%: Positive growth from existing customers.- Below 100%: Potential issues in expansion or upselling. | - Higher percentages indicate strong retention capabilities.- Lower percentages signal retention challenges. |

| Focus | Growth-oriented, reflecting the company's ability to increase revenue from its existing customer base. | Retention-oriented, assessing the capability to maintain existing revenue streams. |

| Key Influencers | - Upselling and cross-selling effectiveness- Product value and utility- Customer success initiatives | - Customer satisfaction- Quality of product or service- Effectiveness of customer support |

| Strategic Importance | Essential for companies focusing on growth through customer expansion and upselling. | Crucial for businesses prioritizing customer retention and minimizing churn. |

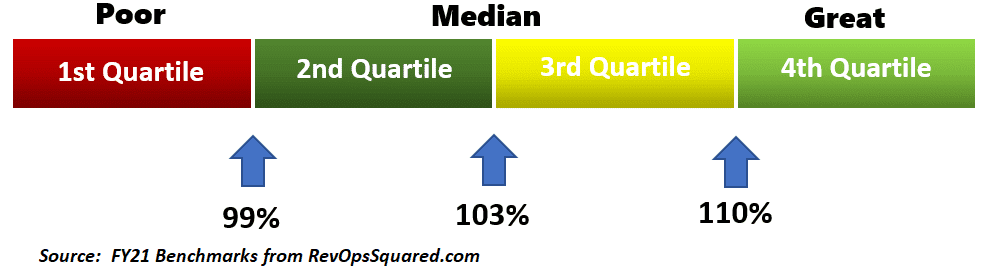

What’s the benchmark for a good Net Dollar Retention rate?

Now that we’ve got a handle on what Net Dollar Retention (NDR) is and how crucial it is for your SaaS business, the big question remains: What is a good NDR for SaaS? In other words, how do you know if your NDR is hitting the right notes or needs a little fine-tuning?

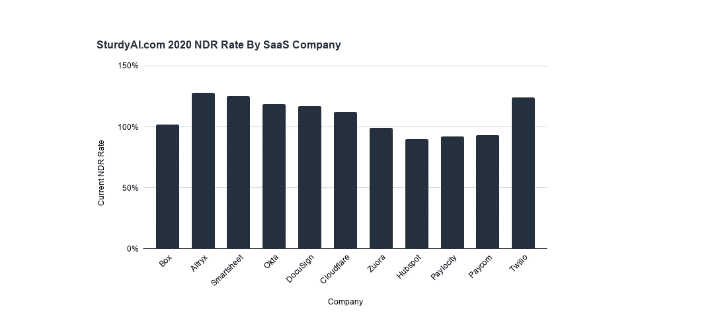

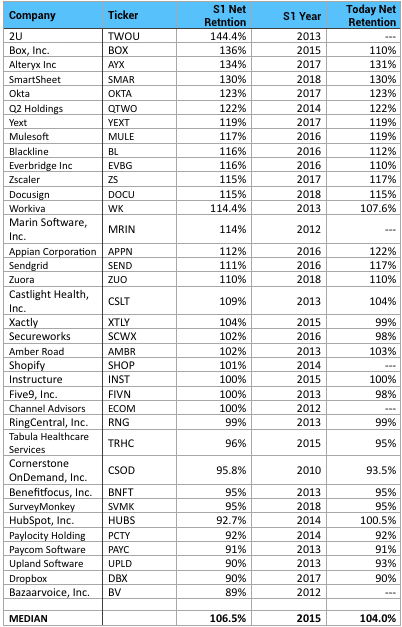

As a rule of thumb, the bigger your NDR percentage, the better for your business. A 100% NDR score means that your SaaS growth is stalling. Everything below the 100% mark indicates a loss, while numbers above that show you’re heading in the right direction. But how do those big SaaS players fare in this department? Well, see for yourself in the graph below. The numbers are a bit old, but they’ll give you a good starting point for getting an idea as to where your numbers are sitting.

We also found it interesting to examine the NDR of publicly traded SaaS businesses at the time of their IPO.

As you can see, public listings can happen even with an NDR score in the low 90s. However, we’ve got little doubt that companies such as Dropbox or HubSpot had other things going for them.

Real-world implications of NDR on SaaS business health and growth

Alright. You now know what your NDR is and how to calculate it. However, what good does that do if you don’t know what insights to draw from it?

So, let’s take a look at some of the takeaways you can draw from your NDR:

- Firstly, your NDR paints a great picture of the impact of your onboarding and customer success department. Customers tend to stick around when they feel welcomed, understand your product inside out, and have a trusty account manager holding their hand throughout their journey. That’s why NDR/NRR is the ultimate metric for tracking your onboarding success.

- Next, your NDR also acknowledges your team’s innovation. If they’re doing a good job, your NDR should increase whenever you roll out exciting new features or introduce improved product versions. That’s a sign that your customers are ready for more.

- Moving on, your NDR is directly proportionate to your customers’ satisfaction. It’s like a standing ovation from your customers. It tells you that they’re not just sticking around; they’re falling in love with your product. They might be upgrading plans, adding more users, and basically investing more.

- As we’ve shown in one of our hypothetical examples above, your NDR can go up while your customer retention rate drops. So, what does that mean? This could suggest those users had already decided to leave you no matter what. However, that doesn’t mean you shouldn’t investigate further. Reach out to them with some email surveys to uncover why they’re leaving you.

- Finally, your NDR could also give you valuable insights about your product’s price tag. If it’s too high, customers might downsize or pause more often. If it’s too low, they might see it as less valuable and forget they’re even subscribed. Finding that sweet spot is crucial, especially in a world where budgets and preferences can change in the blink of an eye.

Fun Fact: Publicly traded companies with higher Net Dollar Retention rates also have higher market valuations, according to Software Equity Group.

So, keep an eye on NDR – as you can see, it speaks volumes about your business’s journey to the stars.

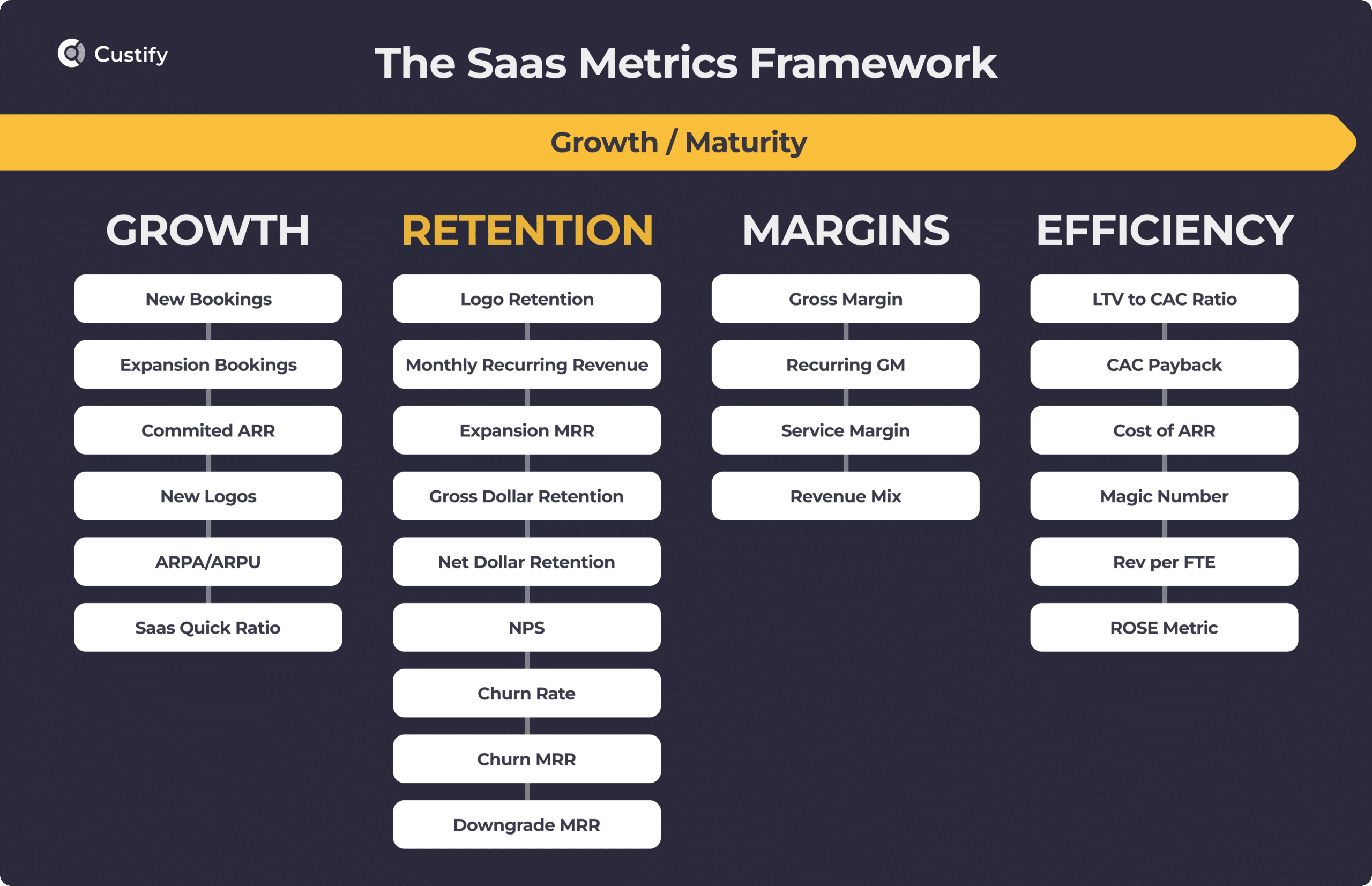

NDR in relation to other SaaS retention metrics

There has been much discussion of upsells, cross-sells, churn, and renewal, so let’s examine how the key customer success metrics related to them compare to the NDR. To do so, a definition for each of them is in order.

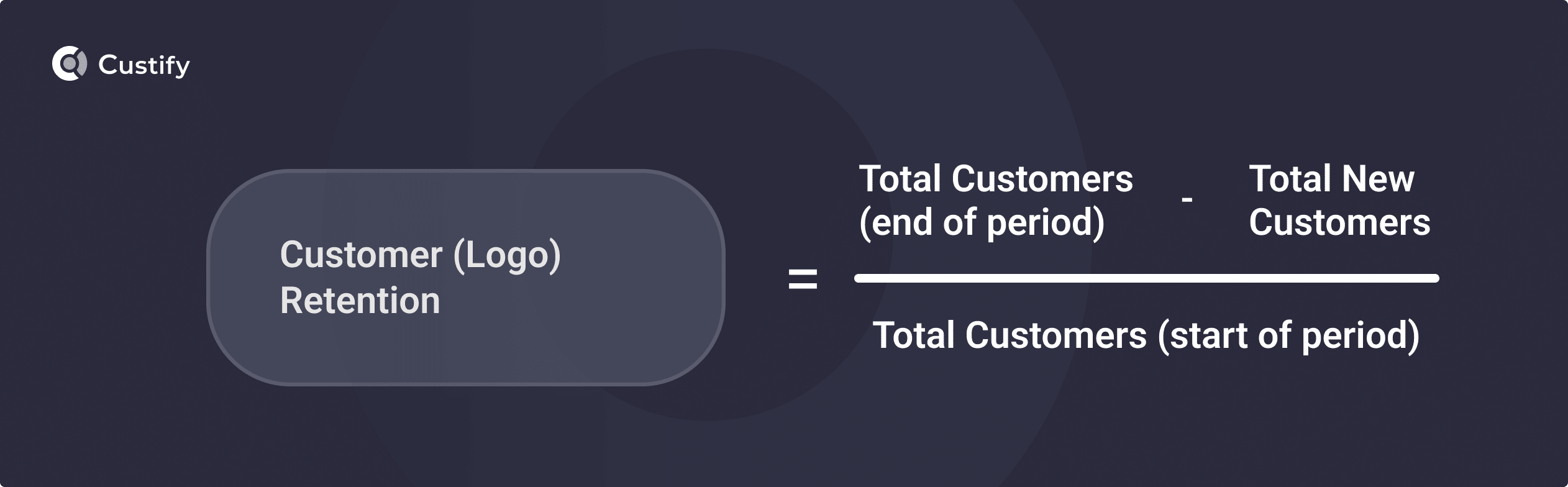

Logo retention represents the percentage of customers who renewed their subscription out of those due for renewing in a specific period.

Monthly recurring revenue is the predicted recurring income made from existing customers every month.

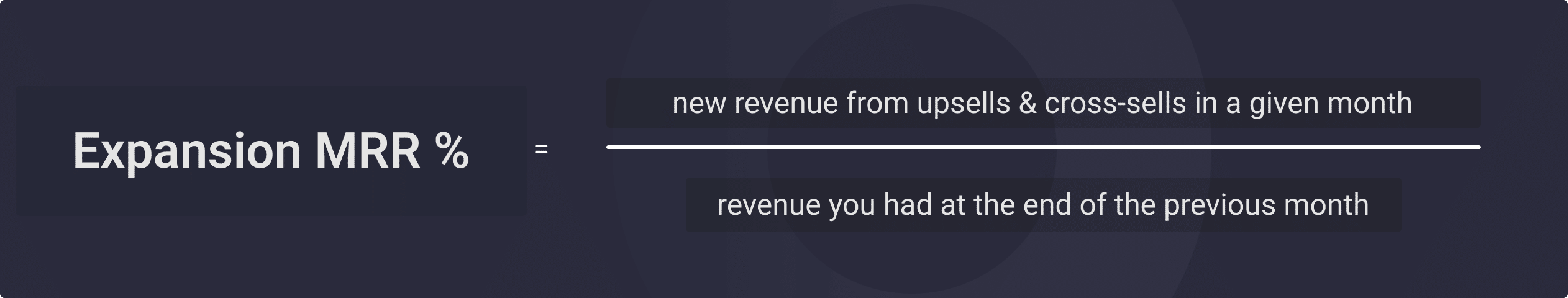

Expansion MRR refers to the MRR generated by existing users who decide to upgrade or add extra services or features to their existing product.

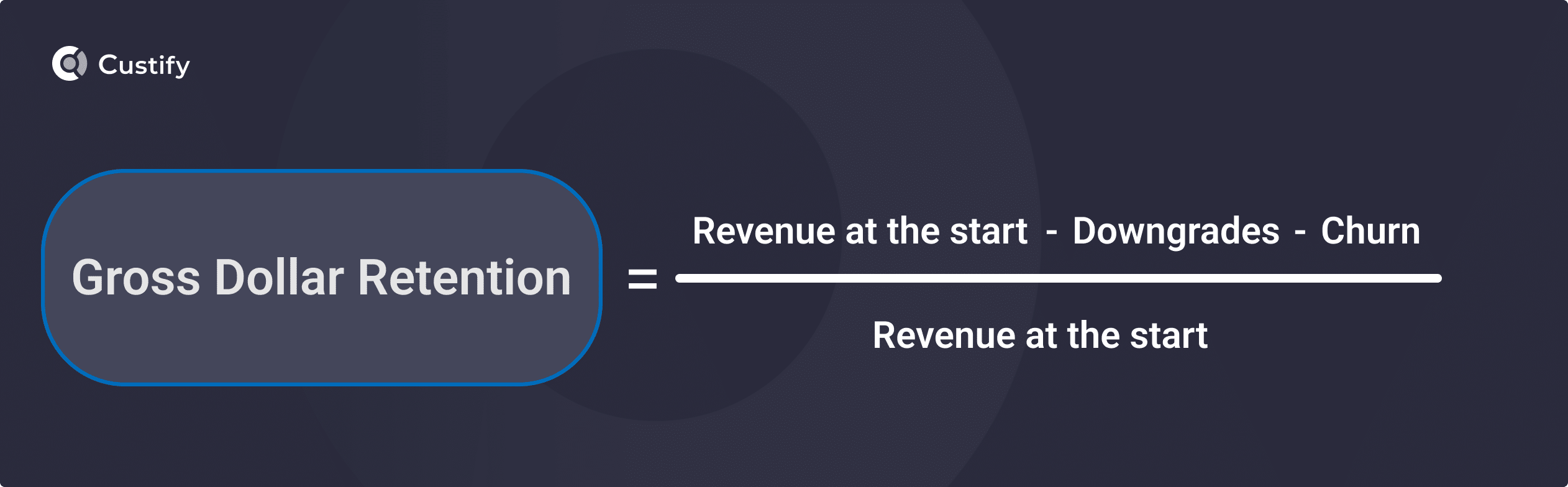

Gross dollar retention measures the revenue retained from existing customers over a given period of time. This metric also factors in how much you lose due to churn and downgrades and also how much you gain from upsells and expansions.

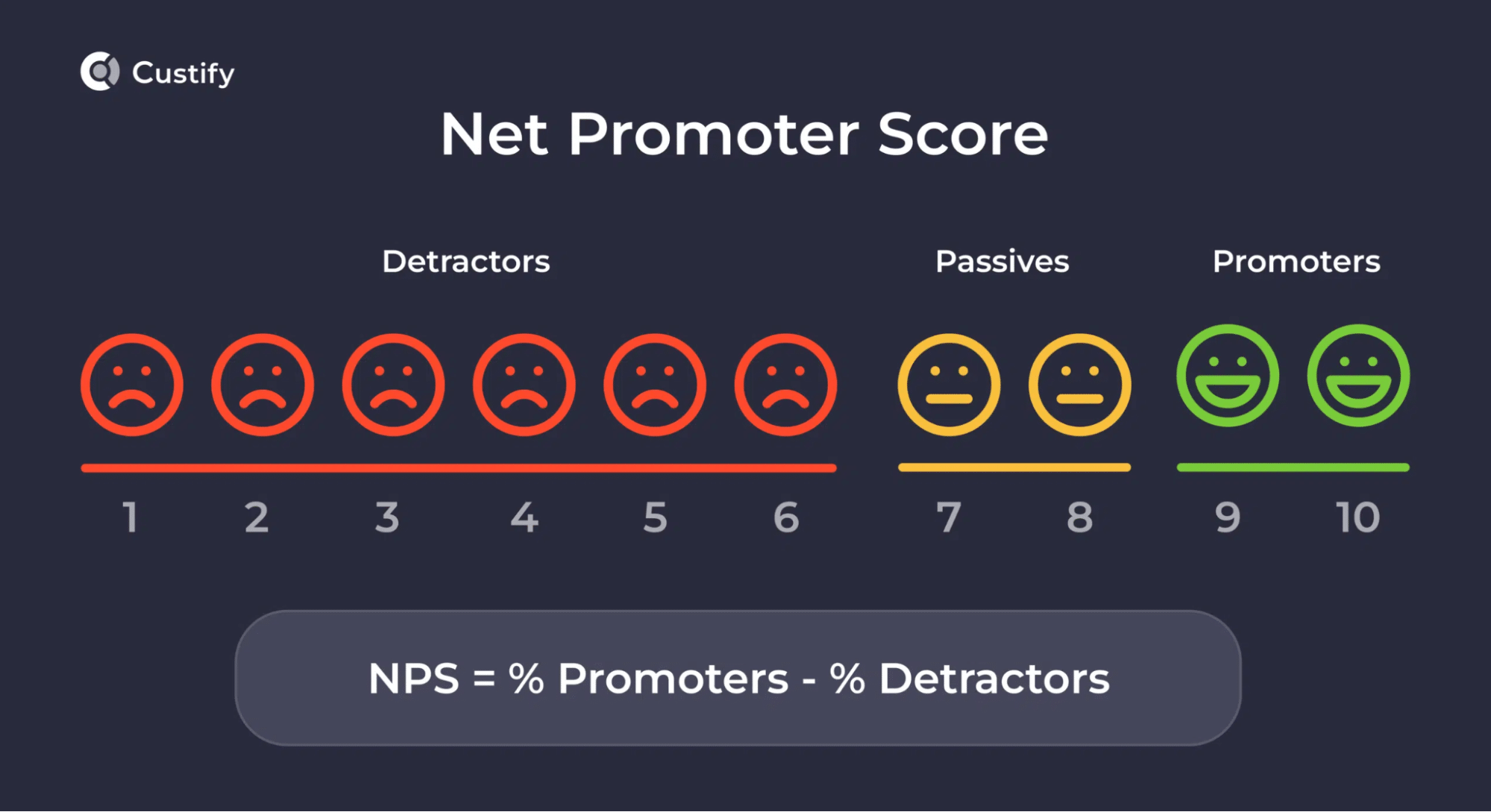

NPS is a metric that measures the satisfaction and loyalty of your customers. To calculate it, you’ll need to split your users into 3 separate groups: detractors, passives, and promoters.

Detractors are those who score 6 or less on your NPS surveys. Passives are those that rate you with 7 or 8. And finally, promoters are those who hold you in their highest regard.

Churn MRR is how much you lose every month due to cancellations.

Churn MRR = (MRR of lost customer #1 + MRR of lost customer #2 + …)

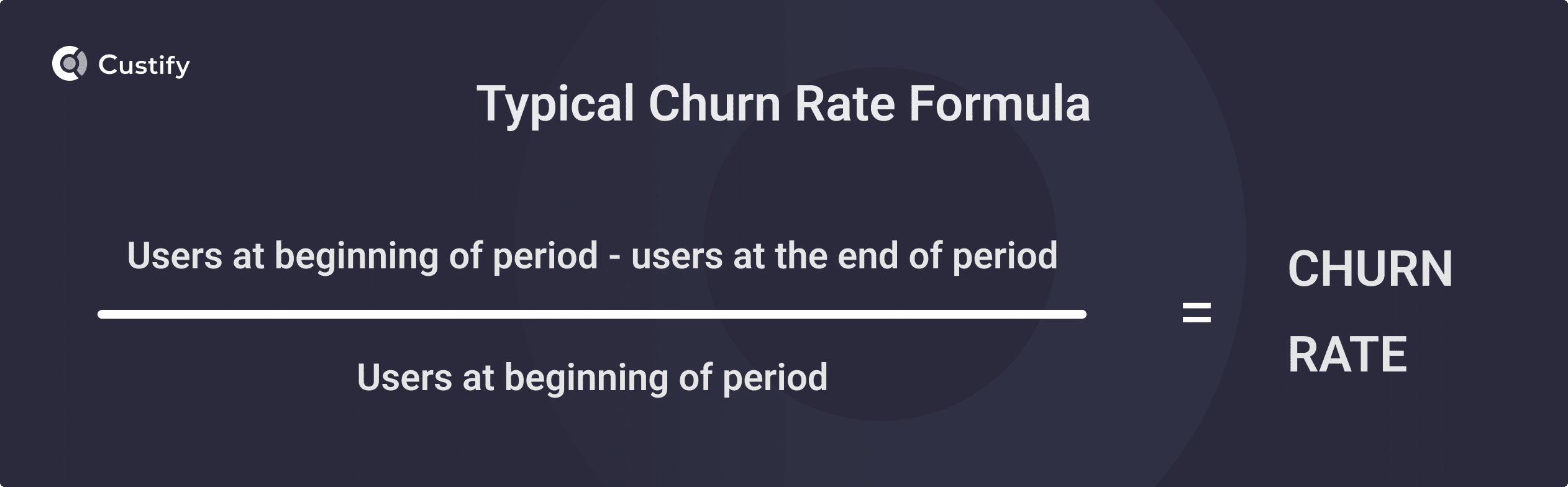

Churn rate is like measuring the tempo of your customer losses. It quantifies how many customers a company loses during a specific time frame, such as a year or a quarter.

Churn budget is the equivalent of setting aside some funds to cover potential losses within a certain time period. It’s like having a financial safety net to handle customers who decide to leave.

Downgrade churn (or downgrade MRR) is when a customer downsizes their order but doesn’t completely leave you. For example, they might reduce their user licenses, but they’re still sticking around in some capacity. Some also call this “erosion.”

Addressable churn is like spotting a leak in a boat and knowing you can patch it up. It’s customer loss that happens due to issues like insufficient support, product fit, or adoption problems. This type of churn is considered preventable because your company can take action to fix the issues and retain the customer.

Non-addressable churn is like a customer slipping away when you’ve done all you can to keep them on board. It’s customer loss that’s typically beyond your control.

While each of these retention metrics is important, none of them gives you a birds-eye view of how your SaaS performs overall (as is the case for the NDR).

How to Improve your Net Dollar Retention (NDR) – Best Practices

Achieving a healthy NDR is a top priority for SaaS businesses. The goal here isn’t to keep the business afloat – it’s about taking it to new heights.

As a Customer Success Manager, you are the linchpin of customer satisfaction and the driving force behind your SaaS business’s NDR. Your role involves an intricate dance of balancing customer needs, product utilization, and churn mitigation.

So, let’s dive in and see some of the best ways of improving NDR from a CS perspective:

1. Increase focus on expansion and customer retention

Improving Net Dollar Retention (NDR) in SaaS hinges on two critical strategies: monetization of existing customers and maximizing retention.

Many SaaS companies miss out on the revenue potential within their existing customer base. This is where a ‘land-and-expand’ model comes in handy. It involves your customer success teams actively promoting new features and functionalities, aiding customers in realizing more value from your product and spotting opportunities to expand their use. It’s a proactive approach to customer relationship growth.

Fact to ponder: “The best SaaS companies grow over 30% in revenue from their customer base alone. – Simon Kucher”

Effective retention strategies do more than prevent churn; they create conditions for customer expansion. Retaining customers lays the groundwork for expansion efforts, ensuring a stable base from which to grow. This focus on keeping current customers satisfied and engaged is a cornerstone of maintaining and enhancing NDR.

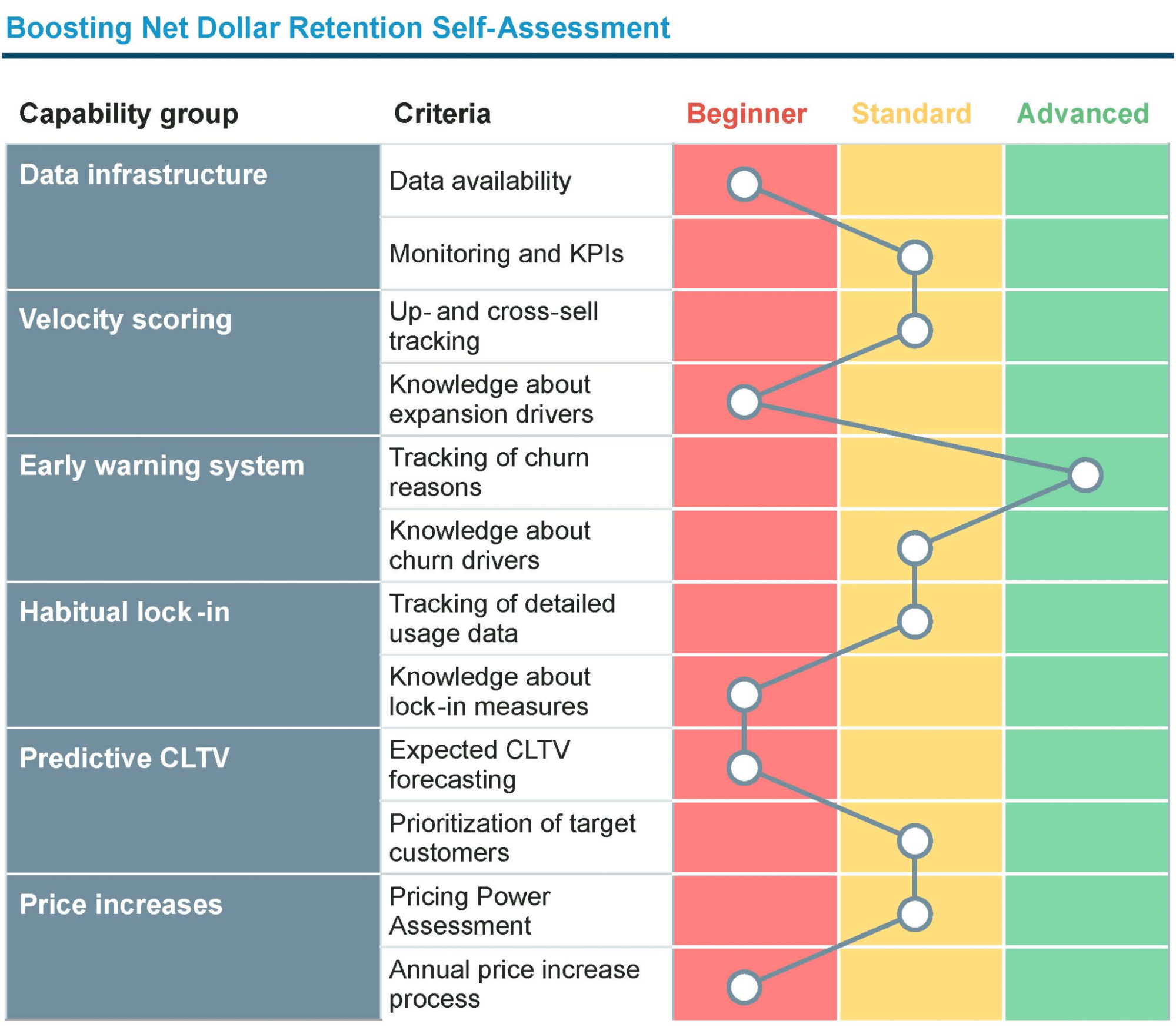

Assess Your NDR Maturity

Understanding your current position on the NDR maturity scale is crucial to excel in these areas. This NDR self-assessment chart by Simon Kucher helps determine your company’s position in customer base management. It highlights areas for improvement in account expansion and retention.

2. Know your customers’ needs and pain points inside out

A thriving SaaS is a SaaS that knows its customers on a profoundly intimate level. Knowing your customers doesn’t mean personalizing emails by including their first names. It’s about getting familiar with their desires, motivations, dreams, aspirations, pain points.

So, how does one do that?

Well, there are multiple research methods for getting to know your audience, some of which we’re going to list below.

- Customer Interviews

The journey begins with direct and meaningful conversations. Engage your customers in comprehensive interviews that go well beyond the surface. Be bold and ask the tough questions. What are their business goals? What challenges do they face daily? How does your product fit into their grand vision? These interviews are your backstage pass to their world, and the insights you gather will shape your customer success strategies.

- Follow the data trail

Data analytics will give you some of the best clues in the quest to uncover your customers’ mysteries. Dive deep into user behavior, examining their interactions with your product. What features do they use most, and which ones do they rarely touch? Look for patterns that reveal where they might be facing obstacles or experiencing success. By examining these data points, you can tailor your support and guidance to address specific pain points.

- Develop a feedback loop

Understanding your customers isn’t a one-and-done job; it’s an ongoing relationship. Implement a robust feedback loop, encouraging customers to provide input regularly. Use surveys, feedback forms, or even quick check-in calls. This constant dialogue ensures that you stay attuned to evolving needs and can adapt your strategies accordingly.

- Start mapping your user’s journey

It’s not enough to know where your customers stand today; you need to see the path they’ve walked. Develop detailed customer journey maps that trace their interactions from onboarding to their current stage. These maps reveal the critical touchpoints where customers may feel delighted or frustrated. By mapping their journey, you can strategically enhance each interaction, ensuring a positive experience.

- Check-in with your support team

Perhaps one of the best ways to familiarize yourself with your customer’s pain points is to analyze the tickets coming into your support team. These tickets are like treasure chests of information, containing valuable clues about where your customers are encountering challenges, what frustrates them, and how you can address these issues.

Besides the frustrations laid out by your customers, these tickets may also offer you valuable clues for potential product improvements. Whether it’s a recurring error message, a frequent feature request, or a common issue that customers encounter, these patterns offer clear directions for enhancing your product.

3. Segment your customer base

Now that you’ve put in the hours and gotten to know your customers like the back of your hand, it’s time to move on to the next level: start segmenting your audience. This is where your journey towards boosting your SaaS business’s Net Dollar Retention takes a fascinating turn. You see, segmentation isn’t just about dividing your customer base; it’s about tailoring success for every want and need of your customer base.

Let’s take a hypothetical example of how segmentation can lift that NDR score. Imagine a SaaS that embraced segmentation. Upon analyzing their customer base, they identified three distinct segments: startups, small businesses, and big corporations. As you can imagine, the needs (and resources) of a startup or a small business are significantly apart from those of a big corp.

After further investigation, the SaaS decided on separate approaches for each of these segments:

Startups: Recognizing the need for affordable solutions and rapid onboarding, the company streamlined its onboarding process, created new budget-friendly plans, and offered 24/7 chat support.

Small Businesses: Because this segment sought both affordable plans and scalability, the company introduced tiered pricing options and a dedicated account manager for personalized support.

Big Corporations: The research revealed that these large enterprises value customization and integration, so the company decided to allocate resources and build tailor-made solutions, dedicated customer success teams, and API integrations.

Now, this is a purely hypothetical example, but you can see how this approach would help improve customer satisfaction, leading to a higher NDR and, possibly, an influx of referrals from delighted customers.

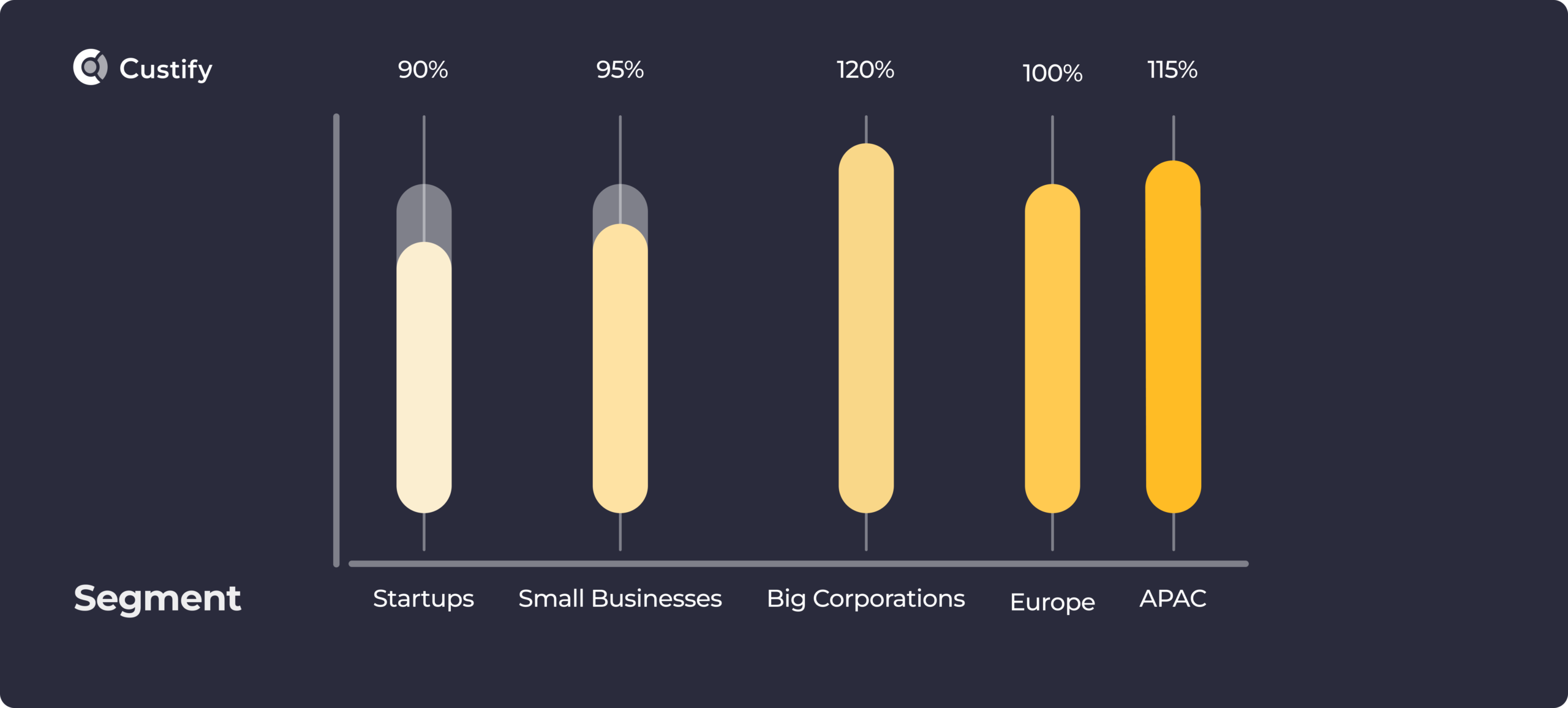

Another important aspect to consider when segmenting your user base is how each segment contributes to your NDR.

Let’s take the example above and see how you could create a graph based on hypothetical data.

Since we’ve already established what our three segments are, the second step would be to calculate the NDR for each of them. Let’s assume the results are those you see below.

NDR score

| Segment | NDR score |

| Startups | 90% |

| Small Businesses | 95% |

| Big Corporations | 120% |

| Europe | 100% |

| APAC | 115% |

Now, here’s how your graph will look based on these values.

Putting together this type of graph helps you see the segments experiencing growth (NDR > 100%), those that are stable (NDR~100%), and those that are on the downfall (NDR<100%).

4. Use in-app marketing to improve account expansion

For one reason or another, some SaaS companies refuse to upsell or cross-sell to their audience. Because they don’t want to seem pushy, they leave money on the table.

Here’s the thing about us, people. We love to buy things. Yet we hate being sold to. The difference is subtle, but getting this right can make all the difference for your SaaS.

Let’s expand on the topic.

Consider a startup that stumbles upon your app. They’re looking for ways to streamline their operations and boost productivity. When they come across your product, they’re not just making a purchase; they’re investing in their vision for growth. This act of ‘buying’ empowers them. It’s a decision they make to advance their business independently.

Now, imagine the same startup exploring your competitor’s product. The competitor employs aggressive sales tactics, pushing the startup into a corner with constant calls, emails, and pressure to make a decision. In this scenario, the startup feels ‘being sold’ rather than ‘buying.’

Customers today are savvy and independent. They have access to a wealth of information and options. When they sense a pushy sales approach, it triggers resistance and skepticism. They may even perceive the product as less valuable due to the aggressive tactics.

Armed with this information and with the knowledge you have of your customer’s wants and needs, putting together successful account expansion campaigns shouldn’t feel like pulling teeth.

Remember, all you’re doing is offering users a way to achieve their goals in a faster/ easier/ cheaper/ etc. way.

Now, let’s take a look at some tactics to help you get your message out to your customers.

Show users what they’re missing out on

Once again, Human Behavior 101 says we don’t like to miss out on things. We don’t want to feel left out. That’s why some good old FOMO (fear of missing out) is often all you need to get users to pull out their credit cards and throw more money at your SaaS.

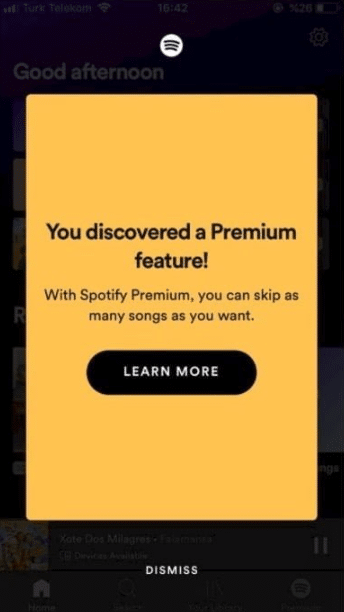

A good tactic for distributing these messages is through modals. The upsell modal is triggered when a user wants to perform an action that isn’t available with their current plan.

But don’t stop here. Users about to churn may be convinced to stay by highlighting the beloved features they’ll no longer have access to. However, to discover those features, you’ll need to put on your detective hat and look at your product usage analytics. Pull out the most used features and build your messages around them.

Remember to stay moderate with these messages. People don’t like being sold to, and pestering them with in-app messages won’t help your case.

Leverage contextual in-app messages

In-app messages are notifications sent to users of your app. Like modals, you can assign certain triggers for them to appear. And just like modals, they’re most effective when they’re adapted to the user behavior.

These messages provide users timely guidance and information while interacting with your product, nurturing their experience and fostering engagement. Here are real-world examples of how in-app contextual messages can make a significant difference in improving NDR:

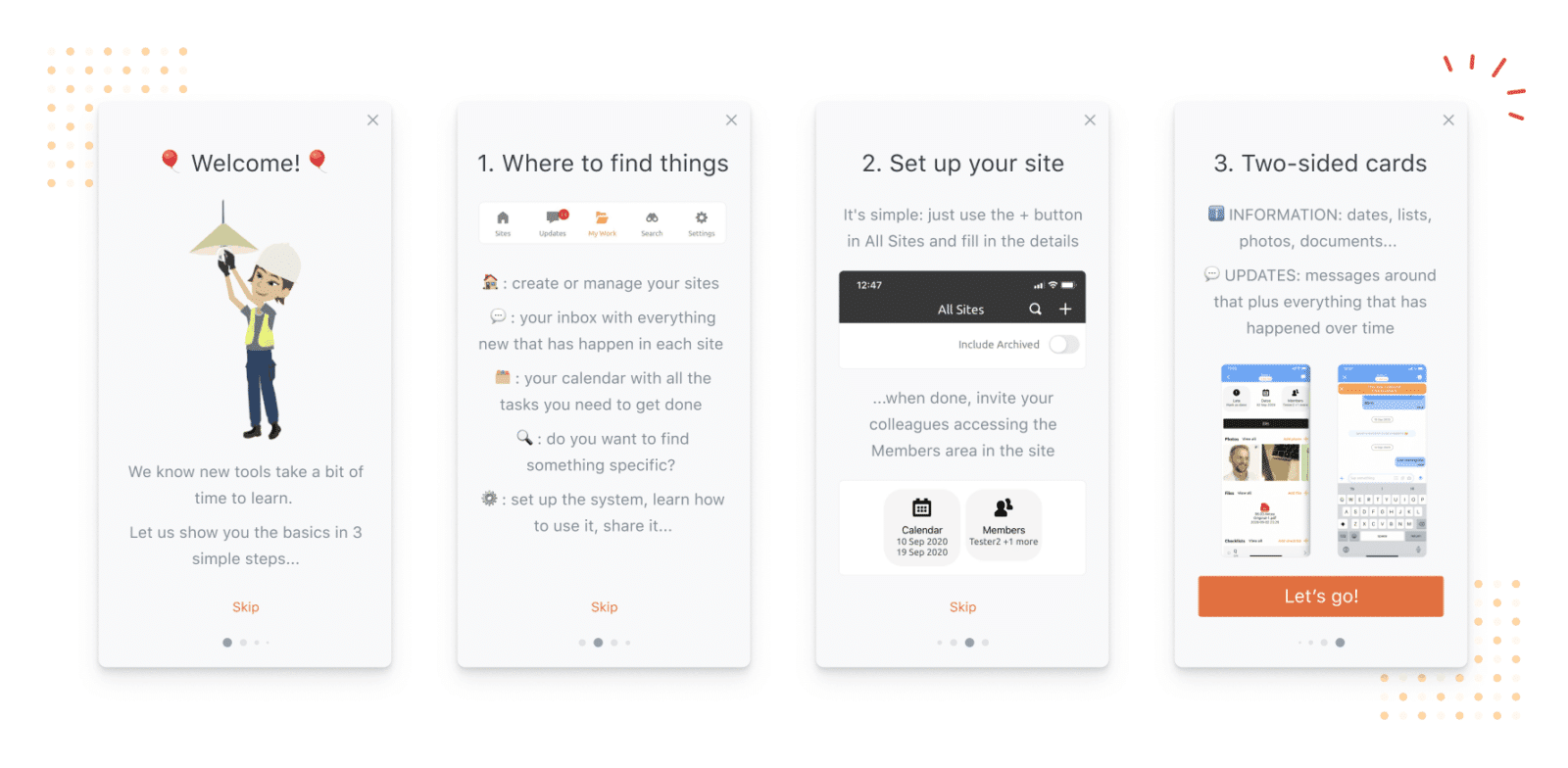

a) Onboarding and feature adoption:

Consider a scenario where a user, Jane, just signed up for your SaaS platform. She’s exploring the dashboard and has yet to discover some key features. An in-app contextual message pops up, saying, “Welcome, Jane! Did you know you can automate tasks with our ‘Smart Workflow’ feature? Click here to learn more.”

Source: OneSignal Case Study – Ogun

Impact on NDR: In-app messages that guide users during onboarding and highlight features they might have missed can accelerate their understanding and utilization of your product. This boosts satisfaction and makes them more likely to stay and expand their usage.

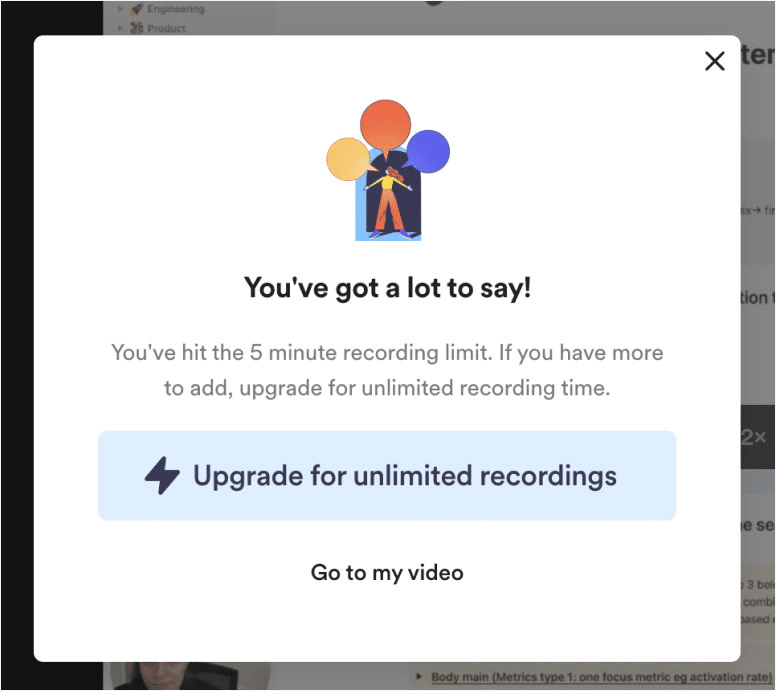

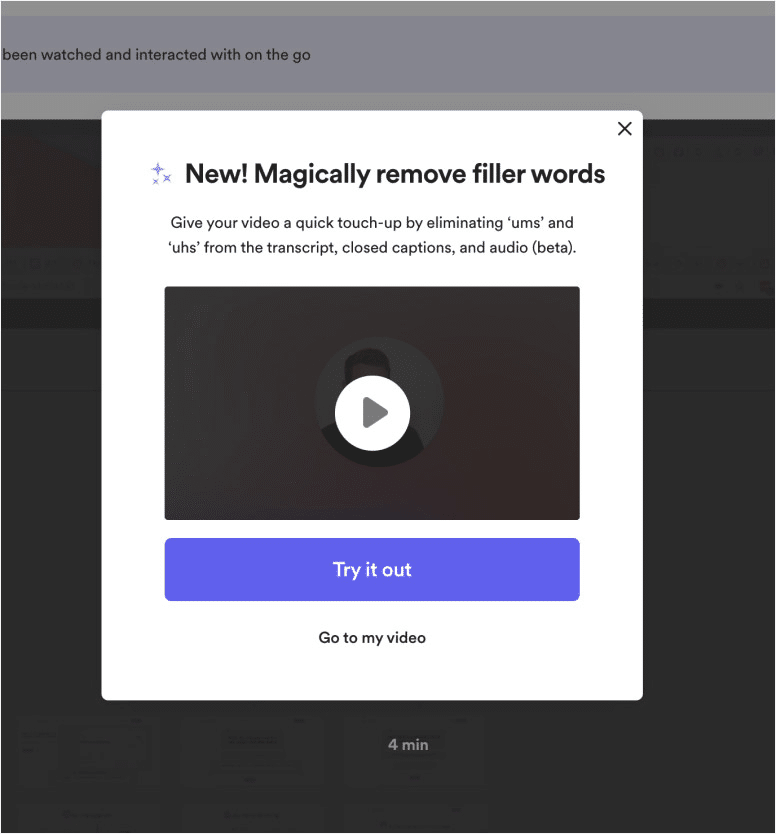

b) Upgrade opportunities:

Now, let’s take John, an existing customer. He’s been using the basic plan but hasn’t explored the premium features. An in-app contextual message appears, saying, “Unlock advanced capabilities with our Premium Plan. Click here to learn how it can benefit you.”

Source: Loom

Impact on NDR: In-app messages that present upsell opportunities to existing customers can lead to plan upgrades, expanding their investment in your SaaS product and increasing their lifetime value. This directly contributes to NDR improvement.

c) Proactive issue resolution

Maria encountered an error while using your SaaS application. She’s frustrated but unsure about what to do about it. An in-app contextual message appears: “Hi Maria, we noticed you’re having trouble. Click here to chat with our support team for immediate assistance.”

Impact on NDR: In-app messages that provide immediate support or direct users to relevant resources can prevent churn. By addressing issues proactively, you demonstrate your commitment to customer satisfaction and retention.

d) Feature discoverability

Dave’s one of your oldest customers. However, he’s completely clueless about a recent feature enhancement that could make his job a lot easier. A contextual message in the app gently informs him, “Dave, we’ve just introduced ‘Quick Reports’ for faster insights. Check it out here.”

Source: Loom

Impact on NDR: In-app messages that educate users about new features or improvements keep them engaged and interested in your product. This continuous learning encourages them to stay and explore further, increasing NDR.

5. Reduce churn

Churn. This word alone sends shivers down the spine of every Customer Success Manager and SaaS business. It’s the haunting specter that keeps customer success managers awake at night. Churn is to SaaS businesses what Joker is to Batman – a formidable nemesis, constantly testing your mettle and pushing you to improve. Reduce churn, and your entire business will profit, not just your NDR.

Let’s see some of the tactics you can deploy to reduce churn and improve NDR:

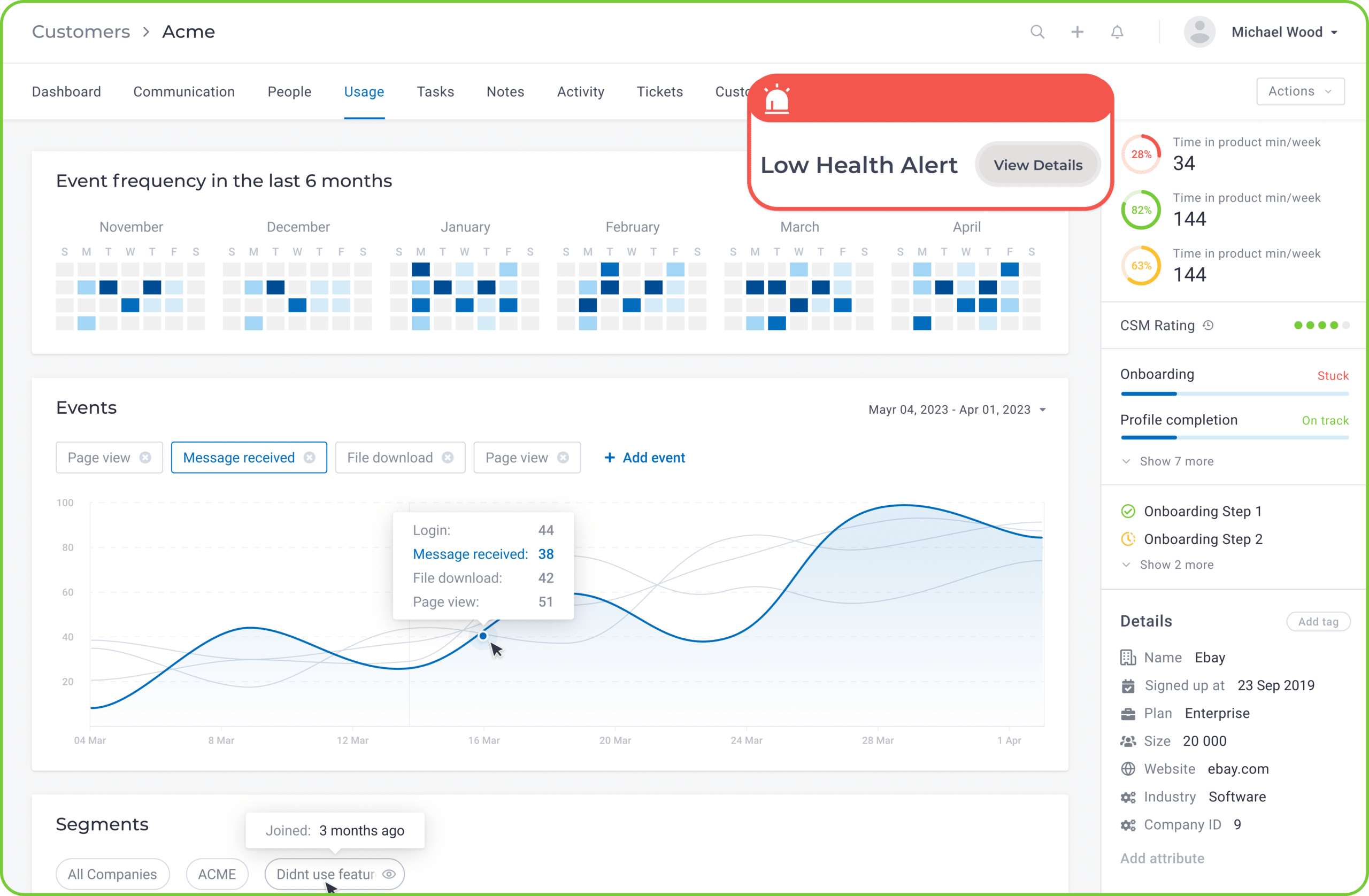

a) Use custom triggers and health scores to keep track of at-risk accounts

Certain actions of your users should be considered red flags. Once again, you need to dive deep into your product analytics to uncover them. These red flags can be specific usage patterns, support ticket frequency, lack of interaction with your emails, or inactivity. Once you figure out what they are, start setting up triggers that tell you an account is at risk of churning.

Now, what about health scores? In a nutshell, these scores mirror the well-being of each customer account. To evaluate your customer health scores, you need to factor in a series of components such as product engagement, support interactions, billing history, or usage trends.

Custom triggers and health scores act as your first response line against churn. By monitoring and addressing potential issues before they escalate, you can rescue at-risk accounts and strengthen customer retention.

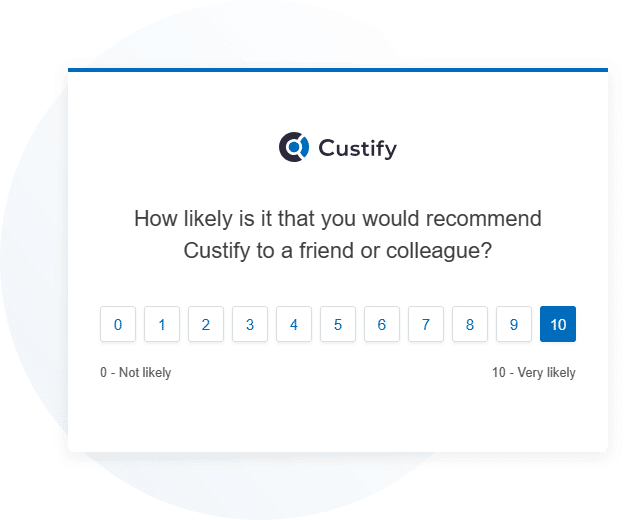

b) NPS surveys

It’s hard to fathom that a question as simple as ’How likely are you to recommend us to a friend or colleague?’ can tell you everything you need to know about your user’s feelings and loyalty to you.

As you can see, users rate your services on a scale of 1 to 10. Answers below 6 should deeply worry you, while those who give you a 9 or 10 are your most loyal customers and brand advocates.

Pro tip: One of the biggest mistakes some SaaS companies make when sending NPS surveys is not following up with a qualitative question. So, once users are done rating you, hit them with another question that asks them to explain why they gave you that score. The responses provide insights into customer sentiment and pinpoint areas to improve.

c) Analyze the impact of onboarding and customer success departments

We’ve said it once, and we’ll say it again – customers who feel welcomed, who understand how to make the most of your product or service from Day 1, and who know they’ve always got someone to help them out on the other side, will stick around your business.

Analyzing the onboarding process helps identify potential bottlenecks or confusion points. By addressing these issues, you can streamline the path to value for your customers, reducing frustration and churn.

After the onboarding process, it’s up to your customer success department to make users feel valued and cared for.

Regular check-ins, progress updates, and sharing best practices keep customers engaged with your product. Effective customer success teams also provide responsive support, helping customers overcome challenges.

So, how do you know if your onboarding process and customer success departments are doing a good job? You look at your NDR’s evolution. If it’s going upward, they’re doing a good job. If the opposite holds, they may be resting on their laurels, and you need to shake things up.

d) Track your feature rollouts and product acceptance

New features or enhanced product versions are not merely a matter of novelty – they’re strategic decisions that have a significant impact on your NDR. Let’s see why.

Ideally, a feature rollout addresses a customer’s needs pain points, or aligns with the current market trend. Each rollout is a unique opportunity to inject new value into your product. As long as you tick these boxes, your customers should perceive these additions as beneficial and aligned with their goals, making them more likely to continue their subscriptions.

Besides improving your customer retention, these new features should also help address churn. Think about it: customers are less motivated to explore alternative solutions when your product already satisfies all their needs.

You can probably see why the NDR is both judge and jury when it comes to feature rollouts and product acceptance. Successful rollouts result in customers staying and expanding their usage, contributing to sustained NDR growth.

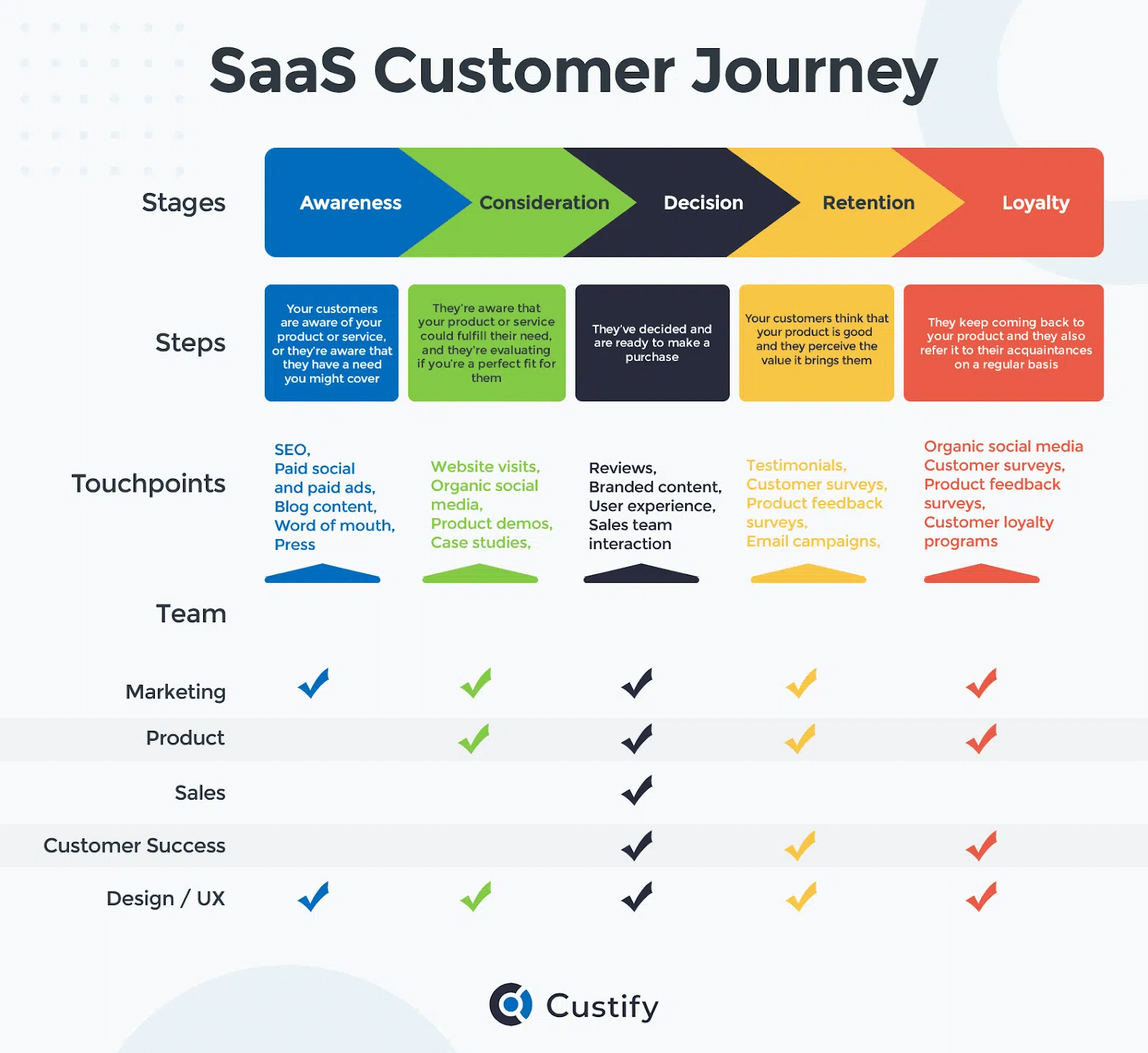

6. Invest in a Customer Success Software to improve customer journey

Did you know that 80% of customers say that the experience you provide is just as important as your product? People forget what you said, but they never forget how you made them feel. So, how do you improve Customer Experience? Well, one way to do it is to start mapping out the journey from prospect to customer of your paying users. In doing so, you’ll be able to provide better support and guidance to every pre- and post-purchase interaction.

Now, one of the best tools to help you visualize and understand your customer journeys is called touch point mapping. Touchpoints are specific moments or channels where customers engage with your company’s products, services, or brand.

If you use a customer success platform, you can easily identify these touchpoints by tracking Lifecycle and Customer Journey phases. By clearly explaining all the interactions between your company and your customers, you can identify the crucial moments when your customers engage with your brand.

These “moments of truth” are the critical interactions that significantly influence a customer’s perception of your business. They can include the first time a prospect visits your website, the support they receive during a problem, the seamless onboarding experience, or the post-purchase engagement.

Identifying and improving these important moments allows you to create a positive and memorable experience for your customers, ensuring that their journey with your company is memorable for the right reasons.

Touchpoint mapping is not just about understanding customer interactions; it’s also about personalizing and customizing the experience. With a comprehensive view of all touchpoints, you can tailor your messaging, support, and engagement to meet individual customer needs.

This level of personalization is made even more effective with a Customer Success Software. Leveraging data-driven insights from touchpoint mapping, you can send targeted messages, recommend relevant products or features, and provide timely assistance. This personalized approach not only boosts customer satisfaction but also increases the likelihood of upselling, cross-selling, and retaining loyal customers – thus ultimately increasing your NDR.

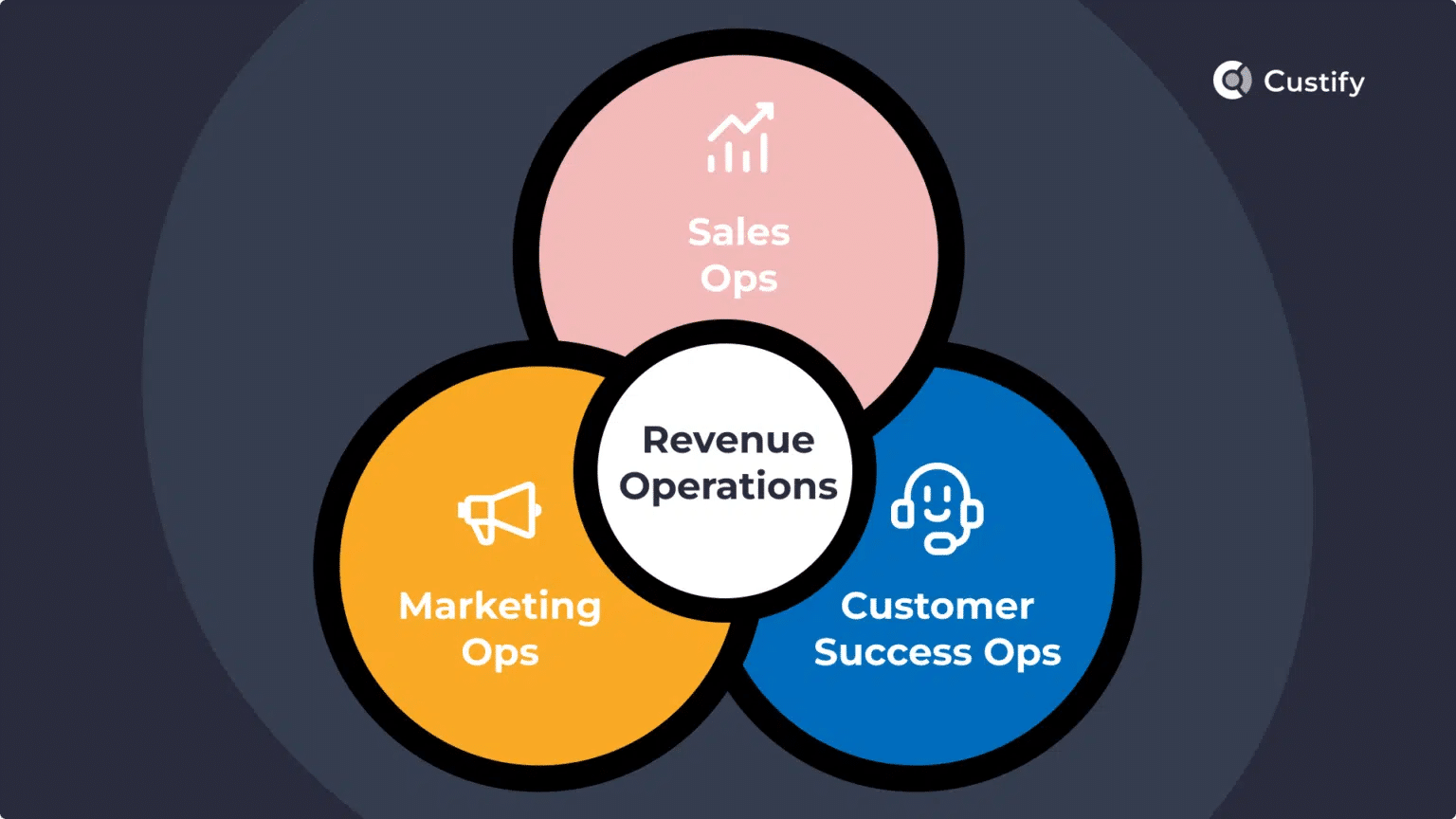

7. Unify all revenue operations

A strategy that often goes unnoticed brings forward the concept of a unified revenue operations team comes into play. By bringing together various departments, including sales, marketing, finance, product, and customer success, under a single umbrella, companies can greatly enhance their NDR performance. Let’s look at what this unified approach would bring to the table.

Firstly, a unified revenue operations team fosters an environment of seamless data sharing and collaboration. When sales, marketing, finance, product, and customer success teams work in silos, essential information often gets trapped within each department.

Businesses can gain a comprehensive view of customer interactions and financial data by sharing data across teams. This transparency helps to calculate NDR more accurately, gain in-depth customer insights, and better understand the impact of different strategies on NDR.

Next, we also need to consider how this would beneficially impact the alignment of those customer-centric goals across the revenue operations team. When sales, marketing, product development, and customer success teams operate independently, they may pursue different objectives and metrics.

However, a unified revenue operations team can align these departments with a common goal: ensuring a remarkable customer journey. This alignment is crucial for fostering customer loyalty, mitigating churn, and elevating NDR as it unites all departments in their efforts to meet customer expectations and consistently provide valuable experiences.

When everyone is on the same page, creating clear messages and providing a smooth customer experience becomes much simpler. This consistency enhances customer satisfaction and reduces the likelihood of customer confusion, frustration, or churn due to misaligned expectations.

The benefits of this approach would be felt across the product development team as well. With real-time insights into customer needs and pain points, the product team can prioritize updates and innovations directly impacting NDR. Businesses can increase customer satisfaction, usage, and NDR by addressing customer challenges and continually enhancing the product.

Let’s also take a minute to consider the impact this approach would have on the decision-making process. By sharing data and insights across departments, businesses can make informed choices that contribute to NDR growth. For example, finance teams can assess the financial health of customer accounts, while marketing can target high-value customer segments, and customer success can proactively address potential churn risks.

A cautionary tale of bad NDR reporting

If there’s one metric that can assess the fiscal well-being of a SaaS – it has to be the NDR. That’s why investors who are keen to determine the worth of a company’s IPO pay extra attention to it.

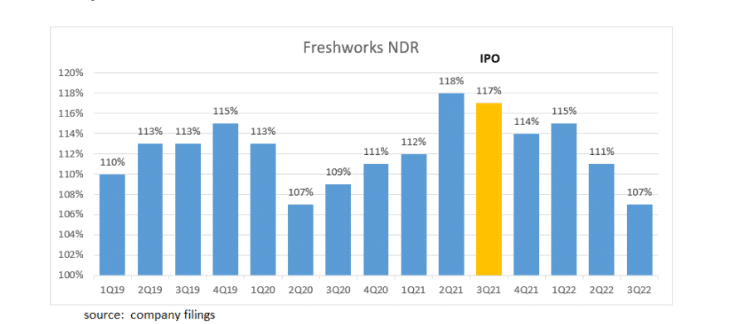

However, the cautionary tale of SaaS giant Freshworks in November 2022 serves as a stark reminder that the accuracy and transparency of NDR reporting can significantly impact a company’s market perception and legal standing during such critical financial events.

In November 2022, SaaS giant Freshworks found itself in a sea of troubles as it stared down the barrel of a class-action lawsuit on the grounds of false and misleading documents used to validate its IPO.

The problem boiled down to the company’s NDR. According to Scott+Scott Attorneys at Law LLP, Freshworks failed to mention that its NDR had plateaued, and its revenue rate growth and billings were slowing down.

Whether Freshworks’ error was caused by poor math skills or something else – we do not know. As you can see, their NDR numbers after their IPO are listed in the chart below.

The main takeaway is that if you’re planning an IPO, you need to be absolutely sure that you offer investors the right numbers.

Case Studies of Companies with High NDR

As the saying goes, only a fool learns from his mistakes. A wise man learns from the mistakes of others. While this section isn’t as much about mistakes as it is about success stories, the principle still holds water. If you’re seeking NDR mastery, what better path to follow if not the footsteps of those who’ve already mastered it?

#1 Sumo Logic – Weighted health scoring & nurturing the relationship with the economic buyers

Picture a 100-point customer health scoring process that goes beyond mere numbers. Sumo Logic’s expert team has skillfully developed and implemented a powerful multifactor scoring system that offers an unparalleled insight into the overall health of each account. The uniqueness lies in their rigorous testing methodology, which scrutinized the scoring system across hundreds of accounts. This ensures significantly enhanced precision and effectiveness.

Sumo Logic’s accounts are color-coded with shades of green, yellow, and red, offering a visual representation of their health status at a glance. Interestingly, green isn’t just a color; it symbolizes customers most likely to renew, a testament to the accuracy of Sumo Logic’s system.

Dione Hedgpeth, Chief Customer Officer at Sumo Logic, says that the system is so reliable that 99% of those green-labeled customers renewed their subscriptions during one quarter.

In fact, before its 2020 IPO, Sumo Logic recorded a net dollar retention rate between approximately 120-130% for each of the preceding 10 quarters, as highlighted by Meritech Capital.

Sumo Logic achieved this by mixing together key factors such as – economic buyer sentiment, the success plan, adoption rates, and training effectiveness. However, the X factor that binds all this together is given by none other than the Customer Success Manager’s input. This input injects some real-world context – such as whether the customer is newly acquired or is on the path to renew or expand.

Another key element of Hedgpeth’s unique approach to boosting NDR is maintaining a close rapport with economic buyers and buying groups. According to her philosophy, having a finger on the pulse of economic buyers and the dynamics of buying groups is instrumental in preventing unwarranted surprises.

In the realm of sales, conventional wisdom dictates that the success of any deal hinges on securing approval from the decision-maker, often denoted as the economic buyer, following the MEDDIC methodology.

Hedgpeth suggests blending parts of how sales usually work with the many aspects of customer success. She sees common ground between the two, highlighting how these strategies make customer relationships stronger and make revenue operations work better. It’s like putting the pieces together in a way that helps both customer success and making more money work well together.

#2 Snowflake – the power of matching people’s needs

There’s a good reason why the term “product-market fit” keeps popping up in more and more conversations in the tech world. When a product effectively fulfills the needs and demands of its users, it possesses a remarkable power that not only attracts new customers but also secures their loyalty over time.

Snowflake is a data cloud platform that enables customers to store, analyze, and share data. As stated in McKinsey, It has a remarkable 180-ish percent dollar-based net retention. Snowflake achieves this by having six clear NDR rules:

- Superior product: Snowflake is fast, scalable, and reliable. It can process complex queries in seconds and handle massive amounts of data.

- Universal skillset: Snowflake uses SQL, a common language for data analysis, which makes it accessible to anyone in the company who can do math.

- Usage-based pricing: Snowflake charges for data storage and query consumption, which aligns with the value customers get from the product. The more data they store and analyze, the more they pay.

- Multi-cloud strategy: Snowflake is built on top of the three major cloud providers: Amazon, Google, and Microsoft. This gives customers flexibility, security, and bargaining power. They don’t have to commit to one vendor or worry about their competition.

- High switching costs: Snowflake requires a lot of data migration and integration, which can take months to complete. Once customers have done that, they are unlikely to switch to another platform or go back to their legacy systems.

- Network effects: Snowflake allows customers to share and exchange data with other parties on the same platform. This creates a data network that increases the value of the product and attracts more users.

It’s not just about getting new customers for Snowflake; it’s about how well their product naturally becomes vital to organizations. If users like Snowflake, they stick with it and even tell others about it.

Final thoughts

Phew – we’ve surely covered a lot of stuff throughout this article. So, let’s try to sum it all up and leave you with a clear set of ideas related to the NDR.

- Your NDR tells you the growth your SaaS generates without getting new customers.

- An NDR score of above 100% tells you that your upgrades outweigh downgrades and churn.

- As opposed to other retention metrics, the NDR gives you a birds-eye view of how your SaaS is performing overall.

- You are the glue that holds it all together. From customer onboarding to proactive communication, troubleshooting, feedback gathering, upselling, cross-selling, education, renewals, and expansions, your role as a Customer Success Manager is central to NDR success.

- The journey to superior NDR starts with a deep understanding of your customers’ needs and pain points. Analyze support tickets, customer feedback, and other insights to identify challenges and opportunities for improvement.

- Segmenting your audience empowers you to tailor your strategies, messaging, and support to meet customer needs. It enables you to provide a more personalized experience, which can lead to higher NDR.

- Successful feature rollouts can significantly impact NDR. When customers see value in new features and enhancements, they are more likely to stay and expand their usage. Use NDR as the validator for the success of these rollouts.

- A Customer Success Platform, like Custify, is your secret weapon. It helps you unify customer data, automate workflows, personalize engagements, prevent churn, streamline renewals, and identify upselling and cross-selling opportunities, effectively elevating NDR.

- A unified approach encompassing sales, marketing, finance, product, and customer success is vital for improving NDR. It enables consistent messaging, aligned customer-centric goals, data-driven decision-making, optimized product development, and upselling opportunities.

In conclusion, the essence of achieving a stellar Net Dollar Retention (NDR) lies in a harmonious blend of customer-centric strategies and robust internal coordination. As a Customer Success Manager, you are pivotal in orchestrating this blend. Remember, NDR isn’t just a metric; it’s a comprehensive reflection of your SaaS’ health, directly influenced by how well you understand and meet your customers’ evolving needs.

By harnessing the power of Customer Success Software, aligning with cross-functional teams, and continuously innovating your service offerings, you’re not just driving growth; you’re building a sustainable, customer-first business. So, as you move forward, let NDR be your guiding star in the journey of customer success and business growth.